Sharing the Benefits of an Expanded Tax Credit

Understanding elasticities can help explain why Tesla raised the price of its Model Y by $1,000 after the Treasury Department relaxed its tax credit terms for electric vehicles.

The U.S. Treasury recently announced that more electric vehicles would be eligible for up to $7,500 in tax credits following a revision of its vehicle classification definitions. Under previous guidelines, SUVs priced below $80,000 qualified for EV tax credits, while sedans and wagons needed to be priced below $55,000. The Treasury will now allow crossover SUVs to qualify for credits, which raises the retail price cap for vehicles made by GM, Volkswagen, Ford, and Tesla. The day after the announcement, Tesla raised the price of its five-seat Model Y by $1,000.

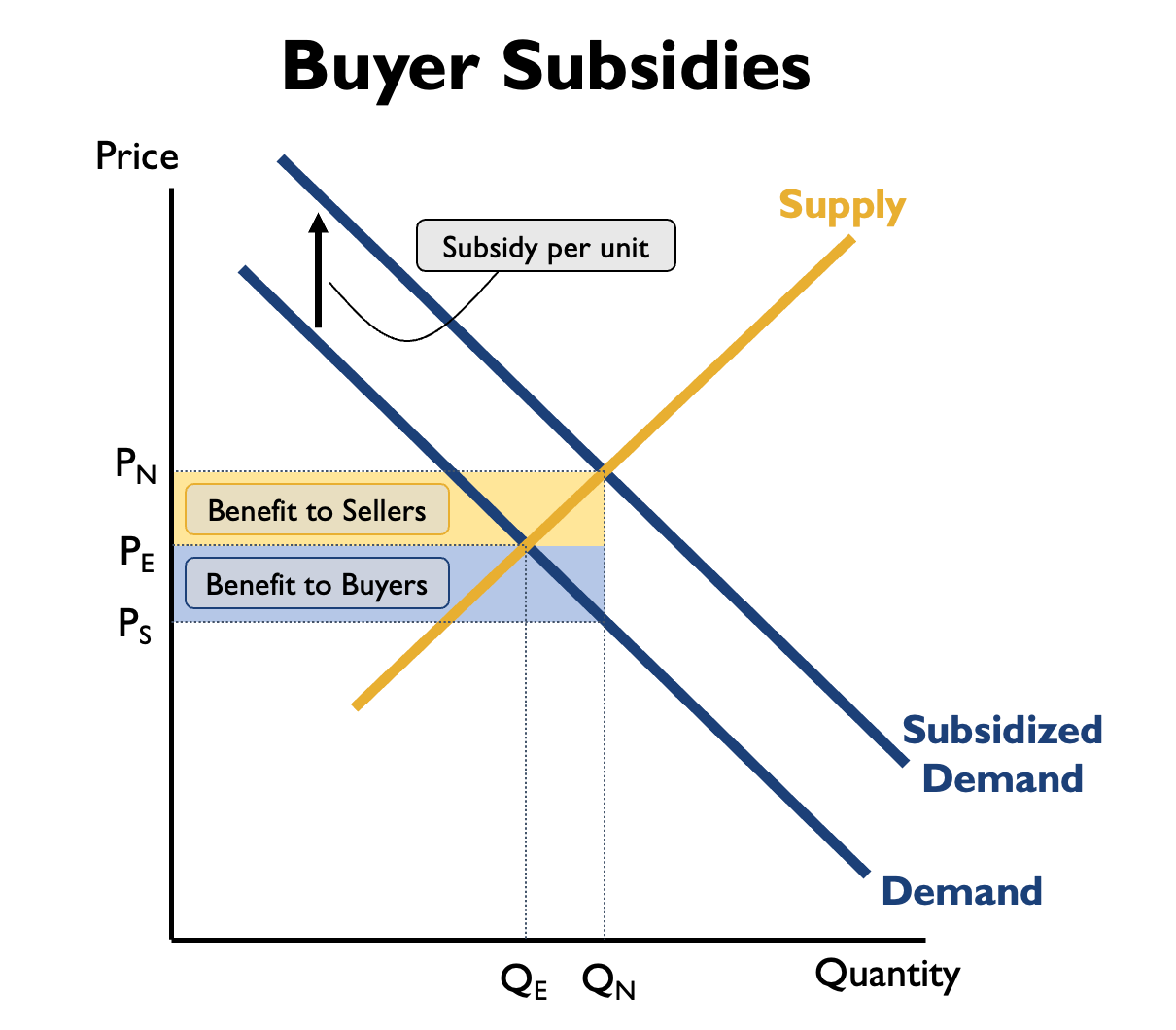

Subsidies and taxes are often used by governments to incentivize certain behaviors in the market. In the case of electric vehicles, buyers are offered subsidies in the form of tax credits as part of a government initiative to reduce greenhouse gas emissions. However, it's important to note that the benefits of these subsidies are not limited to just car buyers. Instead, they are shared between buyers and sellers, which is why Tesla’s price response wasn’t so unexpected. The distribution of these shared benefits is referred to as the subsidy incidence.

This distribution is determined by the relative elasticities between buyers and sellers. Depending on how responsive buyers and sellers are to price changes will determine which side of the exchange will receive the larger share of the subsidy. These subsidies are intended to increase the demand for electric vehicles, which increases the final sales price of the product. The size of that initial price increase, however, will be based on relative elasticities. While the exchange price between buyers and sellers will be higher than before the subsidy, buyers will pay less overall once the tax credit has been applied. Elasticities can help us understand how much less buyers pay compared to how much more sellers receive.

