What Cardboard Can Tell Us About the State of the Economy

A decline in cardboard box sales may serve as an early indicator of whether the U.S. might be headed for a recession

You’re reading Monday Morning Economist, a free weekly newsletter that explores the economics behind pop culture and current events. Each issue reaches thousands of readers who want to understand the world a little differently. If you enjoy this post, you can support the newsletter by sharing it or by becoming a paid subscriber to help it grow:

The past six months have been filled with talk of a looming recession. Job growth has been positive, but each month has seemed to come up short of expectations. Consumer confidence surveys continue to show more worry than optimism. Retail sales have been up and down, even as wages keep climbing.

So what should we believe about our economic future? Economists often turn to economic indicators: numbers and signals that hint at whether the economy is expanding or shrinking. Some are official government stats. Others are more surprising. But one of the strangest comes from something you’ve probably recycled this week: the cardboard box. With box makers cutting back production, the industry may be sending us a warning sign that doesn’t come neatly packaged.

The Big Three Indicators

There are lots of ways to measure the economy’s progress. Builders breaking ground on new homes can signal confidence that buyers are ready. Fewer car sales might suggest families are holding back on big purchases. Economists track dozens of these measures, but three of them (gross domestic product, inflation, and unemployment) tend to dominate the headlines each month.

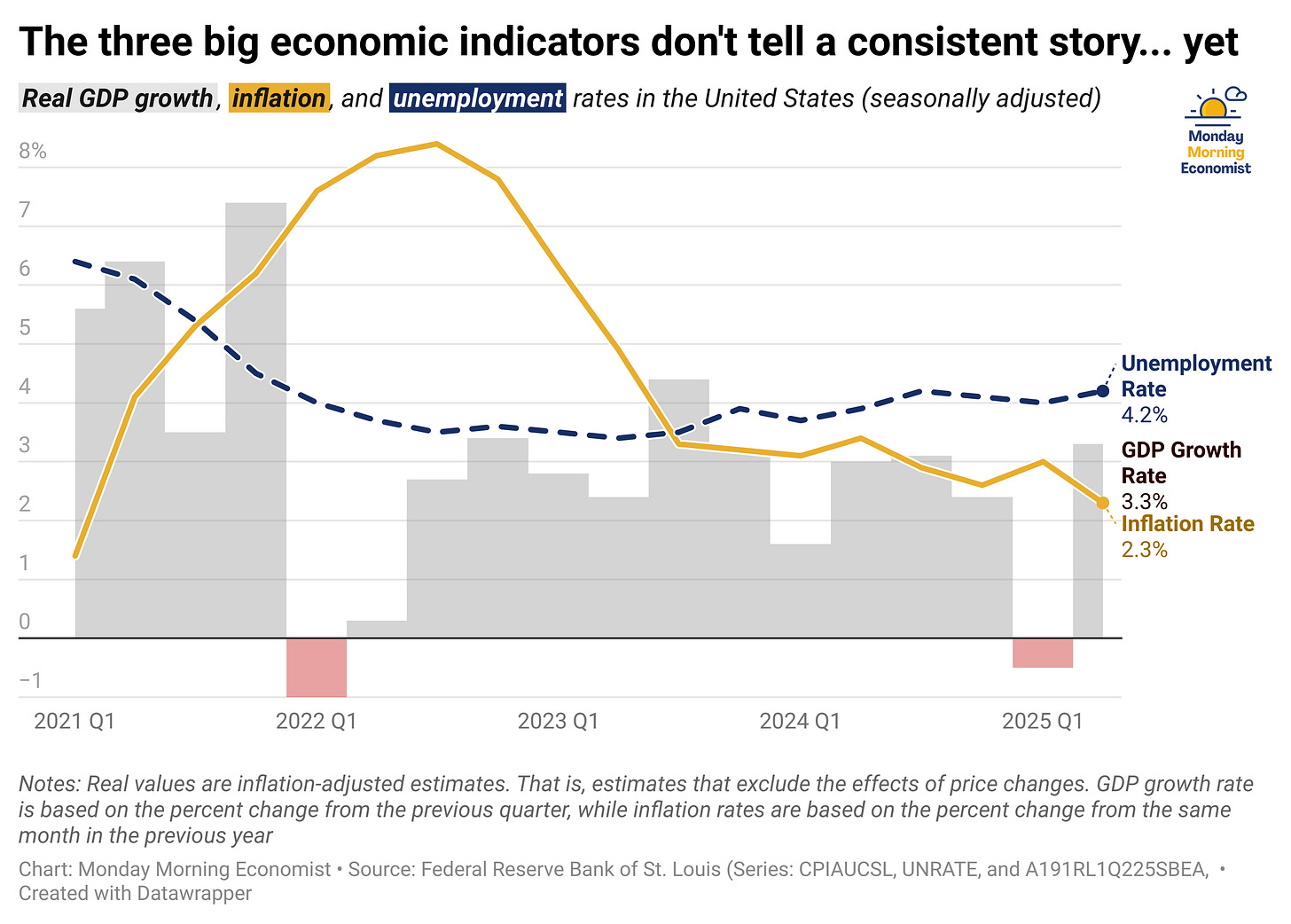

Gross Domestic Product (GDP) measures the total value of all goods and services produced, but growth has slowed in the past few quarters. Growth is still positive, but not as strong as it was coming out of the pandemic. The inflation rate was uncomfortably high a few years ago, but has been coming down steadily since the summer of 2022. And unemployment? It’s been edging up slightly over the past several months, though it remains low by historical standards.

These three indicators form the backbone of most economic discussions. Policymakers, investors, and business leaders pay close attention to them because they offer a snapshot of where the economy stands. Families care because the direction of these trends shapes their day-to-day lives, whether it’s the cost of groceries, the stability of a job, or the sense of security about the future.

Leading vs. Lagging Indicators

Timing matters. Some economic indicators tell us where we’ve been, while others hint at where we’re headed. We can divide them into two broad groups: lagging and leading indicators.

Lagging indicators (like the unemployment rate) are announced only after the economy has already changed course. By the time we hear about the unemployment ticking up, a slowdown is usually well underway. Leading indicators (like building permits or new orders for durable goods) tend to move first. They give policymakers and businesses an early warning about what’s coming, helping them prepare before a downturn takes hold.

For the rest of us, it’s the difference between being surprised by a recession and seeing the storm clouds in advance. Leading indicators don’t cause recessions, but they can give us a valuable head start in case we need to prepare for one.

