Trading Places: Mexico is Back as the U.S.'s Top Trading Partner

This shift marked a significant transition in the hierarchy of U.S. trading partners, with Mexico overtaking China, which had been our top source of imports for 20+ years.

You are reading Monday Morning Economist, a free weekly newsletter that explores the economics behind pop culture and current events. This newsletter lands in the inbox of over 2,800 subscribers every week! You can support this newsletter by sharing this free post or becoming a paid subscriber:

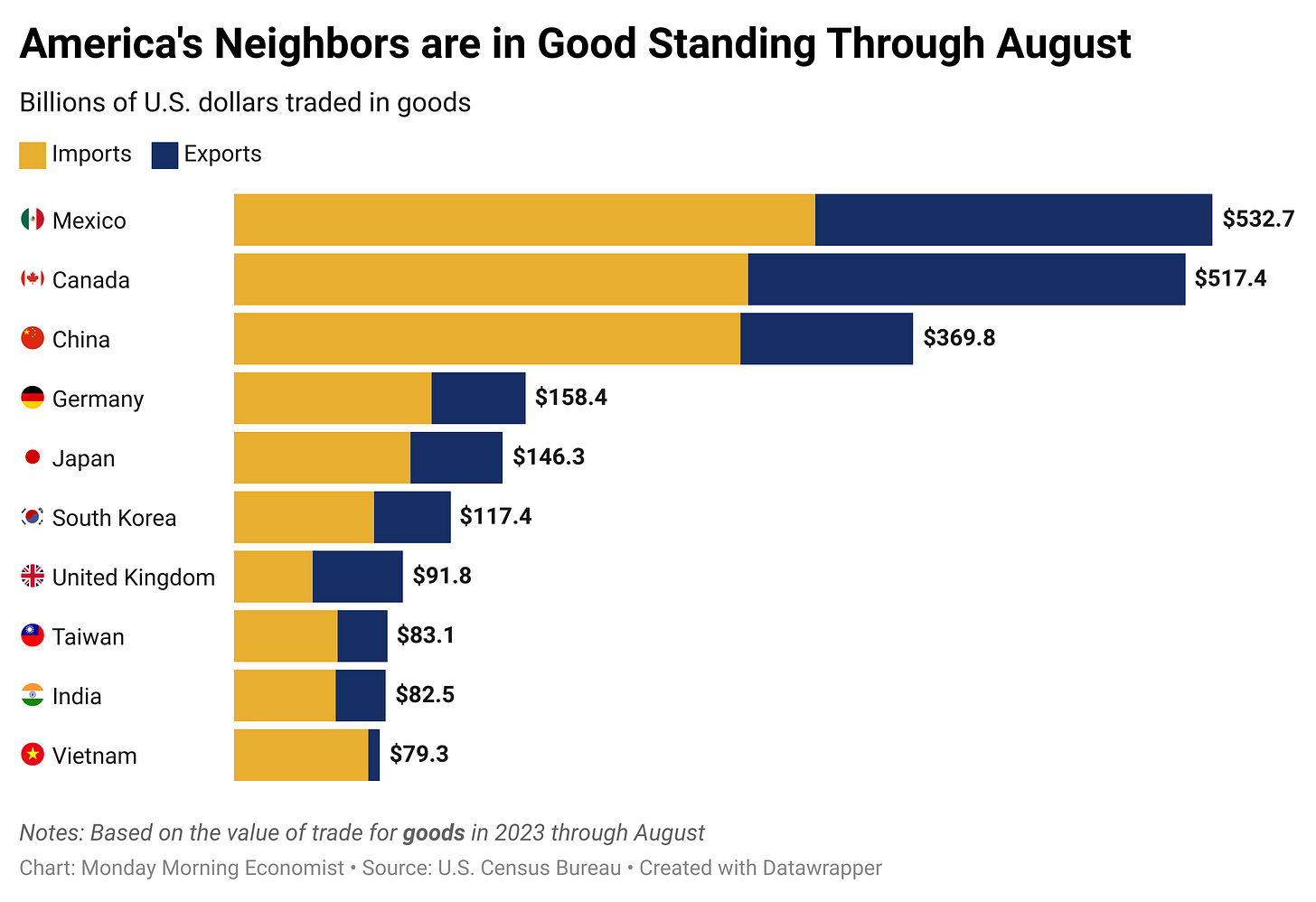

Earlier this year, Mexico made a big splash regarding bilateral trade with the United States. The U.S. and Mexico exchanged $532.68 billion between each other in just the first eight months of the year. This isn’t necessarily too surprising because Mexico has been our top trading partner for 3 out of the last 4 years. What makes this year so newsworthy, at least for now, is that Mexico has become the United States’ top source of imports, surpassing China who had previously held that title since 2003!

