Short Squeeze on Aisle 7

The 1920s aren't all that different than 2020s

I may have surprised you last week when I created a new email newsletter about teaching economics and didn’t even mention a major financial headline that had just happened. It seemed like everyone on social media was talking about “small investors” fighting back against big corporate hedge funds," so why wasn’t I doing that too? It made for a perfect narrative of a modern-day tech/finance David v. Goliath. The only thing that was really new about this story was the platform used to organize those “small investors.”

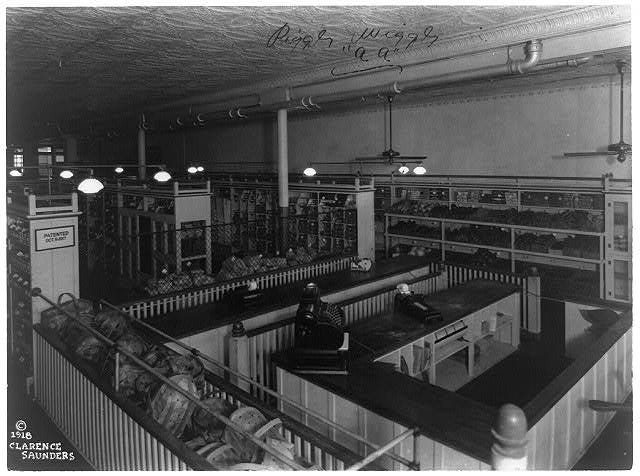

Let’s take a trip back to 1923 to see how a local grocer was revolutionizing the way people shopped for groceries while also dealing with a short squeeze of their own. Piggly Wiggly opened a few years earlier along Jefferson Avenue in Memphis, Tennessee. Clarence Saunders had a radical new idea that would change how the world shopped for groceries. Thanks to the Library of Congress archives, we can see digitized photos of his original store taken by Saunders himself:

Piggly Wiggly introduced the concept of a self-service grocery store. In other grocery stores, customers would enter, present a clerk with a list of items they wanted to buy, and the clerk would go about collecting the items. It was seen as a way to help save customers time since the clerks knew where all the items were located, but it was actually much more expensive to hire that many clerks, which resulted in higher prices for customers.

With the new setup, customers enter the store through a turnstile and browse a true maze of aisles themselves. The initial goal was to reduce the prices of products since the store’s labor costs were now lower, but there was another benefit. Not only were more people shopping a Piggly Wiggly because of their new lower prices, but customers were also buying more items because they saw things on the shelf they hadn’t considered buying before. Sales really took off when they introduced the shopping cart in 1937. Before, customers were forced to use a basket, which you can see on the left side of this entry photo:

Now let’s get back to the finance part of this post so you can see how it compares to what we saw a few weeks ago. Within a few years of opening its Memphis store, Piggly Wiggly was operating over 600 other stores around the country. In an effort to open even more stores, the company issued 100,000 new shares. Along with other unrelated Piggly Wiggly news, a lot of investors began selling their shares, which caused the price of the stock to fall by 1/3 (from $45 per share to $30 per share). Wall Street firms like Merrill Lynch decided to “short the stock,” which means they were betting it would go down even more.

This seems in line with the traditional analysis of supply and demand. I know I cautioned before not to always believe that’s the answer to any problem, but stock certificates are actually a pretty good example of a perfectly competitive market. The market for shares Piggly Wiggly involves a lot of buyers and a lot of sellers who are all trading identical products. The stock price represents the market price and is influenced by changes in market behavior. Piggly Wiggly issuing 100,000 new shares represents an increase in supply, which causes prices to decrease. Stockholders scared Piggly Wiggly may be overexpanding or might go bankrupt would decrease their demand for shares, which decreases the price as well. From an outsider’s perspective (like Wall Street financial companies), this seems like a good opportunity. If they issue short calls and the price continues to fall, they’ll make a lot of money. They were in for a surprise!

Instead of letting the price continue to fall, Saunders borrowed $10 million on margin from a number of other investors. His goal was to buy up all the remaining shares (increase demand for the stock) and punish those Wall Street firms who were betting against his company. The New York Stock Exchange (NYSE) would eventually suspend trading on Piggly Wiggle shares, but not before the stock price reached $124! If you adjust that value for inflation, that would be equivalent to about $1,875 today.

Saunders would eventually hold almost all of the shares to the company, but there’s a small problem. He continued to purchase shares even as prices continued to increase. Wall Street firms were quick to sell their shorts to avoid even larger losses (this is the “short squeeze” part of the story). So what’s the problem? Saunders held almost all of the stock for the Piggly Wiggle company, but there were no buyers available to sell them back to.

You may have read over a particular line earlier that is really important to the story. The NYSE suspended trades of Piggly Wiggly because they realized that Saunders had attempted to corner the market. Saunders was left holding very expensive certificates and no one to sell them to. Buying shares at high prices as a way to punish people who bet against you may feel satisfying in the moment. From an investment standpoint though, you’re supposed to “buy low, sell high” not “buy high, sell low.” Saunders was estimated to have lost $9 million.

Saunders would eventually lose control of the Piggly Wiggly company, which would be divided into a variety of regional divisions or sold to other regional chains. His next big business idea was a fully automated grocery store known as Keedoozle, but he seemed way ahead of his time with that one. Piggly Wiggly still operates around 700 stores today, many of which are in smaller cities and towns. If you’re ever in Memphis, you can visit the Museum of Science and History to see a replica of the original store.

I know grocery store chains are a source of regional pride in the United States, and I wanted to give you chance to share your favorite! I grew up in Texas, so I have a soft spot for HEB. I live in Pennsylvania now and everyone is wild about Wegmans. I’d love to hear about your favorite chain!

I LOVE Trader Joe’s. Top tier snacks.