A Run for Your Money

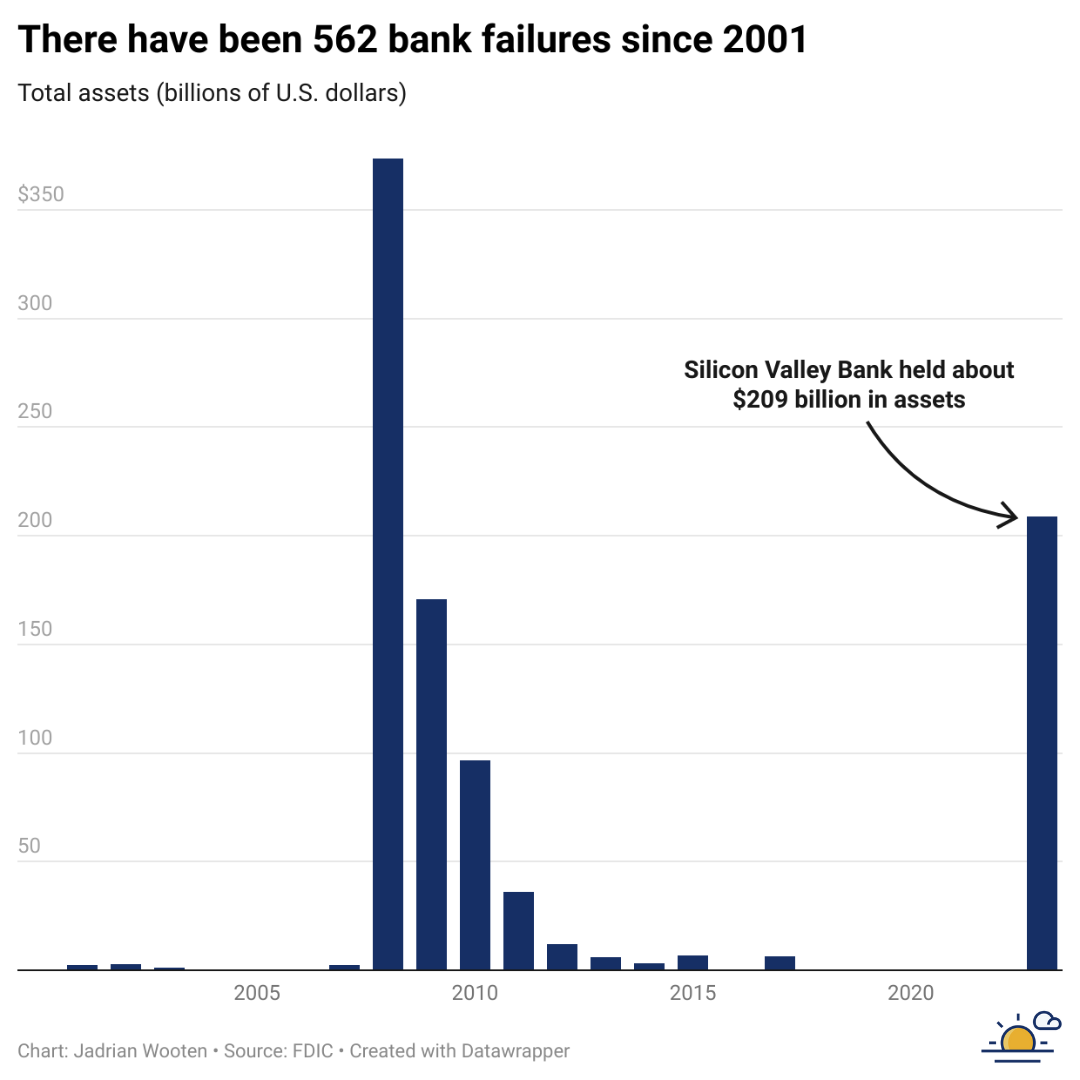

Over the past few decades, Silicon Valley has become a hub for innovation, venture capital, and high-tech startups. Last week it was the site of the largest bank closure since the Great Recession.

Over the past few decades, Silicon Valley has become a hub for innovation, venture capital, and high-tech startups. Against this backdrop, Silicon Valley Bank (SVB) emerged as a leading financial institution, catering to the unique needs of tech entrepreneurs and investors. However, the bank's fortunes took a turn for the worst last week, culminating in a bank run that forced the Federal Deposit Insurance Corporation (FDIC) to take over. Silicon Valley Bank's accounts are mostly uninsured, causing widespread concern among depositors. While the FDIC insures up to $250,000 on most individual account types, Treasury Secretary Janet Yellen stated that the government will not bail out the bank, but is assisting worried depositors.

