The Spooky Shutdown Strategy of Spirit Halloween

Empty storefronts come alive again for a few months every Fall thanks to Spirit Halloween and an economic concept known as "the shutdown rule."

You are reading Monday Morning Economist, a free weekly newsletter that explores the economics behind pop culture and current events. This newsletter lands in the inbox of over 2,500 subscribers every week! You can support my newsletter by sharing this free post or becoming a paid subscriber:

Every year, as the leaves turn shades of red and gold, and a chill creeps into the air, a peculiar transformation occurs across cities and towns in the United States and Canada. What were once vacant storefronts, abandoned memories of big box retailers that shuttered their doors years ago, suddenly come back to life, but with a spooky twist – they become Spirit Halloween stores.

These pop-up shops of all things spooky and festive have become a beloved annual tradition, seemingly appearing overnight to the delight of Halloween enthusiasts everywhere. The ability of Spirit Halloween to swiftly materialize in empty spaces is nothing short of remarkable.

Most Spirit Halloween stores are generally only open 8–10 weeks out of the year and typically sign 3-month leases to allow for set-up and cleaning. While landlords may prefer long-term tenets, some revenue is better than no revenue. Spirit Halloween recognizes the opportunity cost of letting those spaces sit empty, but their business model goes beyond that. If you want some behind-the-mask data on the company’s business model, check out this post from SatPost by Trung Phan :

Our journey takes a slightly different path. We’re peeling back the curtain, not on ghouls and goblins, but on the economics behind Spirit Halloween. We’ll uncover the financial wizardry that powers Spirit Halloween’s seasonal magic. We’ll explore concepts like average costs, demand, and the shutdown rule, all while unraveling the intriguing tale of this iconic pop-up retailer. So, let’s set the stage by revisiting the birth of Spirit Halloween.

The Rise of Spirit Halloween

Back in 1983, in Castro Valley, California, a small boutique existed amidst the quiet hum of everyday life. Joe Marver, Spirit Halloween’s founder, operated a women’s clothing store. But something peculiar caught his eye: lines of people snaked out of a Halloween store down the strip during the month of October. Recognizing an opportunity, Marver decided to transform his boutique into a Halloween store during the spooky season. And thus, the first Spirit Halloween was born.

In 1999, Marver sold the company to Spencer Gifts, a mall-based store renowned for its gag gifts. Spirit Halloween quickly built a reputation for offering a wide range of Halloween merchandise, attracting thousands of devoted fans to its grand openings. But what sets Spirit Halloween apart is its transient nature.

Unlike most businesses, Spirit Halloween stores are not open year-round. Instead, they spring to life for a limited time each fall, making the most of the Halloween season’s demand surge. Just how big is Halloween in the United States? Americans are expected to spend more than $12 billion on Halloween, including $4.1 billion on costumes, $3.6 billion on candy, and $3.4 billion on decorations.

Now, let’s get into some of the economic concepts that power Spirit Halloween’s seasonal operation. At the heart of this story lies the fundamental concept of average costs and demand, which determines when the stores open and close each season.

Understanding the Economics

There are a few different average costs that businesses like Spirit Halloween focus on, but let’s start with two of them to determine whether Spirit Halloween is turning a profit, operating at a loss, or better off closing shop for the year.

Spirit Halloween sells a wide variety of products, but for simplicity, we’ll consider their business as a whole and think of the “average price” of what they sell each day. Demand refers to the quantity of a product or service that consumers are willing and able to purchase at various price levels. For Spirit Halloween, demand represents consumer interest in Halloween-related items during different times of the year.

Now, let’s talk about the average total cost. The average total cost is the total cost incurred by a business divided by the quantity of goods produced. Again, we’ll lump the things that Spirit Halloween sells into a single “good” to make the analysis easier. When considering their total costs, Spirit Halloween will include costs related to leasing storefronts, stocking merchandise, and paying staff.

If the demand for Spirit Halloween’s products exceeds their average total cost, the business is earning an economic profit. Given that Spirit Halloween keeps reopening year after year, it’s safe to assume they’re generating enough total revenue during the Halloween season to cover their total costs for the year and then some.

But here’s where it gets interesting. What about the months leading up to October? Why open stores in September when demand isn't as high as it is in October? To answer that, we need to consider a measure of costs known as average variable cost.

A firm’s average variable cost includes only the variable costs directly associated with producing one more unit of a good. For Spirit Halloween, this encompasses costs like inventory, labor, and utilities that vary with the number of products they’re selling each day. Understanding demand’s relationship to average variable costs helps explain why Spirit Halloween is closed 9 months out of the year, but still opens a few months before October.

