The Psyche 16 Asteroid Isn't Worth $10,000,000,000,000,000,000

Exploring the asteroid of dreams and the illusion of price stability

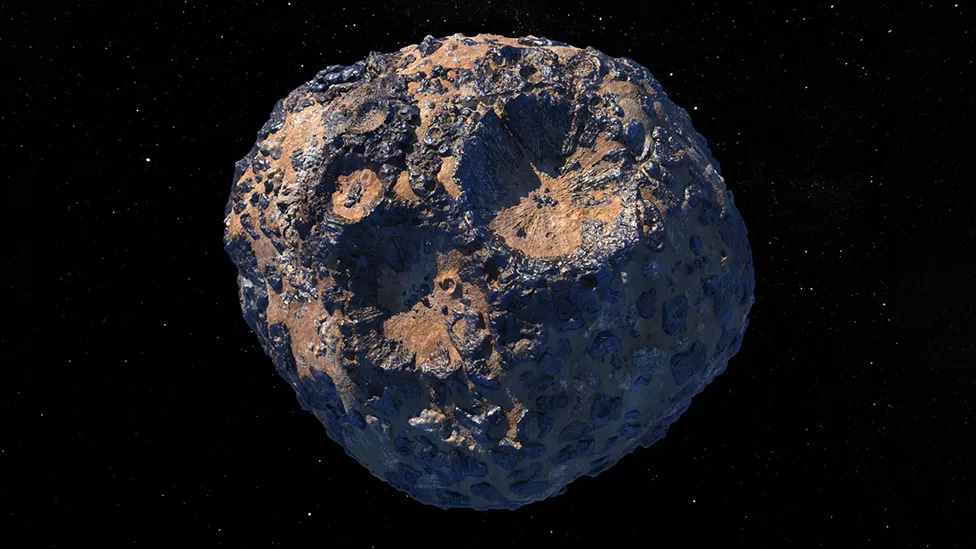

Today, we’re embarking on an intergalactic journey to explore the incredible tale of Psyche 16, an asteroid that has been estimated to contain precious minerals valued at $10,000 quadrillion! The asteroid has become a metallic wonder nestled between the orbits of Mars and Jupiter. Scientists believe it could be the exposed metallic core of an ancient protoplanet, loaded with treasures like gold, iron, and nickel. If these riches were on Earth, they would dwarf the entire world economy. Or would they?

This is where our journey takes an intriguing turn. The estimated value of the asteroid hinges on a calculation of the minerals within the rock, priced at current market rates. However, this approach overlooks a fundamental concept in economics: the interplay of supply and demand, the driving forces behind markets. Understanding this model is the easiest way to see how the discovery of celestial riches would not instantly bestow wealth upon all of us on Earth.

The supply and demand model is like the law of gravity for economists, guiding market forces with predictable precision. When supply goes up, prices tend to go down, and when demand increases, prices usually go up. Regardless of Psyche 16’s metal makeup, its sheer volume could cause a significant supply shift in the metals market. This shift, in turn, would lead to a decrease in those metal’s prices.

Valuing Psyche 16 at $10,000 quadrillion is wild. Why? That value assumes current market prices. The increase in metal supply would likely send prices crashing down, making the asteroid less of a golden ticket than many people think. Despite this, NASA has teamed up with SpaceX to send a spacecraft to the asteroid in the hopes of studying metal-rich asteroids.

Should NASA or other explorers venture into asteroid mining, there’s a crucial historical example urging caution in their aspirations. Neil DeGrasse Tyson’s belief that the first trillionaire will come from asteroid mining demonstrates how easy it is to overlook the potential repercussions on the market for raw materials. Fortunately, history provides a guide, revealing instances where sudden discoveries of valuable resources in new territories disrupted markets. Let’s journey back to 16th-century Europe.

The Spanish Empire was scooping up loads of precious metals from its New World colonies, including Mexico, Peru, Bolivia, and the rest of the Spanish Empire. At the time, these gold and silver (known as specie) were used as currency. The Spanish thought they had hit the jackpot, and suddenly everyone has a pile of cash — but that’s not a good thing!

Imagine you’re now living in 16th-century Spain. Ships return loaded with gold and silver, and suddenly, Spain is swimming in wealth. But here's the problem: more gold and silver didn’t mean everyone was suddenly rich. Instead, it caused massive inflation. Suddenly, your bread, vegetables, and even that new pair of shoes cost way more. Prices went on a rollercoaster ride, rising sixfold over 150 years.

Because gold and silver were used as currency at the time, the sudden influx of precious metals led to an increase in the money supply. More money floating around might sound great, but when everyone has more money, the prices of the things you want to buy with that money go up. The wealth would eventually spread to other countries in Europe, increasing their price levels as well.

The lesson here? Mining Psyche 16 wouldn’t result in $10,000 quadrillion worth of new metals on Earth. A flood of precious metals into Earth’s markets would most likely crash those markets and make the price of those metals almost worthless. Prices aren’t as steady as people might think! The Spanish Price Revolution is our time-traveling guide, showcasing how supply and demand adjust to account for market dynamics.

Let’s bring it back to the present as we start to think about the future, where companies are preparing for a future in asteroid mining. Companies like AstroForge are gearing up to mine smaller asteroids, rich in metals and other valuable goodies. Think of them like 21st-century gold miners in the middle of a cosmic gold rush. Instead of nuggets of gold buried in the hills of California, they’re hoping to strike it rich with asteroids packed with resources.

As we wrap up our cosmic journey, remember that Psyche 16, while fascinating, teaches us a valuable lesson. Economic dynamics, whether on Earth or in space, are more complex than they seem. The true value of resources, seen through the lens of supply shifts and price dynamics, challenges the idea of instant wealth.

You are reading Monday Morning Economist, a free weekly newsletter that explores the economics behind pop culture and current events. This newsletter lands in the inbox of thousands of subscribers every week! You can support this newsletter by sharing this free post or becoming a paid subscriber:

Asteroid 16 Psyche is named after the Greek goddess of the soul and was discovered in 1852 by Italian astronomer Annibale de Gasparis [BBC]

The Psyche Mission will take 6 years to travel 2.2 billion miles (3.6 billion kilometers) [NASA]

If Psyche were a perfect sphere, it would have a diameter of 140 miles (226 kilometers), or about the length of the State of Massachusetts (leaving out Cape Cod) [Arizona State University]

NASA spent $1.2 billion on the Psyche asteroid probe [CBS News]

NASA has a permanent workforce of 17,330 employees [U.S. Equal Employment Opportunity Commission]

If the asteroid is controlled by a monopolist, he will prevent this disaster. If only the monopolist were a company owned by all the people (eg the government).

Economics truly is the dismal science.