The Cost of Uncertainty

When businesses delay investments and consumers pull back on spending, the ripple effects of lost confidence can bring economic growth to a standstill.

You’re reading Monday Morning Economist, a free weekly newsletter that explores the economics behind pop culture and current events. Each issue reaches thousands of readers who want to understand the world a little differently. If you enjoy this post, you can support the newsletter by sharing it or by becoming a paid subscriber to help it grow:

The stock market has felt like a roller coaster ride lately. The S&P 500 peaked in the middle of February, but has fallen by 5% since. This isn’t just a routine dip, but rather a reflection of a deeper uncertainty that has been brewing since Trump took office. At the heart of this volatility is the on-again, off-again nature of the administration’s tariff policies, especially with Mexico, Canada, and China—our three largest trading partners.

Consumers are bracing for higher prices, and businesses are stuck in limbo. After spending two years battling high inflation and interest rates, many Americans hoped the new administration would bring some financial relief to their bank accounts. With tariffs potentially fully back on the table in a few weeks, companies and households are left wondering what happens next. The past few weeks have felt like the economic equivalent of a cat in a room full of laser pointers.

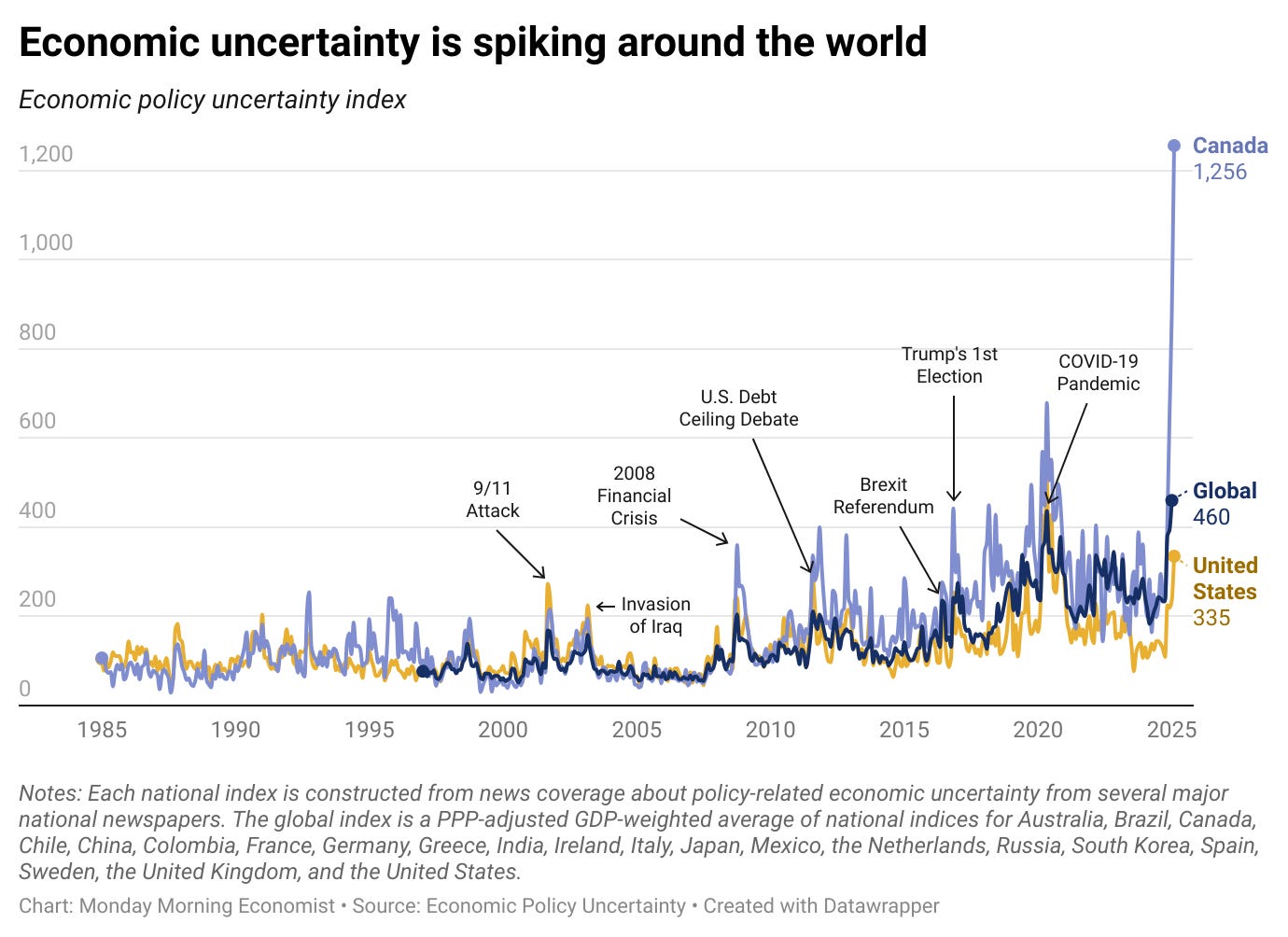

This uncertainty is not just a feeling among a few people on the internet or the talking heads on your television. The Economic Policy Uncertainty Index has been tracking the unpredictable nature of domestic and foreign policy around the world for decades. It’s global measure recently peaked, and the United States measure is at its highest level outside of the pandemic.

