The Undoing of Real Estate's Price Fixing Pact

For decades, the 6% commission was as much a fixture of the home-selling process as the "For Sale" sign itself.

You are reading Monday Morning Economist, a free weekly newsletter that explores the economics behind pop culture and current events. This newsletter lands in the inbox of more than 4,100 subscribers every week! You can support this newsletter by sharing this free post or becoming a paid supporter:

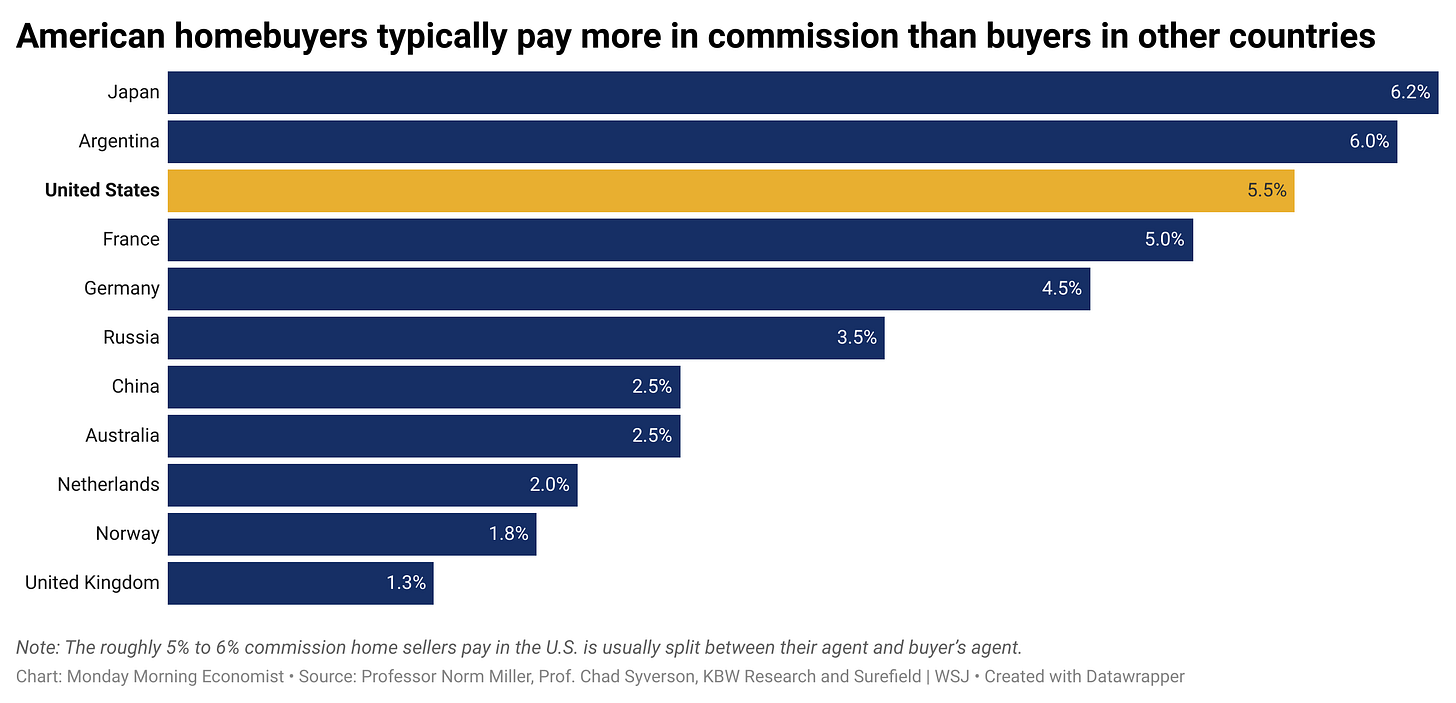

Picture this: you’re selling your house and your agent lets you know they have found an interested buyer. You’re excited, but then you remember that the standard commission for real estate agents involves a whopping 6% of the sale price, often split between the buyer’s agent and the seller’s agent. That’s a hefty chunk of change. But why has that commission been so stubbornly consistent for so many Americans, despite the ever-changing landscape of the ways we buy and sell things?

