Why companies pay for your education

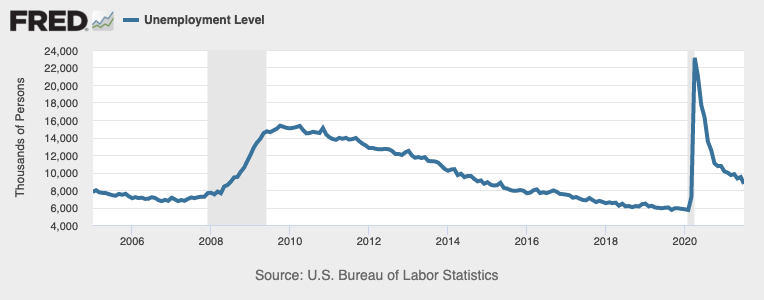

Retailers are still struggling to find enough workers to fill their schedules despite the US economy adding almost 1,000,000 new workers last month and the number of people unemployed being at its lowest level since before the recession began. Even though the recession officially ended in April of last year (more on that next week!), it doesn’t entirely feel like we’re really back to where we were before. It takes a lot longer than people realize to get back to pre-recession levels, but this recovery has been much faster than the Great Recession from 2007 to 2009.

At the peak of pandemic unemployment, there were a little over 23 million people classified as unemployed. The Great Recession topped out around 14 million people who were unemployed during the recession, but a couple of months after the recession ended the number of unemployed people increased to 15.3 million. If we look from the second peak (even though it happened after the recession ended), it took almost 4.5 years to get the number of people unemployed down to the same number we’re at now. This recession started at a significantly higher peak and has only taken about 1.5 years. Recovery has been much quicker than before.

The latest perk being dangled in front of the unemployed isn’t increased pay or a more pleasant working environment, which we saw earlier this year in previous issues of Monday Morning Economist. Target is now trying to entice workers to put on the red shirt in exchange for a debt-free college degree while Walmart is offering a college degree for $1 per day for its associates. Both retailers join other major companies, like Chipotle and Starbucks, in offering their employers the opportunity to earn a degree while working.

There are some limitations to Target’s newly announced program, most notably that it limits the choice of universities. Many of the options are reputable programs like the University of Arizona and Oregon State University. There is a limit on which programs that students can study if they want the entire program paid for, but that list is much broader. The program needs to be one that Target has identified as having the potential to help improve its company, but even that list includes 250 programs, including computer science, information technology, and business management.

Target’s corporate press release paints this as a charitable act, and it is definitely some good publicity. Rarely do profit-motivated companies do things that don’t also have the ability to increase profits at the same time. Target claims to be an industry leader for entry-level workers by offering $15 per hour, but the median weekly earnings for workers with high school diplomas is $712 (about $17 per hour). That number bumps up some when workers have some college experience, but Target will likely continue paying below the national median.

Completing college classes may not actually result in students learning anything about the actual subject their taking, but they may learn how to better manage their time and increase their social skills. These soft skills are still valuable and would likely increase worker productivity at Target. The team at Marginal Revolution University does a phenomenal job at developing educational resources for educations. If you’re looking for an interesting debate on the value of a college degree, I’d highly recommend this Econ Duel they produced a few years ago:

The biggest cost saver of this policy likely deals with employee retention. The retail industry historically has one of the highest turnover rates in the United States. This program has the potential to ensure that Target hires workers who won’t quit quickly and will stick around for a few years, especially if they start at Target right after graduating high school. The cost of replacing workers can range from one-half to two times that workers’ annual salary depending on how much money it costs to recruit, hire, and train workers. Workers who are completing a degree that is paid for by someone else aren’t likely to quit out of fear of losing those benefits.

This might look like a great policy to help workers, but it’s also part of the growing power of firms over their workers. All of the caveats of the program haven’t been posted yet, but programs like this often require workers to pay back the tuition if they quit within a certain timeframe. This locks workers into a low-paying job and doesn’t give them much power in the employer-employee relationship. Again, depending on the policy, it may also prevent them from other personal investments associated with college like study abroad opportunities or internships in their field.

75% of the U.S. population lives within 10 miles of a Target store [Target]

The median weekly pay for a college graduate is $1,173 [Bureau of Labor Statistics]

The separation rate for the entire United States is currently around 3.7% [Bureau of Labor Statistics]

There are around 19.7 million students enrolled in US colleges and universities [National Center for Education Studies]

Week 31 is done and I’ve checked in a total of 49 books for the year. I mentioned last week that I was on vacation, which is why that number jumped so much from our last check-in. Click that link above to see the new additions, but I wanted to highlight my favorite book over the past two weeks: SoccerWomen by Gemma Clarke.

Clarke takes a historical look back at some of the women who have made a big impact on the game of soccer and provides a brief introduction of each woman. It’s one of those books that had me constantly searching for more information after reading each entry. If you’re a fan of the beautiful game, this book is worth checking out.