Bank runs are not a new phenomenon, and they have been observed throughout history, from the Great Depression to the Great Recession in 2008. They are a classic example of herd behavior, where individuals follow the actions of others, even if those actions may not be in their best interest. The SVB bank run appears to have started on Thursday after a Silicon Valley venture capitalist fund, Peter Thiel's Founders Fund, advised its portfolio companies to take their money out of SVB. Other venture capitalists heard about this and told their own companies to take out their money from SVB too.

The rational response for an individual depositor would be to wait and see if the bank is indeed in trouble before withdrawing their funds. However, when everyone else is rushing to the bank, the fear of being left out can be overwhelming, leading to a rush for the exits. It’s very similar to what happened during the early weeks of the pandemic when people rushed to the store to buy toilet paper. A bank run occurs when a large number of depositors suddenly withdraw their money from a bank, fearing that the bank may be insolvent or unable to meet its obligations.

A sudden surge in withdrawals can trigger a liquidity crisis for the bank, as it may not have enough cash on hand to satisfy all the demands for withdrawal. This is due to the fact that the U.S. uses a fractional reserve banking system, which allows banks to take a fraction of the deposits they received and loan that money out to earn a profit. When depositors start asking for their deposits back, the bank only holds a fraction of those deposits. The bank’s inability to meet the sudden demand from its depositors erodes confidence in the bank’s ability to return the deposits, leading to more withdrawals and exacerbating the crisis. This vicious cycle becomes a self-fulfilling prophecy, where a belief that a bank is in trouble becomes the reason for its demise.

For the specifics of SVB’s liquidity issues, check out this quick explainer from my friend Dr. A who also writes on Substack as

:Bank runs can have severe consequences for the banking system and the wider economy. When banks experience a run, they may be forced to sell assets or borrow funds at high rates to meet their obligations. In extreme cases, bank runs can lead to a form of contagion in which the failure of individual banks or even a systemic banking crisis impacts the broader economy.

One way to prevent bank runs is to strengthen the regulation and supervision of the banking system. Regulators can require banks to hold more capital to absorb potential losses and reduce the risk of a bank run. They can also establish emergency liquidity facilities to provide funding to banks in times of crisis. Individuals can also take steps to reduce the risk of a bank run. They can diversify their deposits across multiple banks to reduce the impact of a single bank failure.

The FDIC, or the Federal Deposit Insurance Corporation, was created in response to the banking crises of the Great Depression. Its main function is to provide deposit insurance, which protects depositors in the event of a bank failure. Under current regulations, depositors are fully insured up to $250,000 in each "ownership category." This means that even if a bank fails, depositors can still recover their deposits, up to the insured limit. One big problem facing depositors at SVB is that nearly 95% of all deposits were over this limit.

The presence of deposit insurance is crucial in preventing bank runs. When depositors know that their deposits are insured, they are less likely to panic and rush to withdraw their money. This reduces the risk of a self-fulfilling prophecy and helps stabilize the banking system. However, deposit insurance is not a panacea, and it can create moral hazard problems. If depositors know that their deposits are insured, they may be less inclined to monitor the bank's performance or exert discipline on its management. This can lead to excessive risk-taking and imprudent lending practices, which can ultimately undermine the stability of the banking system.

The case of Silicon Valley Bank is a reminder of the importance of sound banking practices and risk management. It’s also a lesson on the importance of regulatory oversight and monitoring. While the FDIC's intervention may have saved depositors from even more significant losses, it highlights the need for continued vigilance and oversight to prevent similar situations from arising in the future. Banks play a critical role in the economy, and their failure can have severe consequences for the wider financial system. Regulators must ensure that banks are adequately capitalized and have robust risk management systems in place.

Almena State Bank in Almena, KS was previously the last bank closed by the FDIC and held about $70 million in assets [FDIC]

As of March 10, Roku had around $487 million of its $1.9 billion in cash and cash equivalents at SVB [CNBC]

The FDIC receives no Congressional appropriations—it is funded by premiums that banks and savings associations pay for deposit insurance coverage [FDIC]

During the Great Depression, approximately 9,000 banks failed, resulting in the loss of $7 billion worth of depositors' assets. [Social Security Administration]