But behind the numbers and headlines, there’s an important economic consideration that we all need to remember: when people and businesses don’t know what’s coming in the next few months, they often hold back from spending. And when everyone holds back, the economy starts to hold back as well. Let’s look at why certainty matters so much and how today’s uncertainty is shaping our economic future.

Why Does Uncertainty Matter?

Uncertainty makes businesses and consumers cautious. It’s not that they ever don’t want to spend or invest again—it’s that they’re not sure if now is the right time. Imagine you’re a business owner who’s been thinking about expanding your new factory. If tariffs on your raw materials could change overnight, or that retaliatory tariffs might make it harder for you to send your products overseas, you might decide to hold off expansion until things settle down. Multiply that hesitation across thousands of businesses, and suddenly, new projects stall, hiring freezes, and economic growth slows down.

It turns out that consumers don’t act all that different. When people are worried about their financial future, they often switch to "just-in-case" mode. Instead of splurging on a new car or renovating their kitchen, they save more and spend less. It’s a rational response to uncertainty. But when millions of people make the same choice, it creates a feedback loop. Businesses see lower sales, which further reinforces their caution, leading to a cycle of reduced economic activity.

Why Expectations Matter

Expectations shape our economic decisions in a variety of ways. When businesses expect higher costs from tariffs, they might raise prices. When consumers expect inflation, they might spend differently. The same is true for financial markets—uncertainty makes investors cautious, which can tighten credit and slow growth.

Back in the 1930s, economist John Maynard Keynes coined the term “animal spirits” to describe the emotions and instincts that drive economic behavior. When “animal spirits” are strong, businesses invest, consumers spend, and the economy thrives. But when confidence falters, a growing economy can quickly lose momentum.

When expectations are unclear, caution becomes the default, and that caution can turn a slowdown into something worse. Unfortunately, it doesn’t seem like we’ll get much clarity anytime soon.

Final Thoughts: Are We Heading Toward a Recession?

Recessions are a natural part of the business cycle—what goes up must eventually come down. The U.S. economy has been on a long, steady run without an official recession since the pandemic recession in 2020. Business cycle theory suggests that this stability won’t last forever.

But financial leaders have warned of a downturn for years. Predicting recessions is challenging, and even the experts get it wrong. So why do so many people keep predicting recessions? If you’re one of the earliest (and loudest) prognosticators who turn out to be right, then you’ll likely be celebrated as having some special gift. If you’re wrong, most people will forget that you ever made the production in the first place. Unless you’re Bloomberg, who predicted there was a 100% chance the U.S. would have a recession in 2023. Spoiler alert: it didn’t happen and people haven’t forgotten how dumb their prediction was.

But there’s no denying that today’s mix of market volatility and wavering consumer confidence feels like a recipe for a downturn. Heck, even the President has suggested that a downturn was possibly coming. Unfortunately, there’s a paradox here—if enough people start acting like a recession is imminent, they could end up causing one. Market economies can be a self-fulfilling prophecy like that.

While none of us can individually change the broader economy, there are some steps you can take to “self-insure” against a potential recession. If you’re considering a major purchase—like appliances or electronics—it might make sense to buy those sooner rather than later. Durable goods prices often rise first when uncertainty hits, and it doesn’t look like the Chinese tariffs are likely to change soon.

This is also a good time to review your family’s budget. This doesn’t mean cutting everything fun out of your life, but it’s a good time to look at where your money is going and make sure it aligns with your priorities. If you can throw a little more money into your rainy day fund, a little extra padding can make a big difference if things take a turn for the worse.

In short, uncertainty has real-world consequences. It affects how businesses invest, how consumers spend, and how markets react. And right now, the high level of uncertainty is casting a long shadow over the economy.

Thank you for reading Monday Morning Economist! This free weekly newsletter explores the economics behind pop culture and current events. This newsletter lands in the inbox of more than 6,700 subscribers every week! You can support this newsletter by sharing this free post or becoming a paid supporter:

The S&P 500 is currently up 12.74% since this time last year, but is down 1.68% since the start of 2025 [Yahoo! Finance]

The vast majorities of Canadians think that increasing U.S. tariffs on Canadian goods would hurt the Canadian national economy (80%) and reduce the affordability of goods (78%) [YouGov]

The Atlanta Fed's GDPNow model estimate for annualized growth in the current quarter was -2.8% [Reuters]

In a 1930 essay, John Maynard Keynes predicted that people would work 15 hours per week by 2030 because of rapid technological advancements [Forbes]