Tricks, Treats, and Economics

Grab your candy corn and join us on this economic adventure!

You are reading Monday Morning Economist, a free weekly newsletter that explores the economics behind pop culture and current events. This newsletter lands in the inbox of over 2,500 subscribers every week! You can support this newsletter by sharing this free post or becoming a paid subscriber:

Picture this: It’s Halloween night, and you’re all dressed up as a spooky ghost. You’ve readied your trick-or-treat candy bowls, and you’re watching as superheroes and princesses fill their goody bags with candy all night long. But wait, you may also be thinking about how your bank account will rebound from all the money you spent on Halloween this year. Halloween, aside from the fun and costumes, provides a fun opportunity to talk about economics. After all, major economies around the world have embarked on a spooky journey of their own over the past few years.

Since the start of the pandemic, Americans’ perceptions of the economy haven’t quite aligned with the actual state of the economy. In a recent survey, a staggering 71% of American adults described the economy as either "not so good" or "poor." What's even spookier is that more than half (51%) of those surveyed believed the economy was headed for worse times. Pretty scary, right?

But here's where things take an odd turn. In that same survey, 60% of adults stated that their own financial situations were "good" or "excellent." So, while many people might see the overall economy through a gloomy lens, they actually feel pretty confident about their own financial well-being. It's like wearing a vampire costume on the outside but feeling like a superhero underneath.

You might be wondering about the puzzling results. Why is there a gap between how people perceive the economy and how they view their own financial situations, and should we even care? Well, the past few years have witnessed a steady increase in both prices and interest rates, prompting many families to tighten their belts and reduce non-essential spending. To make matters worse, this marks the second Halloween in a row that U.S. candy prices have experienced double-digit inflation. Now we’re really getting spooky.

Economics Doesn't Have to Be Spooky

In the spirit of trick-or-treating, I’ve arranged this week’s newsletter to mirror a trip around your local neighborhood. Instead of collecting miniature candy bars, you’ll be collecting fun-sized examples of economic concepts you may see during Halloween. As a preview of what to expect, we’ll look at economic concepts that are behind:

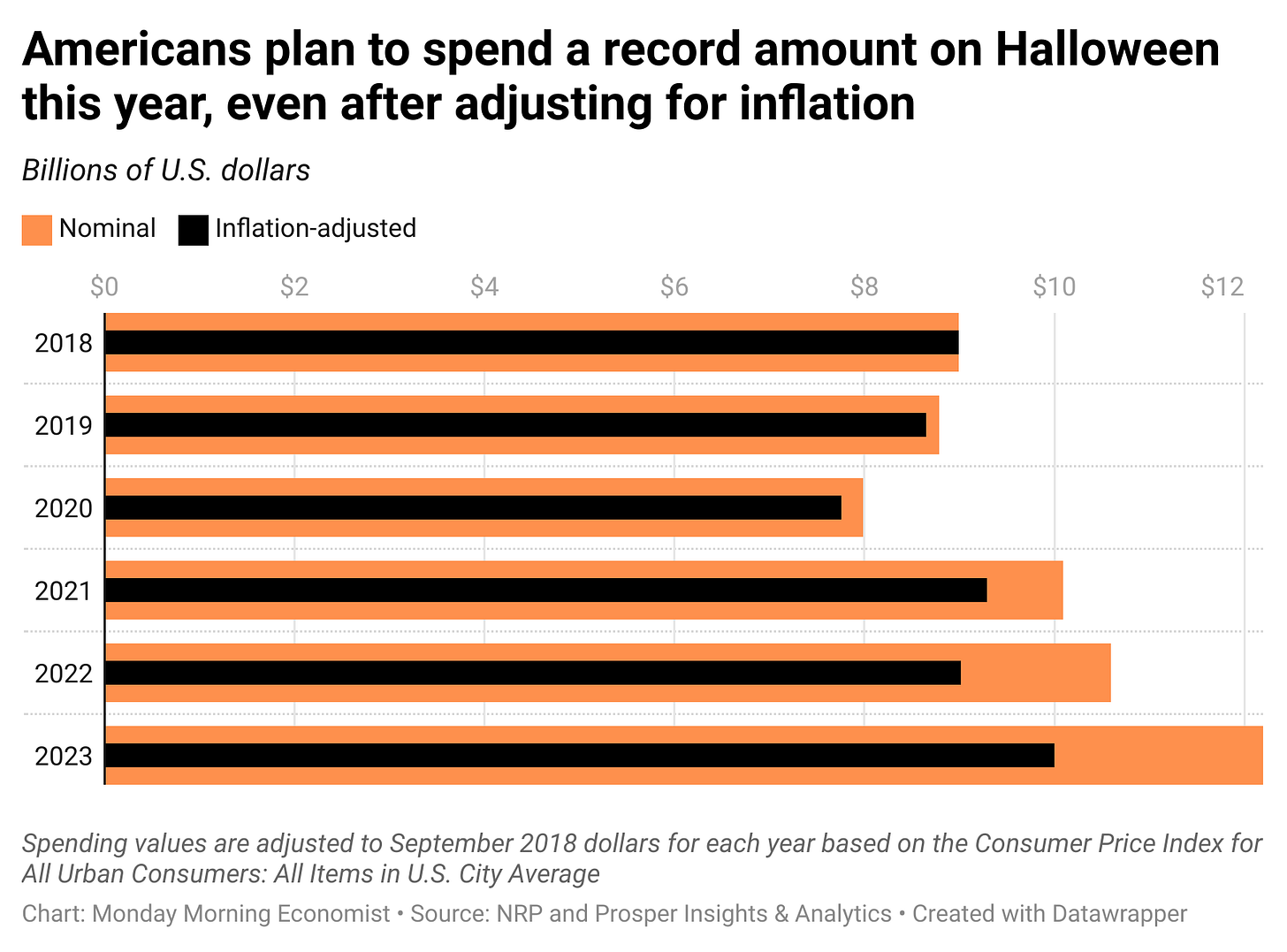

But here's where the Halloween twist comes into play—this year, the National Retail Federation has revealed record-breaking Halloween spending. They estimate that Americans will spend an astounding $12.2 billion this Halloween, surpassing last year's record of $10.6 billion.

Now, you might be wondering, with inflation affecting everything from candy to costumes, are people actually spending more on Halloween or is it just inflated due to all that annoying inflation The answer is a resounding yes. Even after adjusting for the impact of inflation, Americans are set to spend nearly $1 billion more than they did before the pandemic.

But again, why are people suddenly splurging on Halloween costumes and decorations when those same people have such a gloomy outlook on the economy? The COVID-19 pandemic left a deep mark on our economy and our confidence in it. Lockdowns, job losses, and uncertainty made people more cautious about their spending. Fast forward, and inflation remains a persistent challenge, while investors grapple with the uncertainty of whether the Federal Reserve will raise interest rates again. For many consumers, the past few years have felt like navigating a haunted house filled with economic uncertainties.

Consumer confidence surveys are valuable tools that help us measure something critically important: the confidence people have in the economy. These surveys look at whether people are optimistic or pessimistic about both the overall economy and their personal financial situations. Each index (1,2, 3, 4) gathers their responses and compiles them into a score. The higher the score, the more confident people feel. Conversely, a lower score indicates that people might be experiencing uncertainty or caution regarding the economy.

But why does all of this matter when we're thinking about the state of the economy? It's a lot like trying to solve a mystery —the way people perceive the economy can significantly influence their actions. If people are feeling good and confident, they're more likely to spend and invest, and that can give the economy a boost. But if they're worried and uncertain, they might cut back on spending and be more cautious. And when that happens, it may spiral into a recession.

So, while surveys about the state of the economy might paint a gloomy picture, the actual behavior of people tells a different story. Halloween isn't the only time we've seen this kind of behavior this year. As we continue to rebound from the pandemic, consumers are splurging on experiences like concerts, movies, sporting events, and, apparently, Halloween. Economists are also dialing back their predictions that a recession is coming:

So, what's behind this remarkable surge in consumer spending on experiences? It's as if people have been waiting (not always) patiently to venture back into the world and indulge in spending, traveling, and experiencing life outside their homes. Furthermore, it's important to remember that not all Americans have been equally affected by the economic turbulence of recent years. While some faced hardships, others managed to save money during the pandemic, resulting in increased disposable income that they are now spending.

The record-breaking spending figures might seem counterintuitive in the face of ongoing economic uncertainties, but they serve as a reminder that consumer behavior and economic indicators don't always match up. Despite their doubts and concerns, American consumers are showing faith in the economy by opening their wallets. Here's hoping that when those tiny goblins show up for trick-or-treating, there are more full-sized candy bars compared to last year.

A record number of people (73%) will participate in Halloween-related activities this year, up from 69% in 2022 [National Retail Federation]

Candy and gum prices are up an average of 13% this month compared to last October [Associated Press]

Home Depot’s 12-foot-tall skeleton costs $299 [Mashable]

In the most recent release, the U.S.’s gross domestic product increased at a 4.9% rate with consumer spending jumping 4% [Bloomberg]

Americans had an excess savings rate of 14.37% of their annual disposable income toward the end of 2021 [Federal Reserve Bank of New York]