What's a Tariff?

Tariffs not only impose immense economic costs but also fail to achieve their primary policy aims and foster political dysfunction along the way

Thank you for reading Monday Morning Economist! This is a free weekly newsletter that explores the economics behind pop culture and current events. This newsletter lands in the inbox of more than 4,500 subscribers every week! You can support this newsletter by sharing this free post or becoming a paid supporter:

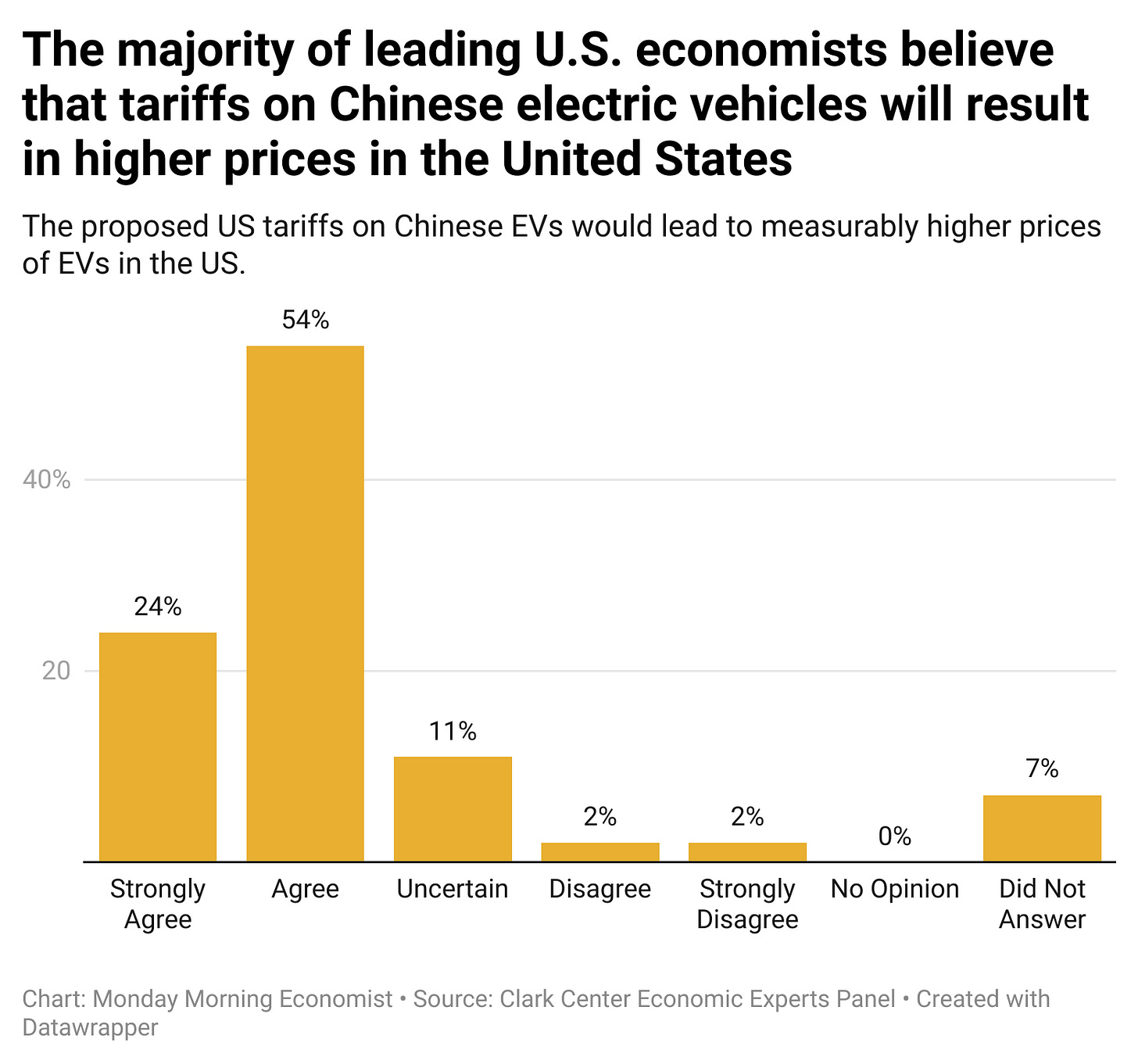

The trade drama between the U.S. and China just got a new chapter. President Biden recently slapped new tariffs on Chinese electric vehicles and other important imports. Now, you might be wondering, "What exactly are tariffs, and why do countries use them if they seem to cause so many problems?" Those are great questions!

