Why Fired Coaches Still Get Paid Millions

A coach’s buyout is like unemployment insurance, but one that sometimes pays out even when you were the reason you got fired.

You’re reading Monday Morning Economist, a free weekly newsletter that explores the economics behind pop culture and current events. Each issue reaches thousands of readers who want to understand the world a little differently. If you enjoy this post, you can support the newsletter by sharing it or by becoming a paid subscriber to help it grow:

The stadium was packed with thousands of fans waving towels and hoping for a midseason victory from their favorite college football team. But by the time the final whistle blew, those cheers turned to jeers. The next morning, the head ball coach was called into a meeting that would end their tenure with the team. They walked out without a job, but with something most other fired workers never see: a multimillion-dollar payout.

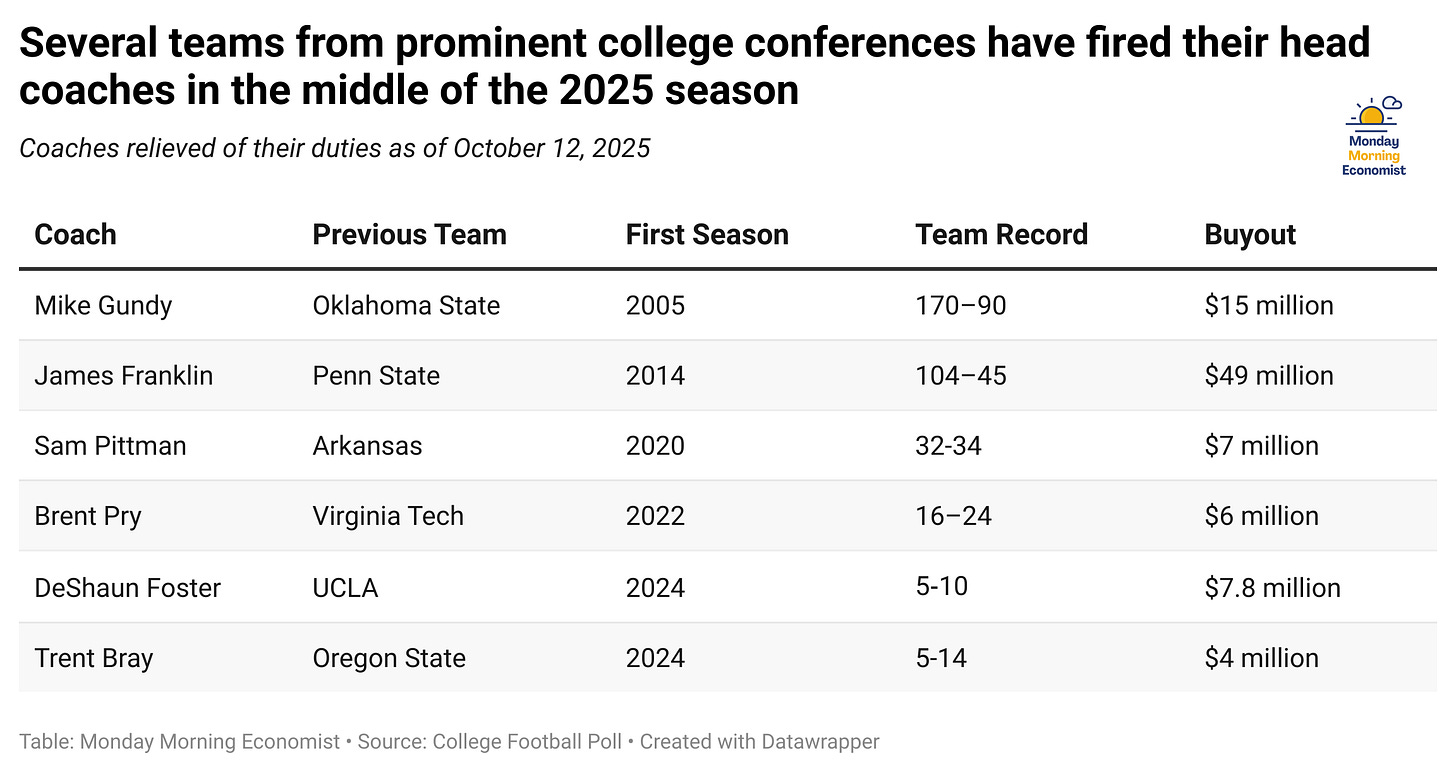

Several prominent college football programs have already fired their head coaches midway through this season. A couple of those coaches had more than a decade of experience, while others were barely two years into their tenure. Either way, one theme has dominated the headlines following their departure: the buyout.

