A growing focus over the past few months has been the US labor market’s increasing quit rate. Despite the economy working itself slowly back to full strength, a growing number of workers are quitting their job. At first blush, this may seem like a bad thing, but this is often a sign of a healthy labor market! When this many people are quitting, it usually means they have some level of financial security or they have already secured a new job. The growth in the quit rate seems extreme following the most recent recession, but it’s actually a trend that started at the end of the last recession in 2008:

There was a year-long period right before the pandemic where the quit rate was steady, but the trend after the recession is pretty consistent with the trend since the end of the 2008 Recession. One possible reason for the sudden increase, rather than a more gradual increase could be the increase in savings that occurred during the pandemic. Households on lockdown also benefited from multiple stimulus checks, unemployment aid, or deferred student loan obligations. This rationale lines up nicely with the concept of opportunity costs. If you aren’t financially secure, it’s unlikely that you’ll quit a job without having another one already lined up. As financial security improves, more people are likely to quit even without a job lined up because they can afford to live a few months without income.

One of the more concerning issues right now though is that a larger share than usual is quitting, but without having a job lined up. The millennial generation (those born between 1980 and 1995) was hit hard by the 2008 recession and still own about 11% less wealth than previous generations when they were the same age. Quitting now, without another job lined up, could undo a lot of the progress that has been made over the past decade.