The Cardboard Index

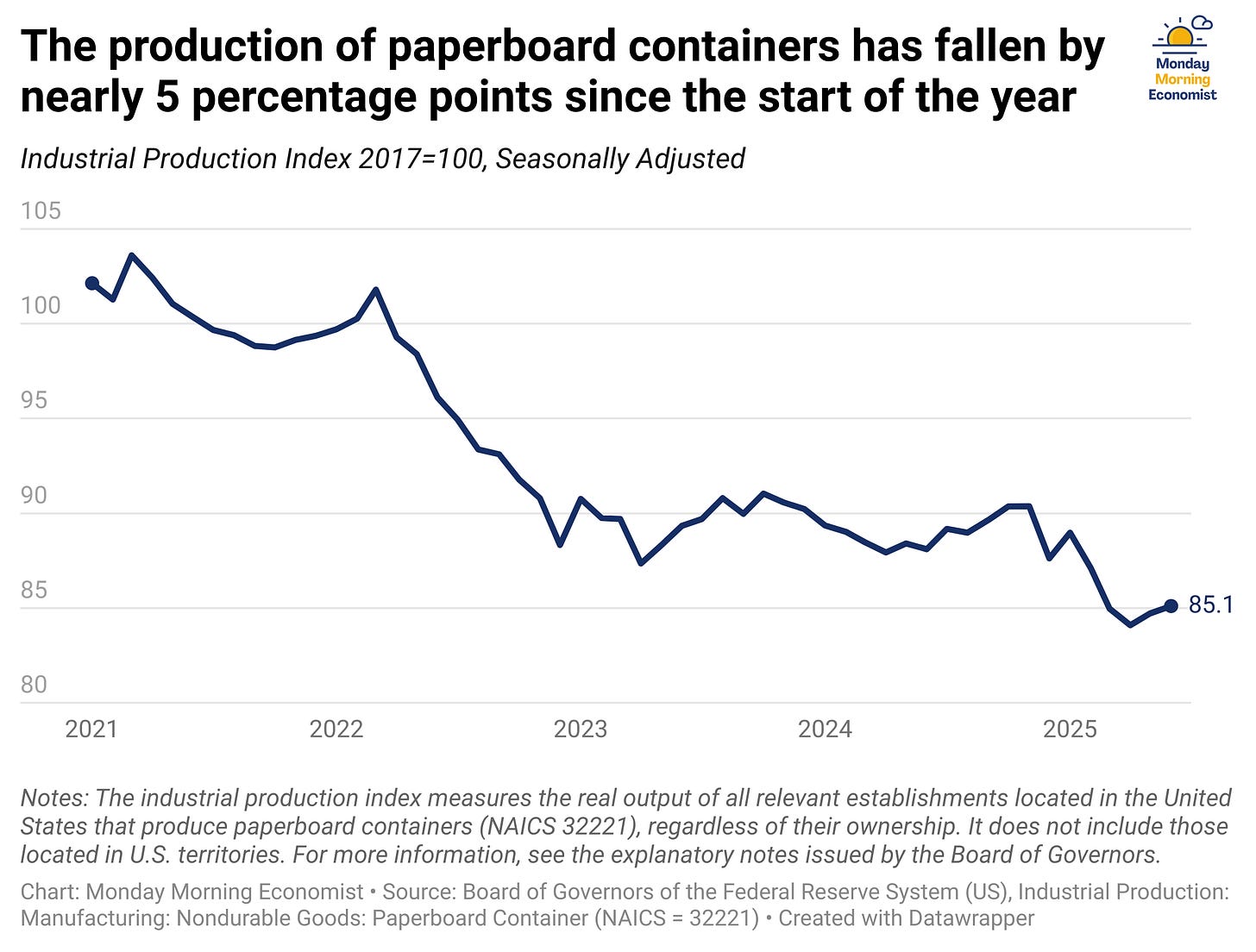

And that’s where cardboard boxes come in. Almost every product you buy spends some time inside one. It is estimated that close to 75–80% of all non-durable goods are shipped in corrugated cardboard containers, which makes boxes a surprisingly good proxy for the flow of goods through the economy. If companies expect stronger demand, they order more boxes. If they anticipate slower sales, orders dry up fast.

This relationship is why corrugated box shipments have earned the nickname “the cardboard box index.” Former Fed Chair Alan Greenspan, who served from 1987 to 2006, was known to track it as a real-time signal of economic activity. But what would he see if he were looking at the news today?

Over the past few months, several U.S. box makers have announced closures or cutbacks. In total, about 9% of domestic production capacity is set to shut down, putting thousands of workers out of jobs. That’s the steepest pullback the industry has made since the 2008 financial crisis.

What does this mean for the rest of us? If we’re to assume that cardboard boxes are a leading indicator, it could be a bad sign of what’s ahead. If they’re cutting back on capacity, it likely comes as a response to fewer orders. That would suggest weaker demand in the broader economy. If shipments keep falling, other indicators like GDP or unemployment may eventually catch up.

Final Thoughts

Predicting recessions is hard. A few years ago, some analysts went so far as to declare there was a “100% chance” of a downturn, but that never materialized. Business cycles are inevitable, and another slowdown will come eventually, but no one knows when. Even though the changes in the cardboard box industry may make some people uneasy about the future, it’s still just one piece of the puzzle.

