Rent-Seeking Keeps Americans From a Simpler, Cheaper Tax Filing System

Private companies' rent-seeking behavior has kept Americans from accessing a simpler and cost-effective tax filing system, resulting in wasted resources for tax filers.

As tax day looms on the horizon, many Americans are busy preparing to file their income taxes. For some, this means turning to software services like TurboTax, which promise an easy and convenient way to complete their taxes. Many Americans are eligible for a free federal method for filing taxes, but end up paying for services they don't need. The entire process creates a lot of anxiety and wastes a lot of time, but why is it that the United States doesn't have a system like some other countries, where the government tells you how much you owe?

The United States has a complex and cumbersome system that requires taxpayers to file their taxes themselves or hire a tax preparer. This system is time-consuming, confusing, and can be expensive, especially for those who use paid tax preparation services like TurboTax. These services often charge high fees to file even a basic tax return, even though a free federal method is available. In fact, 41% of Americans have taxes so simple the IRS could complete the return automatically. So why don’t they?

The answer lies in the fact that private companies have a vested interest in maintaining the status quo. By keeping the current system in place, and complicated, these companies continue to profit from providing tax preparation services to millions of Americans. Beverly Moran, a law professor at Vanderbilt University who focuses on federal income tax offers this explanation for why tax preparation companies don’t want to see the process simplified:

There’s the tremendous benefit for these big companies that do pay tax returns, because if tax returns were simple, you would do them yourself. But they get so complicated that people get afraid.

Rent seeking is a concept that describes the practice of using resources to gain an economic advantage without creating any new wealth. In the context of income taxes, rent-seeking occurs when private companies lobby the government to maintain the current system, rather than implementing a more efficient one that would benefit taxpayers. The major tax preparation companies spend significant amounts of money on lobbying efforts to prevent the IRS from creating a simpler, cost-effective alternative that would inevitably reduce their profits.

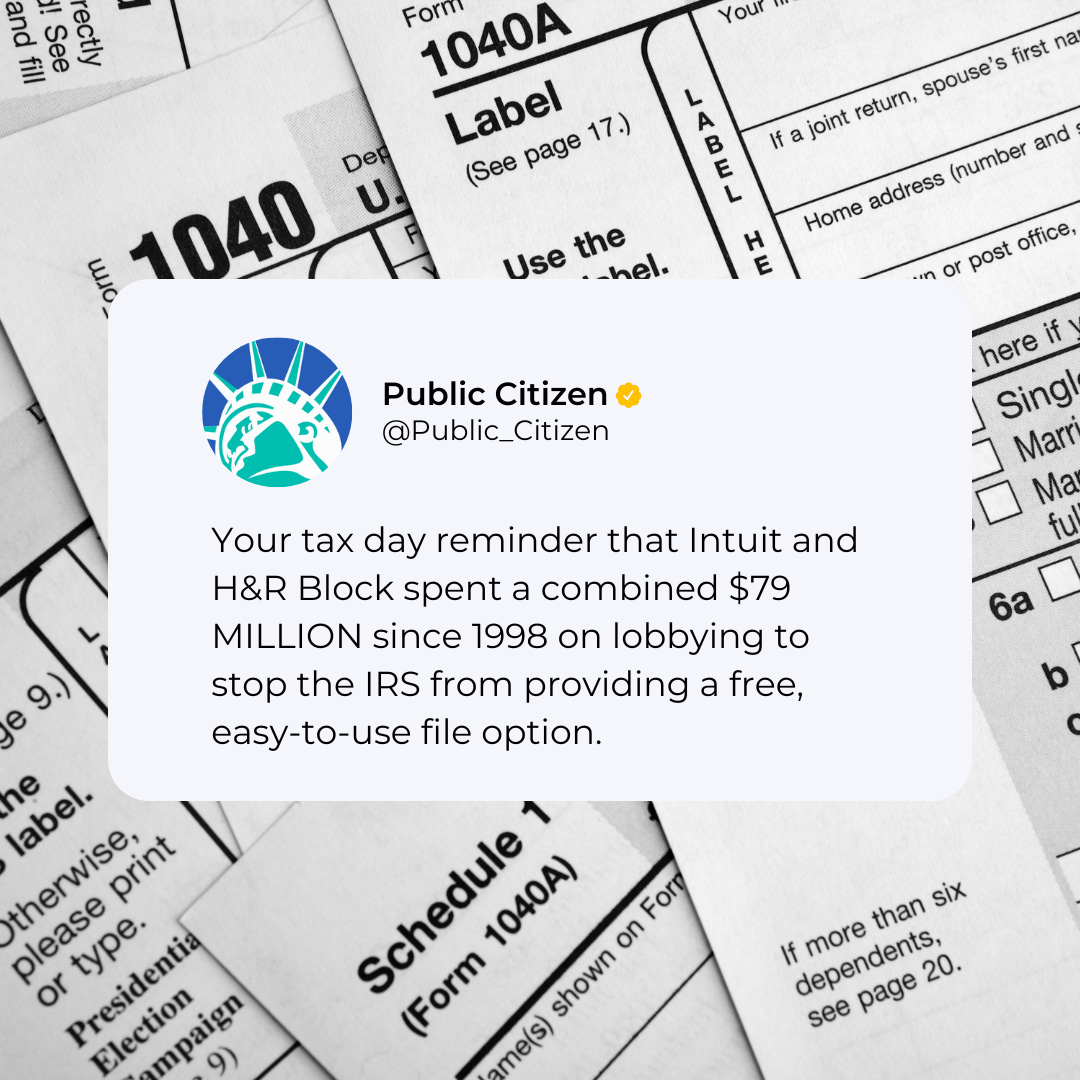

Companies like Intuit and H&R Block spend millions of dollars each year on lobbying efforts to persuade Congress to prevent the IRS from creating its own free filing alternative. This prevents taxpayers from having access to a simpler, cost-effective option, and instead, compels many of them to use private tax preparation services that often charge fees. This is an example of rent seeking, where private companies use their influence to shape government policies in their favor, even if it is not in the best interest of the general public. Rent seeking can lead to inefficiencies in the economy, as resources are diverted away from productive activities and towards activities that only benefit a select few.

The concept of rent seeking isn’t limited to income taxes. It can occur in many other areas of the economy, such as regulations, licensing requirements, and government contracts. In each of these cases, private companies use their influence to shape government policies in their favor, at the expense of the general public. Rent seeking can also lead to economic inequality, as it allows a select few to gain an economic advantage at the expense of others.

So what can be done to address rent seeking? One solution is to increase transparency and accountability in government decision-making. This can help to ensure that policies are made in the best interest of the general public, rather than a select few. Another solution is to reduce the influence of private companies in government decision-making. This can be done through campaign finance reform, which would limit the ability of corporations and other special interest groups to donate to political campaigns.

In the case of income taxes, the government could consider implementing a system like some other countries, where the government tells taxpayers how much they owe. Pre-populated returns could also help people who aren’t currently filing taxes. This would eliminate the need for private tax preparation services and reduce the inefficiencies and economic inequality associated with the current system.

The average American spends 13 hours and $250 each year filing their personal income taxes [Vox]

The IRS has already received 90,111,000 total returns for the 2023 filing season as of March 31, 2023 [Internal Revenue Service]

At last count, 36 countries, including Germany, Japan, and the United Kingdom, permit return-free filing for some taxpayers [Tax Policy Center]

Intuit, Inc. spent $3,270,000 on lobbying expenses in 2021 [Open Secrets]

One-third of Americans question the IRS’ ability to fairly enforce tax laws as enacted by Congress and the President [Internal Revenue Service]