The Economic Logic Behind the "No Tax on Tips" Policy

Imagine how much more pervasive tipping could become if tips were no longer taxed

Thank you for reading Monday Morning Economist! This free weekly newsletter explores the economics behind pop culture and current events. This newsletter lands in the inbox of more than 5,000 subscribers every week! You can support this newsletter by sharing this free post or becoming a paid supporter:

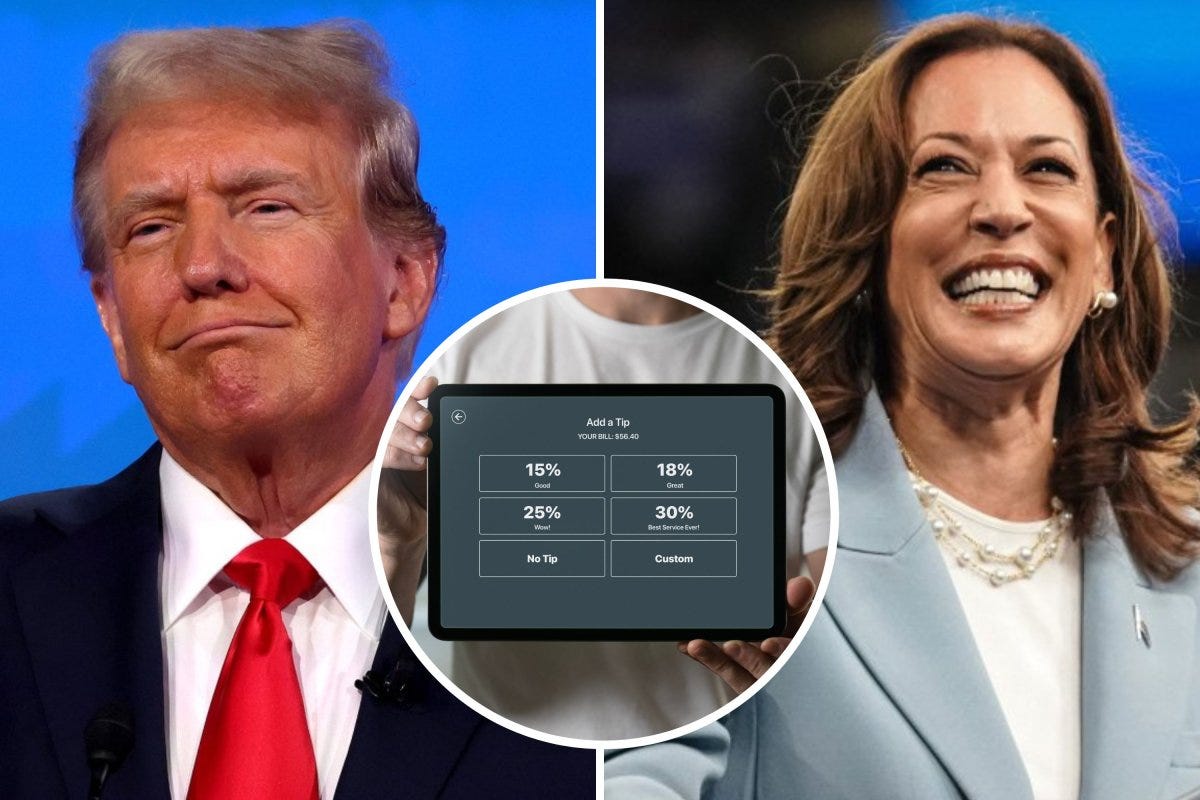

Amid the flurry of campaign promises, both Donald Trump and Kamala Harris have recently championed a proposal to eliminate federal income taxes on tips—a move that, at first glance, seems like a straightforward populist play. After all, who wouldn’t want to give a financial break to America’s service workers, the waitstaff, bartenders, and hairdressers who often rely on tips to make ends meet? However, as with many policies that seem generous on the surface, this one is layered with economic and political implications that warrant a closer look.

Tips as a Form of Income

For roughly 4 million American workers, tips aren’t just a nice addition—they’re the bulk of their income. This group makes up about 2.5% of the entire U.S. labor force and is heavily concentrated in industries like hospitality and personal services. In these sectors, the federal minimum wage for tipped employees is a mere $2.13 an hour, far below the standard minimum wage that many of us are familiar with. The expectation is that tips will make up the difference, theoretically lifting these workers above the poverty line. But, as is often the case, theory and reality don’t always align.