It’s a remarkable arrangement. In almost any other profession, getting fired means losing your paycheck. In college football, it can mean financial security for years to come. But why would a university agree to pay that kind of money to someone they just decided they don’t want anymore?

Buying Job Insurance

College coaching looks glamorous from the outside: million-dollar salaries, packed stadiums, private planes. But behind the scenes, it’s one of the most unstable jobs in America. A coach can go from beloved to unemployed in a single season. Sometimes in a single game.

It’s also a major disruption to their personal life. Families will eventually have to move, and their kids will change schools. There are only about 130 top-tier football programs in the country, which means there aren’t many places to go next. Head coaching positions don’t come around often, especially at good programs.

That’s the economic reality coaches face when they sign their contracts. They’re entering a market where the supply of jobs is small and the pressure feels relentless. So before they agree to put their careers on the line, they want protection. That’s where the buyout clause comes in. Economically, it’s a form of insurance.

The university is covering some of the downside risk of bringing in a new coaching staff. In exchange, the coach takes on a high-visibility role where every loss is televised and every decision is dissected.

It’s not so different from the way we buy insurance in our own lives. You insure your car in case of an accident, or your home in case of a fire. A coach is insuring their career against the one thing they can’t control: getting fired because of a missed field goal, an injured quarterback, or a few unlucky bounces went the wrong way. And just like an insurance premium, that protection costs money.