The Seasonal Cycle of Spirit Halloween

Spirit Halloween’s seasonal model hinges on recognizing that demand for Halloween products skyrockets during October, drops off considerably in November, and then starts to increase some in August and September. October is the most obvious "high demand" period, as consumers eagerly spend on costumes, decorations, candy, and more.

This heightened demand surpasses Spirit Halloween’s average total cost (ATC), making it a profitable venture. The demand during this month is so high that it even offsets all the other months when they may be unprofitable due to low demand and some consistent costs of operation. Remember, they still have staff on hand operating their online store and seeking rental space for the next holiday season.

However, there’s a twist in the tale. September is likely a different story. Spirit likely operates at a loss in September but is confident that the surge in demand during October will more than cover for this early deficit. But why would any business operate when they’re losing money? Why not operate only during the month of October when demand is greater than the average total cost?

Shutting down physical stores from November through August seems obvious since demand is so low that they would lose a lot of money operating stores at this time. In economic terms, the demand (price) is below the average variable costs of production. September is an interesting month because demand is much higher than in the preceding months but not as high as in October.

When deciding whether operating at a loss is better than shutting down, the goal is to see whether there is enough demand to cover the firm’s variable costs. Even though demand in September may not have the full surge of customers, as long as there are enough shoppers to cover variable costs like staffing, electricity, and supplies, any additional revenue will chip away at that month’s rent. If the business shuts down in September, they would still have to pay the fixed costs of inventory and rent. Operating at a loss means Spirit Halloween is minimizing its losses.

And that takes us back to some data we know about Spirit Halloween’s leases and store hours. Most stores sign 3-month leases but are only open for 8-10 weeks. In the first month (August) demand is so low that it’s not worth opening: demand is below average variable cost. The stores will lose money on fixed costs like rent and maintenance, but that’s all they’ll lose in that month. Stores will begin to open in September, even if demand isn’t at its peak. The higher demand will allow the store to cover its fixed costs and then some of the variable costs as well. October is the peak month when demand is so much higher than average total costs that they’ll earn enough profit to sustain themselves for the rest of the year.

And now consider the demand in the months after October. Once Halloween is over, the demand for spooky costumes and decorations dwindles, falling below Spirit Halloween's average variable costs. In economic terms, this is the "shutdown" phase. Continuing operations would only result in losses, and Spirit Halloween wisely closes its stores until the next Halloween season. This adherence to the shutdown rule is vital in ensuring the company's long-term profitability.

Conclusion

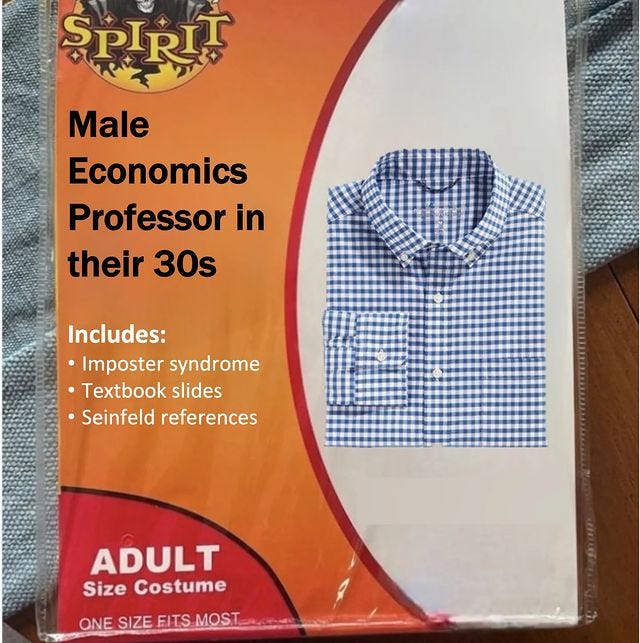

And there you have it, the economics behind Spirit Halloween's seasonal pop-up magic. It's not just about the costumes and decorations; it's about mastering the art of supply and demand, average costs, and strategic timing. The next time you visit a Spirit Halloween store that seems to have sprung from the shadows, remember the economic wizardry behind its existence. If you haven’t picked up your costume yet, there’s still time to go as my favorite character:

Halloween’s origins date back to the ancient Celtic festival of Samhain [The History Channel]

A record number of people (73%) will participate in Halloween-related activities this year, up from 69% in 2022 [National Retail Federation]

Reese's Peanut Butter Cups are the best Halloween treats according to kids [YouGov]

Candy prices in August were up 9.43% from the year before [BLS via FRED]

There are an estimated 79,260 people employed in the candy manufacturing industry in the United States [BLS]