There may be no economic principle more celebrated and scrutinized than the invisible hand of the market, a term coined by Adam Smith to describe the self-regulating behavior of markets. The idea is that in a free market, competition among sellers drives prices down and ensures that goods and services are allocated efficiently. The mechanism driving this outcome is that each is doing what’s in their own best interest, not benevolence. But what happens when sellers in a market get a little too cozy with each other?

It turns out, there’s a term for this phenomenon. The recent landmark settlement involving the National Association of Realtors (NAR) highlights a fundamental challenge to Smith’s principle of the invisible hand: the temptation and, at times, the practice of price fixing. This collusive behavior undermines the competitive forces of the free market and results in higher prices for buyers.

The Case of the Price-Fixed Commission

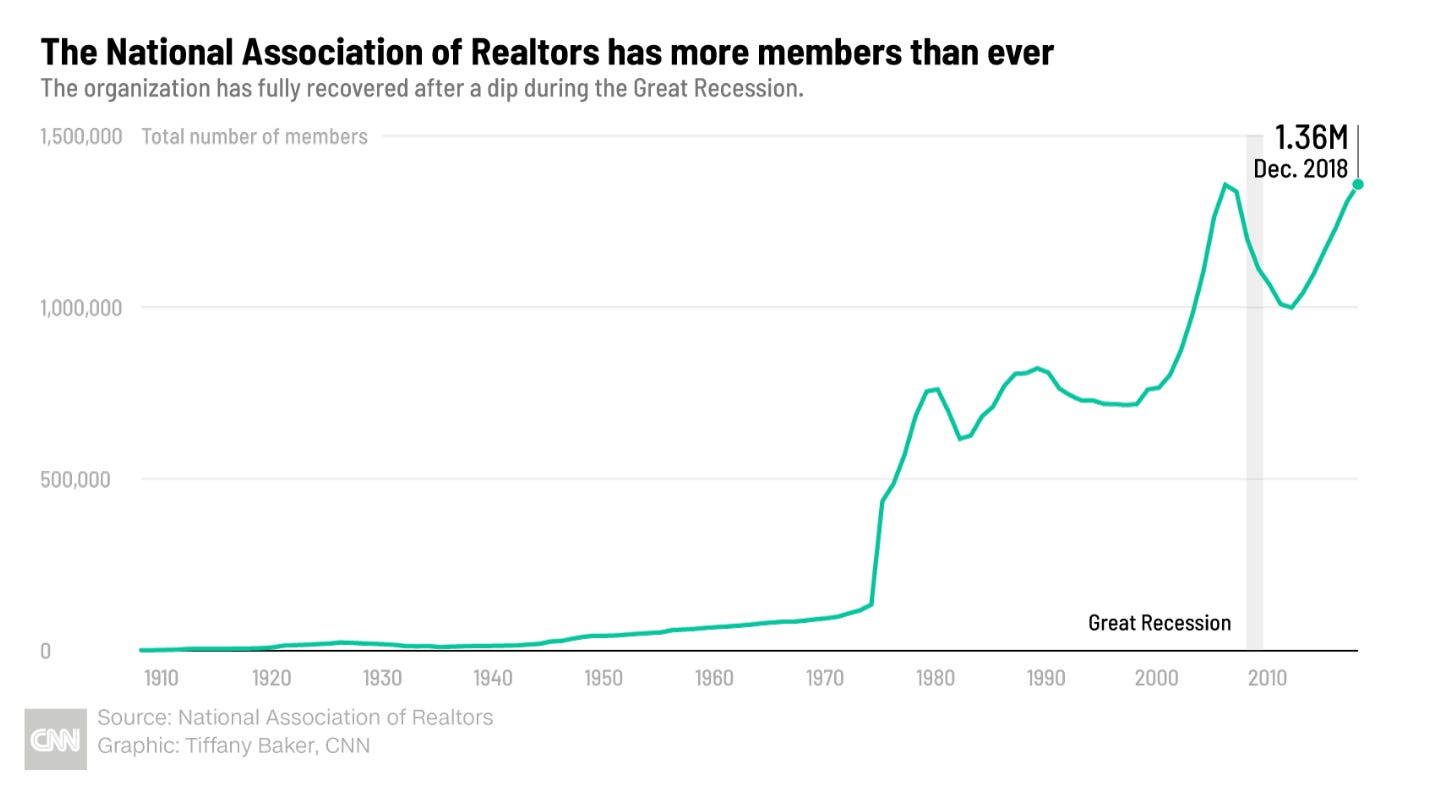

The NAR has been accused of engaging in a form of collusion that artificially inflated commission rates for decades. Some of their other business practices have been called anti-competitive as well, but the main point is that they’ve been accused of price fixing. We’re not talking about the behavior of a few bad agents; the most recent settlement amounted to a staggering $418 million.

The NAR maintains that it does not set commissions—they’ve always been negotiable. So then how did agents manage to keep those commissions so high for so long? It all comes down to information—or rather, the lack thereof. While agents may have known the commissions were negotiable, many sellers simply weren’t aware that they could negotiate those fees. This asymmetric information perpetuated the 6% standard, leaving sellers none the wiser.

But change is on the horizon. The settlement mandates greater transparency and competition in the real estate industry. By requiring written contracts and prohibiting broker compensation from being listed on the MLS, the market moves closer to what economists call perfect information—where everyone knows what everyone else knows. This should bring down commissions closer to what we see in other countries, where almost no one else pays 6% fees.

The Future for Realtors

You might be thinking, "Won’t this hurt real estate agents’ incomes?" It’s a valid concern. After all, commissions make up a significant portion of their earnings. However, there’s a silver lining for the best realtors out there. Increased competition could expand the market and potentially offset losses for the best individual agents in the area. We aren’t likely to see a significant decrease in housing prices until we build more homes, but good agents are still valuable, especially for first-time homebuyers.