The University’s Dilemma

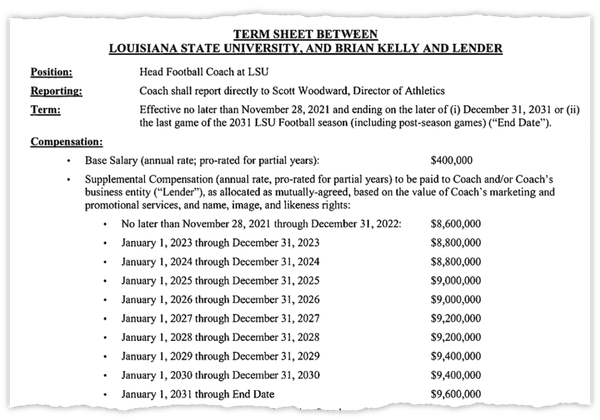

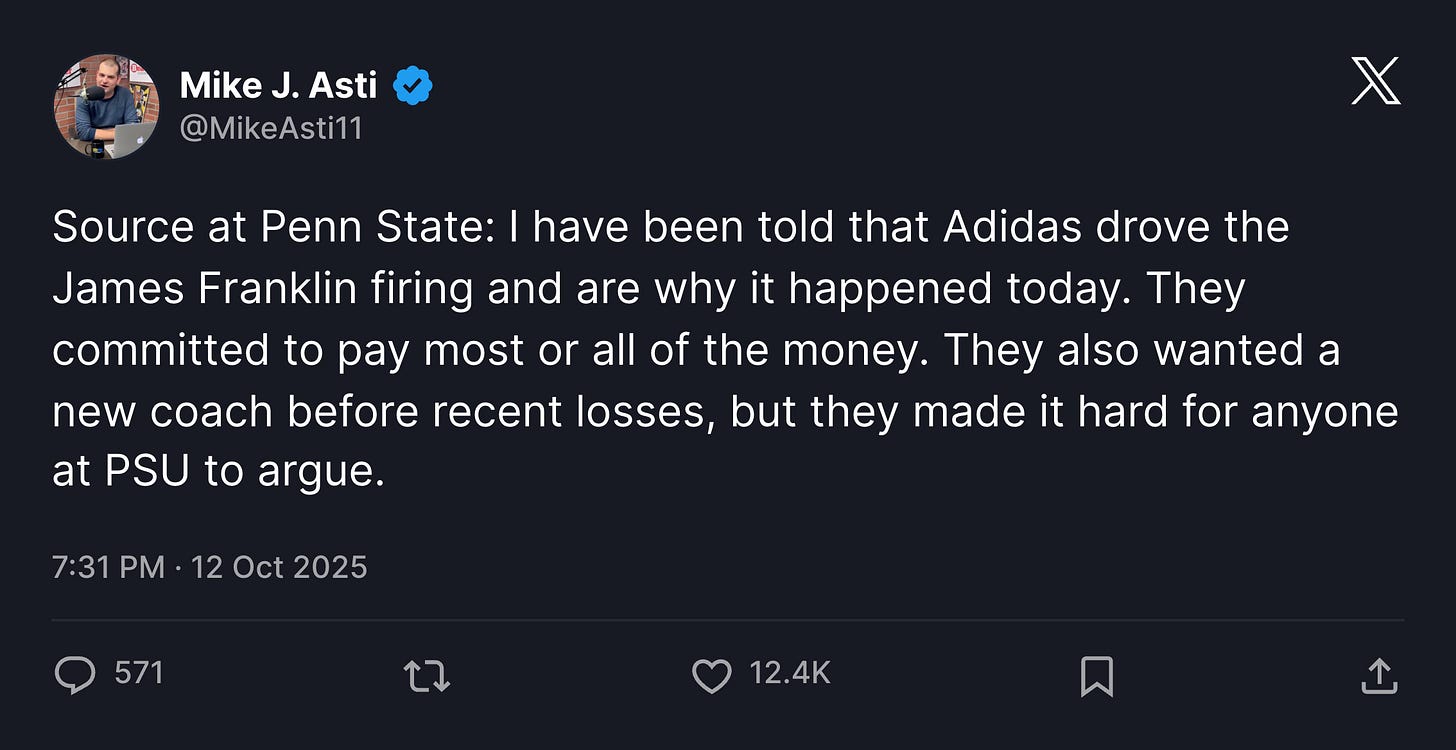

For athletic directors and university presidents, firing a coach isn’t an easy decision. James Franklin at Penn State and Jimbo Fisher at Texas A&M were coaches with national championship expectations. Each led programs with top recruits, national attention, and deep pockets. Both were let go with several years left on their contracts.