In practice, the distribution of tips is anything but uniform. Workers in upscale restaurants or trendy bars might do well, but those in lower-end establishments can struggle to earn a living wage. For them, income from tips is unpredictable and fluctuates with customer generosity and broader economic conditions. This instability makes the idea of eliminating taxes on tips especially appealing—keeping more of their earnings could provide some much-needed financial relief.

However, the story doesn’t end there. The majority of low-income workers who rely on tips already benefit from tax credits like the Earned Income Tax Credit (EITC) and the standard deduction, which often reduce or even eliminate their federal income tax liability. Estimates suggest that a little more than a third of tipped workers don’t earn enough to owe federal income taxes in the first place. So, while the idea of tax-free tips sounds appealing, the actual economic benefit for many might be less significant than supporters suggest.

Concentrated Benefits & Diffuse Costs

To understand why politicians would push a policy that benefits a relatively small part of the population, we should consider the concept of concentrated benefits and diffuse costs—a key idea in public choice theory. These scenarios often lead to the adoption of policies that may not be economically efficient but are politically advantageous.

Here, the concentrated benefits are straightforward. The 2.5% of the U.S. labor force that earns tips stands to gain directly from the proposed tax exemption. While this group is small in size, it’s politically significant, especially in states like Nevada, where the service industry is a major employer. In such states, the support of tipped workers—and their unions, like Nevada’s powerful Culinary Union—can be crucial in a tight election. For politicians, winning over this organized and vocal constituency can provide a significant electoral edge.

On the other hand, the costs of this policy—like reduced federal revenues, potential pressure on Social Security and Medicare, and added complexity in the tax system—are spread thinly across the entire population. For the average taxpayer, the impact might be so small that it goes unnoticed. This widespread but diluted cost means there’s little motivation for the general public to organize in opposition. Few voters are likely to rally against a policy that only slightly affects their finances, even if the long-term economic consequences could be negative.

A Look Through the Public Choice Lens

Public choice theory sheds light on the underlying motivations for policies like the proposed elimination of income taxes on tips. At its core, public choice theory applies the same principles of economics that explain market behavior to the realm of politics, viewing politicians as rational actors driven by self-interest—in this case, the pursuit of votes and political power.

Through this lens, the proposal to exempt tips from federal income tax is less about sound economic policy and more about strategic political maneuvering. Trump and Harris, rather than focusing on the broader economic impact, are primarily interested in the immediate political gains. By appealing to a specific, influential voter base—namely, tipped workers and their unions—they are engaging in what economists refer to as rent-seeking behavior. Rent-seeking occurs when individuals or groups attempt to obtain financial benefits through the political process rather than through productive economic activity. In this case, the political actors are seeking to secure votes and support by promising favorable tax treatment to a well-defined group.

Mancur Olson, a prominent public choice theorist, explained that small, organized groups are often more successful in achieving favorable policies than large, dispersed groups. The concentrated benefits of this policy create strong incentives for collective action among tipped workers and their advocates. These groups have a clear, tangible stake in the policy’s success, which can translate into organized lobbying efforts and political mobilization.

The proposal to eliminate taxes on tips is a classic example of how public choice theory explains the intersection of economics and politics. It highlights how politicians can craft policies that cater to specific interest groups to secure political support, even if those policies are not necessarily in the best economic interest of the broader population.

Final Thoughts

The convergence of concentrated benefits for a small but politically significant group, diffuse costs spread across the general population, and the strategic self-interest of politicians has resulted in a policy that, while appealing to some, may not be the most effective or equitable solution in the long run. For the millions of Americans who depend on tips, the prospect of keeping more of their hard-earned income is undeniably appealing.

However, as is often the case with election-year promises, the true impact of this proposal may be more about securing votes than enacting meaningful economic change. Ultimately, the proposal to eliminate taxes on tips is as much a lesson in the economics of politics as it is in the politics of economics.

According to a Harris Poll survey, 64% of Americans are uncomfortable with more types of businesses and services asking for tips, and 78% would like to see more transparent tipping practices [Fast Company]

The median hourly wage for waiters and waitresses was $15.36 in May 2023 [Bureau of Labor Statistics]

Nevada has the highest concentration of tipped workers in the country, with about 25.8 waiters and waitresses per 1,000 jobs [Associated Press]

The median non-tipped worker in 2023 was 41 years old, while the typical tipped worker was a full 10 years younger: 31 years old [The Budget Lab at Yale]

If the govt stops taxing tips, I expect to see a lot more jobs become tipped positions.

Mr. Pink hardest hit

Here’s a better idea. Pass H.R. 25 the FairTax Act.