And what about the future of the industry itself? We’ll likely see a shift away from the one-size-fits-all commission model. Instead, agents may start offering a la carte services or tiered pricing, giving consumers more choices and driving innovation in the industry. Realtors who can adapt by offering compelling, competitively priced services will thrive. Those who cannot will find themselves squeezed out, leading to a contraction in the number of real estate agents—a prediction echoed by industry analysts.

The Taming of the Invisible Hand

Let’s zoom out for a moment and take in the bigger picture. This isn’t just a story about real estate agents and home sellers; it’s about competition and consumer choice. The settlement represents a victory for the fundamental principles of free markets, nudging us towards a more efficient market. It’s also a good reminder that the invisible hand sometimes needs a little nudge in the right direction.

As we look ahead, the shift should result in greater transparency and competition. While this might mean lower costs for some consumers, it also presents a challenge for realtors to innovate and stand out in a crowded field. Yet, there may be some opportunity in the unsettling new environment. By adopting more flexible pricing models, agents may be able to attract a wider clientele.

The impact of these changes won’t stop at the doors of real estate brokerages. Just as digital platforms revolutionized our shopping and entertainment habits, the real estate industry may (finally) be on the brink of a digital renaissance. Gone are the days of relying solely on standard commissions; realtors must now articulate their value proposition to consumers. Change isn’t just inevitable—it’s an opportunity for progress.

At the end of 2023, The National Association of Realtors reported having 1,554,604 members [Yahoo! Finance]

As of May 2022, there were an estimated 193,010 real estate sales agents earning a median annual salary of $49,980 [Bureau of Labor Statistics]

Americans pay roughly $100 billion in real estate commissions annually [The New York Times]

Approximately 1,879,700 people work in the real estate industry [Bureau of Labor Statistics]

50% of homebuyers find their homes online, yet 87% of them still end up retaining an agent [CNN]

The end of the standard 6% commission seems long overdue.

It always seemed crazy to me that an agent could earn twice as much money selling an $800,000 house as they would selling a $400,000 house.