To kick things off, let’s rewind just a bit. The U.S. has been putting tariffs on Chinese goods for a long time. Some of the more recent tariffs were even able to push Mexico back into the top trading spot with the United States. But despite study after study showing that tariffs end up costing American consumers more money, the U.S. keeps on imposing them. So, what’s the deal with that?

What Is a Tariff?

Let’s start with the basics: what exactly is a tariff? In simple terms, a tariff is like a tax that the government slaps on goods coming into or going out of the country. It’s essentially a toll to get your stuff across the border. But why do governments use tariffs? The main idea is to make foreign goods appear relatively more expensive than domestic goods. The logic goes that if imported stuff costs more, then people would be more likely to buy domestic products instead.

Tariffs generally fall into one of three categories, depending on how the tariff is applied to the product. The most common is an ad valorem tariff. These are calculated as a percentage of the value of the imported goods. For instance, let’s say you’re importing a car worth $20,000 that is subject to a 25% tariff. That means you’ll pay an extra $5,000 just in tariff fees.

Then, we have specific tariffs. These are a fixed fee based on the quantity of goods, not their value. So, if there’s a $300 tariff on each ton of steel you bring in, it doesn’t matter if the steel is super cheap or really expensive—you pay $300 per ton either way. Finally, there are compound tariffs. These are a mix of both ad valorem and specific tariffs. Importers pay both a percentage of the value plus a fixed fee based on the amount brought in.

Why Do Countries Like the U.S. Have Tariffs?

There are a bunch of reasons politicians propose new tariffs, and they usually revolve around some pretty specific political goals. One big reason, especially relevant to President Biden’s new tariffs on Chinese electric vehicles and solar panels, is the idea of protecting young domestic industries through industrial policy.

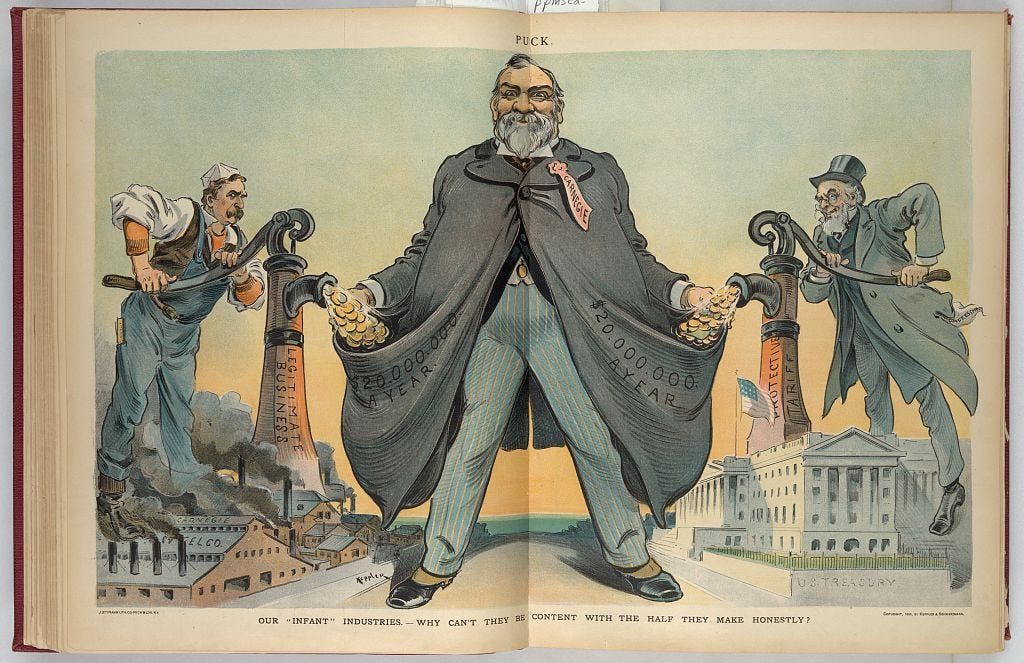

Politicians argue that it’s harder to start a business in the United States when you’re facing giant international companies that can make stuff way cheaper. Imposing tariffs on these products is an attempt to give the “infant industries” a chance to grow and develop without being squashed by cheaper foreign products. This idea goes way back to the 19th-century German economist Friedrich List.