I know all these different years and rankings may seem overwhelming, but stick with me because there’s more to international trade than meets the eye. From 2006 through 2018, China was well ahead of our Southern neighbor in terms of the value of trade with the United States. Mexico wasn’t ever far behind, but how did Mexico go from a rising star to a sudden trade titan?

While the news has focused on Mexico’s place at the top, it’s important to keep in mind that our neighbors to the north are currently our second-largest trading partner. Neighbors often benefit from trading with each other, even if there are other countries somewhere else in the world that can produce things at a lower cost than our neighbors.

International trade is a lot like an iceberg, in more ways than you might think. We see the tip above the water, the visible parts that impact trade like the announcements of tariffs and bilateral trade agreements. But lurking beneath the surface is another iceberg metaphor related to transportation costs.

Imagine you’re at a bustling seaport, like the Port of Los Angeles. Giant cargo ships are constantly loaded and unloaded, and shipping containers are being shuttled around. It’s a hive of activity. Now, think about all the goods on those ships—cars, electronics, clothing, you name it. They’re on a journey, a journey that involves crossing oceans and eventually continents. The cost of getting those items to other countries depends heavily on how friendly the trade terms are with the United States, but also on where the ship is headed. Mexico and Canada benefit from both friendly trade relations and proximity.

The Obvious Costs: Protectionism and Its Impact

Let’s start with the most visible impact on the cost of international trade: government protectionism. This includes limits on the number of items that companies can bring to the United States, but also tariffs charged on items coming into the country. In 2018, the U.S. imposed tariffs on Chinese imports, which led to China responding in kind. These moves were the start of a persistent decline in U.S.-China trade. Today, there is around $335 billion in trade still subject to these tariffs, and helped Mexico move up to the top spot after nearly two decades in the second spot.

What do protectionist policies mean for consumers like you? Well, it’s a lot like going to your favorite grocery store and finding that some of your favorite items now have a service charge added to the price. You used to enjoy shopping there because of all the affordable products, but now the cost of your weekly shopping has gone up. When it comes time to go shopping again, you might start thinking about new grocery stores that don’t charge those same fees.

While you might still be able to buy most of the things you need, even with the added fees, you have less money left over for other items or activities you enjoy. For instance, you might have to skip dessert or delay a family movie night. The Tax Foundation estimates that with the Chinese tariffs still in place, long-run GDP has decreased by 0.21%, wages are down by 0.14%, and the economy has lost the equivalent of 166,000 full-time equivalent jobs.

There are ways to reduce these service charges that penalize trading nations. Trade agreements, like NAFTA and its successor USMCA, play a vital role in shaping international trade. These agreements aim to promote trade between countries by reducing barriers and aligning regulations across the countries involved. They provide a framework for making trade easier, protecting ideas (like copyrights), and resolving disputes. It’s part of why Mexico and Canada are two of our largest trading partners.

The Forgotten Cost: The Iceberg Transport Cost Model

Even if China and the United States were to return to more friendly terms of trade, and the USMCA were disbanded, Mexico and Canada would likely still be two of the United States’ top trading partners each year. Just like an iceberg, where you only see the tip sticking out of the water, the costs associated with transporting these goods are largely forgotten by many people. That’s where the Iceberg Transport Cost Model comes into play. It’s a second explanation for why the United States trades so much with Mexico and Canada, despite China being a famous source of more efficient production methods.

This model argued that a part of the goods shipped between countries is "lost" or "melts away" during transportation, representing transportation costs. For example, if you ship 100 units of something, only a part of it, say 90 units, reaches the destination. These costs can act as barriers to trade, making it expensive to trade certain goods over long distances.

While the model is largely theoretical; it has real-world implications. It’s why you might find many of the goods you use daily are made in neighboring countries, even if you could technically source them from a place on the other side of the world for less. Proximity reduces uncertainty, shipping time, and the risk of spoilage or damage, all of which can outweigh the savings from lower production costs.

Navigating the Global Trade Ecosystem

International trade is like a global system, where countries compete, economies rise and fall, and hidden costs shape trade flows. Mexico’s climb to the top of the trading partner list shows that there’s more to the story than just producing a lot of stuff. Underneath, there’s a web of policies, agreements, and global dynamics at play.

The next time you see a news headline about international trade, remember that there’s more to it than meets the eye. It’s a world where what’s above the water is just the beginning, and where the currents of policy and economics continue to shape our global trade landscape.

Through August 2023, Mexico and the United States have traded a total of $532.7 billion worth of goods between each other [U.S. Census Bureau]

The average U.S. tariff on Chinese imports is 19.3%, while China’s tariff on U.S. imports is 21.2% [The Federal Reserve Bank of Dallas]

Mexico’s largest two trading partners are the United States and Canada [World Bank]

The most valuable export for Mexican producers (globally) in 2021 was cars, accounting for 8.76% of the total value of all exports [The Observatory of Economic Complexity]

Mexico exported $4.77 billion worth of beer to the United States in 2021 [The Observatory of Economic Complexity]