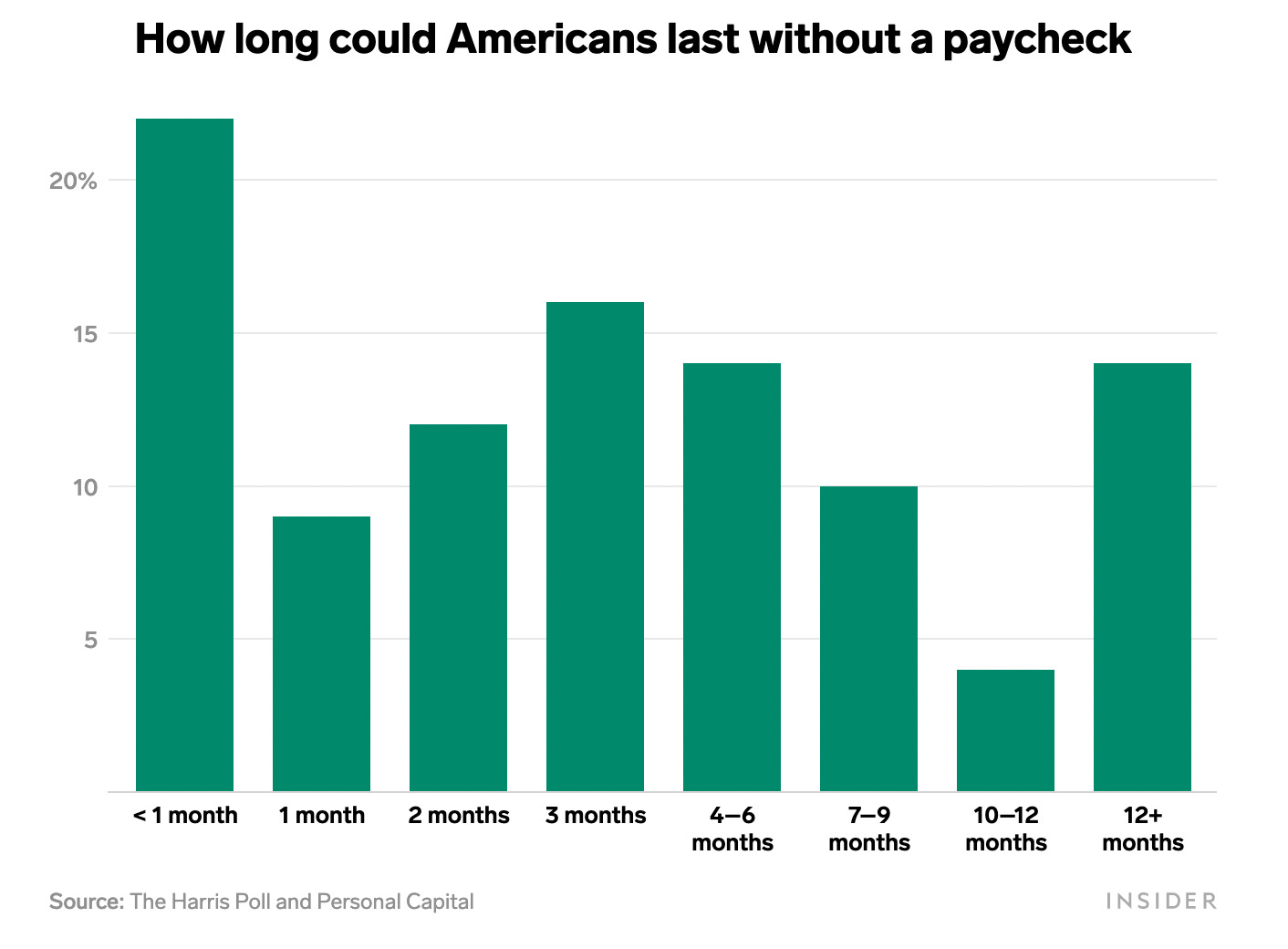

Surveys are indicating that many young workers are quitting without a job lined up in an effort to improve their mental health. While this may be beneficial long-term, it can take a toll on a household’s financial health. It’s a delicate balance and not an easy choice for anyone. Quitting may relieve some current anxiety, but most Americans couldn’t last more than 6 months without a regular paycheck:

The Great Resignation is only just beginning. Workers have been increasingly disengaged with their work environment and those feelings have been amplified during the pandemic. Not only do unmotivated workers hurt firms in the form of productivity losses but replacing workers can cost 1.5 to 2 times the worker’s annual salary. Increasing salaries can only go so far as to improve the situation when the underlying issue is more related to a lack of development opportunities, not feeling connected to the firm’s purpose, and not having strong work relationships. Fixing those problems requires rethinking the entire organizational structure, not just moving someone into a higher tax bracket. Part of the shock happening now with employers is that they’ve been caught flat-footed and don’t know how to respond.

It seems many workers just want to be cared about and not treated as replaceable cogs in the production wheel. For years, companies tried recruiting workers with gimmicky perks like ping pong tables and in-house meals, but those perks mean little if workers don’t feel respected. At worst, those perks influenced workers to spend even more time at the office, which only exacerbates the burnout. Having workers spending more time in the office may be good for firms, but its not so great for workers trying to achieve some semblance of work-life balance.

An estimated 3,977,000 people quit their job in the month of July [US Bureau of Labor Statistics]

Millennial households have an average wealth of $170,000 [St. Louis Federal Reserve]

The personal savings rate in the United States peaked in April 2020 at 33.8% of disposable personal income [US Bureau of Economic Analysis]

Lost productivity of not engaged and actively disengaged employees is equal to 18% of their annual salary [Gallup]

We’ve finished the 36th week of the year, and I’ve checked in a total of 54 books so far this year. I finished up a book on minor league baseball called Where Nobody Knows Your Name. The book follows a handful of players, managers, and even umpires during the 2012 season as they travel between cities and handle the difficulty of being so close to the major league level. There’s been an increased focus on how minor league players are treated, but this book does a really good job of covering the personal decisions of when to call it quits.

I’m also about to wrap up another book on minor league baseball players, appropriately titled I Should Have Quit This Morning. I promise it’s only a coincidence that the books I’m reading are about quitting and this week’s topic is about quitting.

I fired one of my freelance clients back in July... best decision I've made in a while.

Really informative. I am working on a video about this. Will make sure to share a link to your sub stack on it.