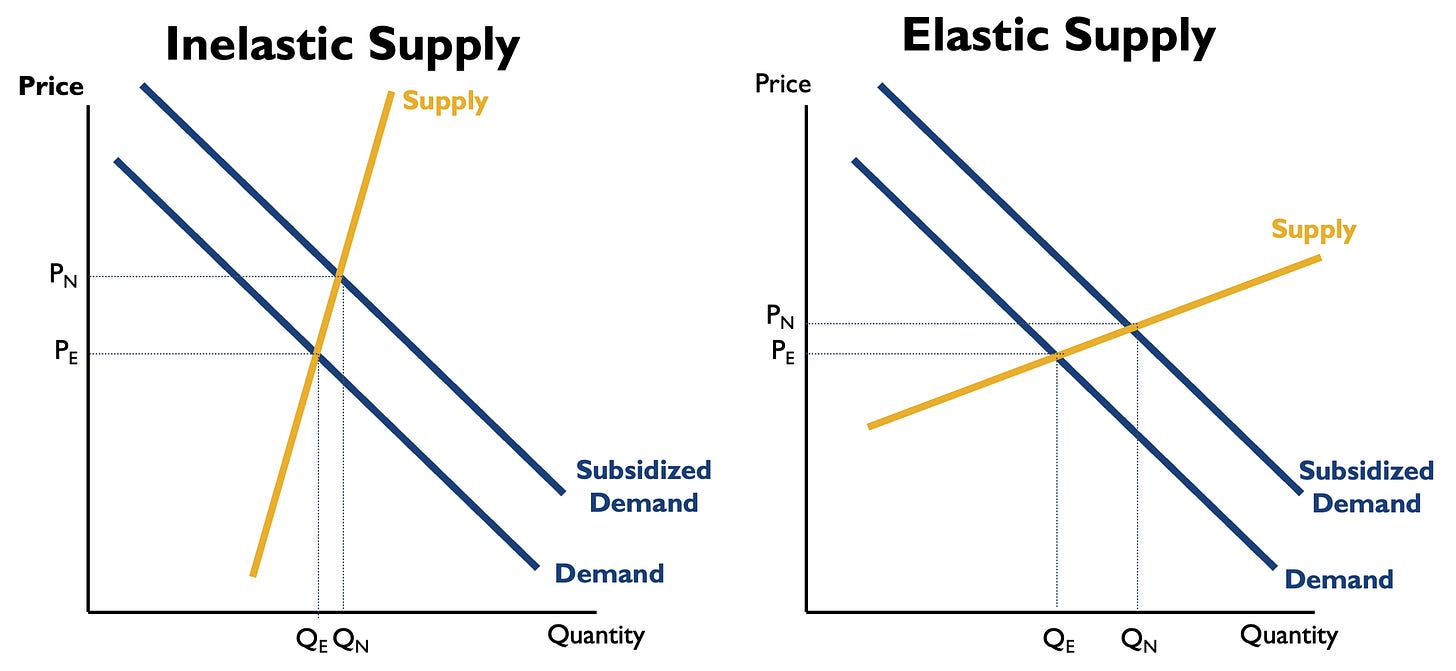

If car sellers are relatively less sensitive to price changes (we would say they are less elastic), the subsidy will primarily benefit sellers more than buyers. Being less sensitive to price changes means that car sellers need to see a large increase in the final sales price in order to increase production even just a little. The subsidy is intended to increase the number of electric vehicles being purchased, so most of the value of the subsidy will flow to car sellers in order to incentive them to increase the quantity of production enough to meet that new demand.

On the other hand, if car sellers are relatively more sensitive to price changes (we would say they are more elastic), they would need only a small increase in the final price in order to significantly increase the production of new cars for purchase. In order to incentive car buyers to purchase all those cars, most of the subsidy value must remain with the buyers. Remember, the tax credit will reduce the overall price of the car for buyers in both scenarios, and elasticities just tell us how it will decrease.

In the case of Tesla’s Model Y, it appears that demand for their electric cars is relatively less elastic compared to sellers. While car buyers have a lot of options for which car they purchase (that would tend to make them more elastic), the production process has been automated enough over the past few decades that it isn’t too expensive for car manufacturers to increase production.

We can infer those elasticities based on how much Tesla changed the price of their car following the announcement of the tax credit expansion to cover the Model Y. The current tax credit is $7,500, but Tesla increased prices by only $1,000. Buyers will end up keeping the majority of the subsidy for themselves. By raising the price of their vehicles after the government increased the tax credit ceiling, Tesla captured less than 15% of the subsidy. Given that buyers receive the majority of the subsidy value, we can infer that they are more price sensitive than Tesla.

It is important to note that the impact of a subsidy on buyers and sellers is not always this straightforward. In some cases, the subsidy may have a larger impact on one group over the other, depending on the specific market conditions or the elasticity of different groups of consumers. While subsidies can be beneficial in encouraging certain behaviors, it’s important to recognize that those benefits incentives don’t flow entirely to the intended recipient.

Among other requirements, the electric vehicle tax credit is limited to filers who have a modified adjusted gross income that does not exceed $300,000 for married couples filing jointly, $225,000 for heads of households, and $150,000 for all other filers [Internal Revenue Service]

The 2023 Tesla Model Y is priced starting at $52,990 [Kelley Blue Book]

As of October 2022, Tesla has sold more than 3 million units on a global scale [U.S. News & World Report]

There are approximately 6,763 Tesla charging stations in the United States [U.S. Department of Energy]

Tesla recently recalled 362,000 vehicles with self-driving software because of concerns with intersection safety [USA Today]