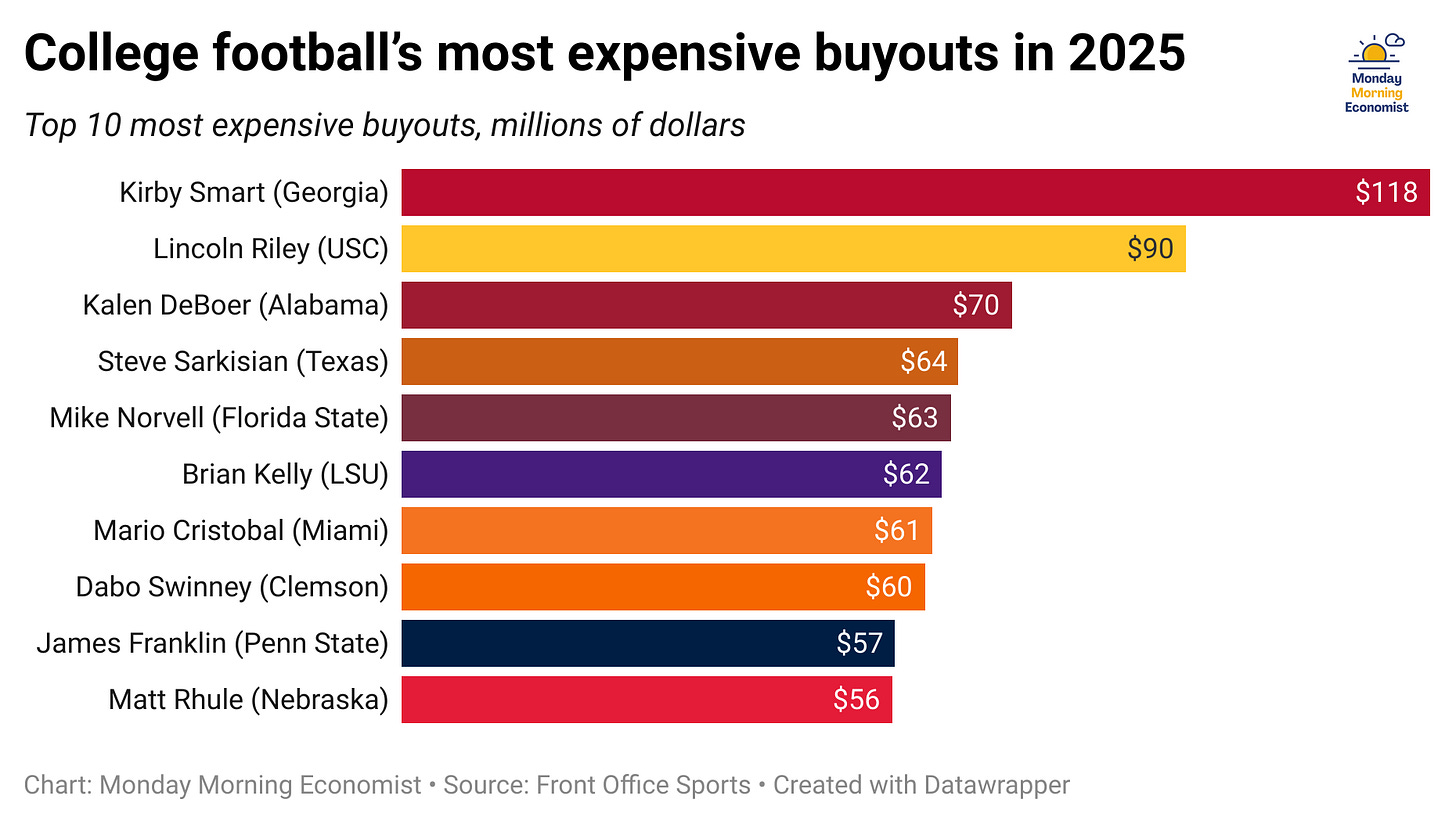

When Fisher was fired in 2023, Texas A&M owed him roughly $76 million, a record-setting buyout that will keep him on the payroll through 2031. Franklin’s buyout isn’t quite as large, but it still runs well into eight figures. It’s money Penn State will owe long after someone else is pacing the sideline.

If you don’t keep up with sports, this might sound irrational. The top college coaches are paid millions every year, and their assistants can earn millions as well. Why cut a coach who has invested so heavily in the program? For athletic directors, the calculation is rarely about the past.

All the time and money teams have invested in their programs in the past are gone. They’re considered sunk costs. Decisions about what to do next are supposed to weigh the future costs. Athletic directors have to ask themselves: Will keeping this coach hurt recruiting? Will it make fans and donors lose faith? Will the program fall further behind if we wait another season?

The costs aren’t just about the buyout. Some current players will follow their coach to another school. Recruits may back out of their commitments. The program loses continuity, and the new coach has to rebuild everything from scratch.

Each firing becomes a kind of economic balancing act. Keep the coach, and you risk losing future wins and revenue. Fire the coach, and you may be paying for it for years. Ultimately, the university is wagering that investing millions today will ultimately save it even more in the future. Whether that bet pays off is another question entirely.

Final Thoughts

Buyouts exist for a reason. They give coaches the confidence to take chances early. They can recruit new types of players, try bold strategies, or overhaul a program that’s stuck in old habits. Without that financial safety net, few would be willing to risk it. Big risks can sometimes result in big failures, and these buyouts may even lead to a moral hazard. Coaches can afford to take on riskier moves because they think they’re shielded from the consequences.

But buyouts aren’t likely to disappear. For high-profile coaches, they’re part of the deal. No one wants to take over a struggling program, coach someone else’s recruits for two seasons, and get fired before their system takes hold. The buyout buys them time, which is the scarcest resource in college sports.

Share this with the friend who yells “fire the coach!” every Saturday so that they can get a sense of what that actually costs. Or just sign them up yourself if they’re too busy Googling their favorite team’s least favorite coach.

Between 2019 and 2023, there were 114 coaching changes, which equate to a turnover rate of approximately 18% each season [CBS Sports]

Georgia Bulldogs coach Kirby Smart has one of the highest buyouts in the country should the school part ways with him: $118 million [Sports Illustrated]

Texas A&M owed Jimbo Fisher $19.2 million within 60 days of his firing and owes him $7.2 million each year through 2031 [ESPN]

The NCAA tried and failed to limit pay for some assistant coaches in the 1990s [The New York Times]

Over the past decade, public universities have spent $530 million to fire college football coaches [Axios]

The new Chad Powers series on Hulu illustrates this well!

Brent Pry will make more this year than I have in my entire career put together. I'm still trying to wrap my head around the risk calculation...