Another reason politicians argue for tariffs is to protect domestic jobs. Even if an industry isn’t new, politicians argue that making imported goods more expensive can help keep domestic jobs from being undercut by cheaper foreign labor. This is especially important for industries considered crucial for national security or economic stability. These politicians are concerned that if their country relies too much on foreign goods, they may be in a jam if a conflict arises. This argument is often used around essential things like steel, pharmaceuticals, and semiconductors.

For some low-income countries, tariffs can be a big source of government revenue. Collecting taxes can be tricky in some countries, but tariffs on imported goods are a bit easier to manage. The money earned from these tariffs can then be used to fund public services and infrastructure projects. After the American Revolution, the U.S. relied heavily on tariffs because collecting other types of taxes was pretty challenging.

Finally, tariffs can be used as a political tool. If another country is playing dirty—like dumping products at super low prices or giving their industries massive subsidies—tariffs may be seen as a way to push back. The idea is to “level the playing field” and pressure other nations to play fair in trade.

But here’s the catch: imposing tariffs, regardless of the reason, can lead to retaliation. Other countries might see our tariffs as unfair and slap tariffs on our products in return. This can hurt our ability to sell goods overseas and end up reducing domestic production—the very thing that some politicians were trying to protect in the first place!

Comparing U.S. Tariffs to Other Countries

The U.S. has pretty low average tariff rates compared to a lot of other countries. As of 2020, the average tariff rate in the U.S. was about 1.52%. While that sounds small, some industries face much higher rates. Take textiles and footwear, for example. Tariffs on these can soar over 11%! This shows how the U.S. targets specific areas for protection.

How do our tariff rates compare globally? Bermuda’s average tariff rate in some years can be a whopping 24.1%, while Belize comes in around 18.7%. That’s pretty high! On the other hand, other big economies like China (2.47%) and Japan (2.22%) keep their average tariffs relatively low but raise them for certain products to shield their domestic markets.

But wait, there’s more! Tariffs aren’t the only tool in the trade restriction toolbox. The U.S. also uses a bunch of non-tariff measures (NTMs). These include things like quotas, licensing requirements, and technical standards. NTMs can cover over 70% of imports in many industries, including food products and machinery. Politicians often argue that these measures are in place to make sure products meet consumer safety and quality standards. So, even if the tariff rate looks low, these other barriers can still have a big impact on trade.

Final Thoughts

Understanding tariffs and why countries impose them is important for making sense of the political and economic debates we hear about every day. On the one hand, tariffs can be pretty handy. They favor domestic industries, increase jobs in that sector, and may even bring in some extra cash for the government. But on the flip side, they make things more expensive for consumers, stir up trade tensions, and create inefficiencies in the global market.

It’s easy to focus on the benefits and downplay the costs, but it’s important to look at both when we look at how international affects our everyday lives. As the continues to repair its trade relationship with China, the debate over tariffs isn’t going away. Some people see tariffs as a necessary shield for our economy, while others see them as a barrier to free trade. Regardless of your position, it helps you better understand why people bring different viewpoints to the table.

The United States imported $551 billion worth of goods and services from China in 2022 [MIT Observatory of Economic Complexity]

Animals and Textiles/Clothing have over 90% of their import value covered by some form of non-tariff measure [Federal Reserve Bank of St. Louis]

The United States is currently imposing a 25% tariff on approximately $250 billion of imports from China and a 7.5% tariff on approximately $112 billion worth of imports from China [Tax Fondation]

The U.S. government raised about $100 billion from tariffs in 2022 [Cato Institute]

Henry Hazlitt has a sad