Tesla's Insurance Rates Increase for Night Drivers

Although Tesla drivers may not change their driving habits at night, this may not be the case for other drivers sharing the road.

Tesla drivers in some states have been shocked to find out that their insurance rates increased when they drove late at night. Tesla Insurance determines the monthly premiums based on a safety score that takes into account the driver's driving habits. The score is based on several categories, including forward collision warnings, hard braking, aggressive turning, unsafe following, forced autopilot disengagements, and late-night driving. A policyholder’s actual premium would be based on individual factors like where they live, which vehicle they drive, and potential discounts for which they may qualify.

Tesla defines late-night driving as time spent driving between 10:00 PM and 4:00 AM. However, the latest update to the safety score weights time spent driving during the early hours of the window differently than later hours of the window. Late-night driving is often riskier due to factors such as drunk driving and driver fatigue. While the drivers themselves may not change their driving behavior at night, the same can’t be said for all the other drivers on the road. As a result, Tesla Insurance effectively charges higher premiums to drivers who frequently drive during later hours.

The rate increase that results from late-night driving is a timely example of statistical discrimination, a concept in economics where individuals are classified based on group characteristics rather than individual characteristics. This type of discrimination happens when firms use observable characteristics such as age, gender, race, or location to predict the behavior of an individual or group and then use that information to make decisions about individuals in those groups.

A classic example of such discrimination occurs when young male drivers are charged higher insurance rates than young females because young male drivers often end up in more accidents. In this case, Tesla is using the fact that late-night driving is riskier than daytime driving to adjust insurance rates for people who drive at night. While driving late at night can be more dangerous due to factors such as drowsiness and drunk driving, it is not necessarily true for all drivers. In this case, Tesla is using the time of day to make assumptions about a driver's risk level and eventually adjusts the cost of their premiums accordingly.

While statistical discrimination may seem unfair at first blush, it is important to remember that it’s not done out of malice. Unlike taste-based discrimination, statistical discrimination is a cost-minimization strategy for firms. Insurance companies rely on actuarial tables and risk assessment models to determine premiums and pricing strategies. These models use statistical data to predict the likelihood of an individual making a claim. By charging higher premiums to high-risk groups, insurance companies can cover the cost of claims and maintain profitability.

Another economic concept relevant to this issue is adverse selection. In the context of auto insurance, adverse selection occurs when risky individuals are more likely to purchase insurance, while those with lower risk profiles are less likely to do so. Cautious drivers who must drive at night regularly may switch to a different insurance company, leaving only the riskiest night-time drivers purchasing their insurance from Tesla. This could lead to a higher concentration of high-risk individuals in the Tesla Insurance pool, which increases the likelihood and cost of claims.

Tesla Insurance does address some of the concerns about statistical discrimination and adverse selection by offering individualized pricing based on individual driving behavior. The night-time driving measure is only one of six factors that determine a driver’s safety score, but it may alter drivers' behavior before 10 PM. Some drivers may rush home before the window begins, creating a more dangerous scenario than Tesla intended. Drivers may also feel discouraged from taking late-night trips, which could result in missed opportunities for social or work-related events. For some, this could have a meaningful economic impact.

Tesla’s market share is down from 70.5% in 2021 to 63.5% in 2022 [Quartz]

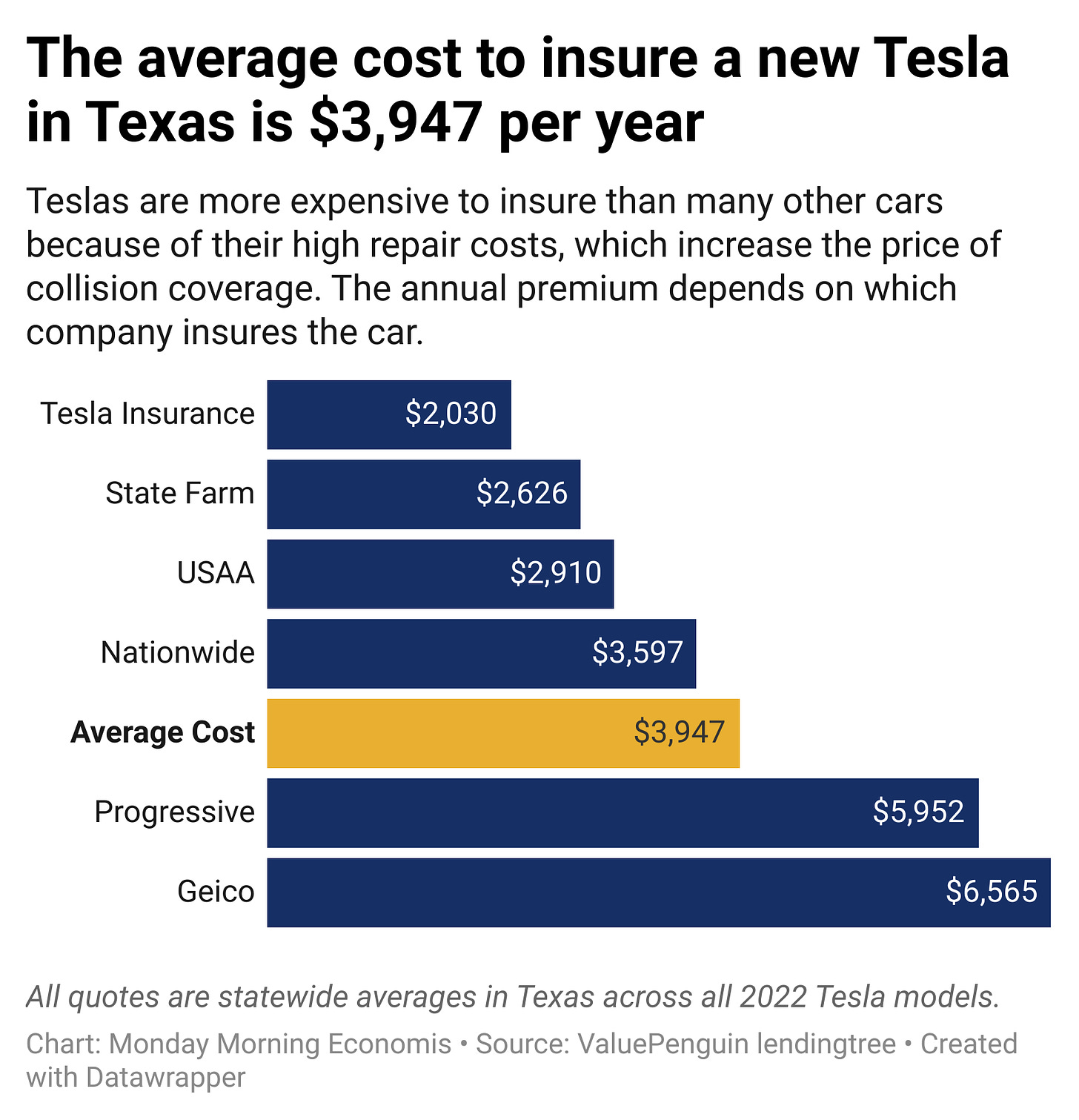

The national average cost to insure a 2022 Tesla model is $251 per month or $3,007 per year [MarketWatch]

Tesla drivers accrue DUIs at the lowest rate of any car brand in the country: 0.88 out of 100 Tesla drivers have a DUI on record, a share that’s 52% lower than the national average [Insurify]

Half of all driver fatalities in the United States occur during dark driving times [Association for the Advancement of Automobile Medicine]

Another great post