For most families, the smart approach isn’t trying to outguess the next recession. It’s about preparing for uncertainty: establish an emergency fund, manage debt carefully, and hold off on big commitments if you’re not sure you can sustain the next few months. Whether the cardboard index is right this time or not, those habits will serve you well in any stage of the business cycle.

If you found this week’s article helpful, consider sharing it with a friend who’s also trying to make sense of the economy. Word of mouth is the best way this newsletter grows. You can also refer friends directly. When they sign up, you’ll unlock rewards as a small thank-you for helping expand our community of readers.

About 10% to 15% of the US industry’s capacity is used to send US exports abroad [Sherwood News]

Approximately 1,165 establishments are employing 90,546 people in the Corrugated and Solid Fiber Box Manufacturing sector [U.S. Census Bureau]

The lipstick indicator was invented by Leonard Lauder, chair of the Estée Lauder cosmetic company, after noticing the rising sales of lipstick as an indicator of troubled times [Investopedia]

During the 2008 recession, cardboard-box manufacturers’ operating revenues fell by more than 50% [Marketwatch]

President George W. Bush presented the Presidential Medal of Freedom to Alan Greenspan on November 9, 2005 [George W. Bush White House Archives]

A. cause-and-effect of obvious bad policy is not dead.

a.1 its called the dismal science because nothing happens in a vacuum.

it seems people are most befuddled with the notion that bad policy has not already affected the stock market, but record IT capex (displacing consumer spending for the the first time) has masked a lot of companies with worsening earnings.

To add, companies use saran wrap instead of boxes, while others maximize the space in the box. I received a request from Amazon on my recent order asking if I wanted my items boxed. Recycling boxes is another alternative. It is amazing to see how something as simple as a box can be an indicator of the health of a business.