Society's $21 Billion Problem

Unused gift cards are costing us more than we think, but retailers don't mind.

Gift cards are popular gifts because they are convenient, easy to purchase, and allow the recipient to select their own gift. A recent Credit Summit report, however, found that almost 60% of Americans hold at least one unredeemed gift card and at least 50% of the respondents had lost a gift card before it was ever redeemed. The combined value of unspent gift cards comes to about $21 billion! It’s one small part of why many economists consider gift-giving to be inefficient, but it’s also one of the reasons retailers love selling gift cards.

The unspent value on all those gift cards is just part of the issue surrounding lost efficiency. The main reason many economists consider gift-giving inefficient is that it can create what is known as a deadweight loss. Deadweight loss is a measure of lost economic efficiency that occurs when the allocation of resources is not optimized. It isn’t specific to gift-giving, but it is easier to understand in this context because of our own past experiences.

Think back to a time when you got a gift that wasn’t your style or wasn’t the right size. Things were usually worse if the gift didn’t come with a gift receipt! When a gift-giver spends money on a gift that may not be wanted or needed by the recipient, this generates a deadweight loss. This lost efficiency adds up when you consider how many people are getting “bad gifts” each year and then add in how much time and money people spend shopping for those gifts. While some people may enjoy gift-giving, the money could have been allocated elsewhere to generate greater value for society.

All that time and money people spend searching for gifts is a great example of transaction costs: the costs associated with buying and selling goods and services. These costs can be significant for both givers and recipients. The giver has to spend time and money to select, purchase, and wrap the gift. The recipient may also have to spend time and money to return or exchange the gift if it is not wanted. Both examples just add to the inefficiency of gift-giving.

Misallocating resources is an interesting way to think about inefficiency. At an individual level, the gift-givers may be spending money on a gift that isn’t valued at the same level by the recipient. As a society, we’re overconsuming by purchasing items where the cost of that item to one person isn’t worth the benefit the recipient receives. Economists debate how large this impact really is, but there is one easy way to solve the problem.

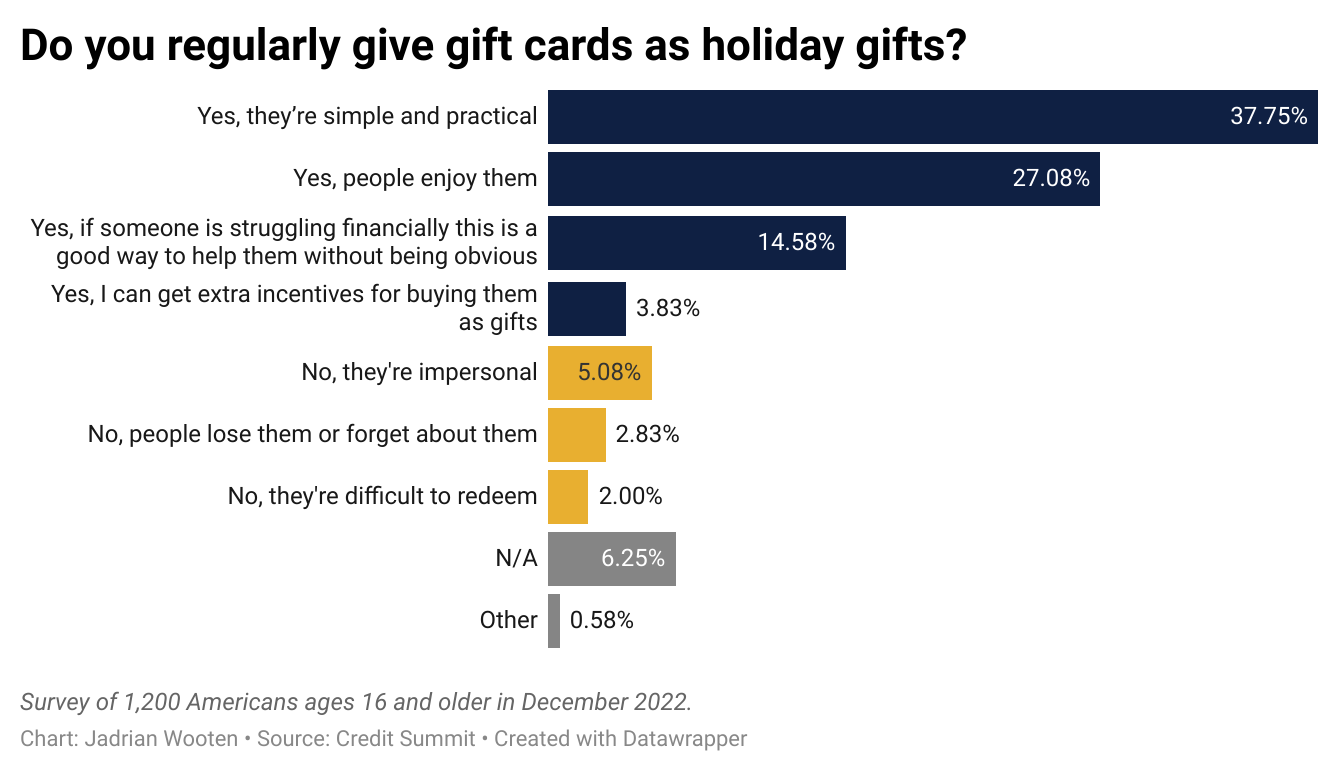

Economists typically argue that cash is the most efficient gift because the recipient can spend it on whatever generates the most value for them. Gift cards are often seen as a compromise that recognizes the recipient knows what makes them the happiest, but allows the giver to demonstrate some effort in selecting a gift. Gift cards also help reduce some of the transaction costs for both givers and receivers because they’re quick to purchase and don’t need to be returned if the gift card accurately matches the recipient’s interest.

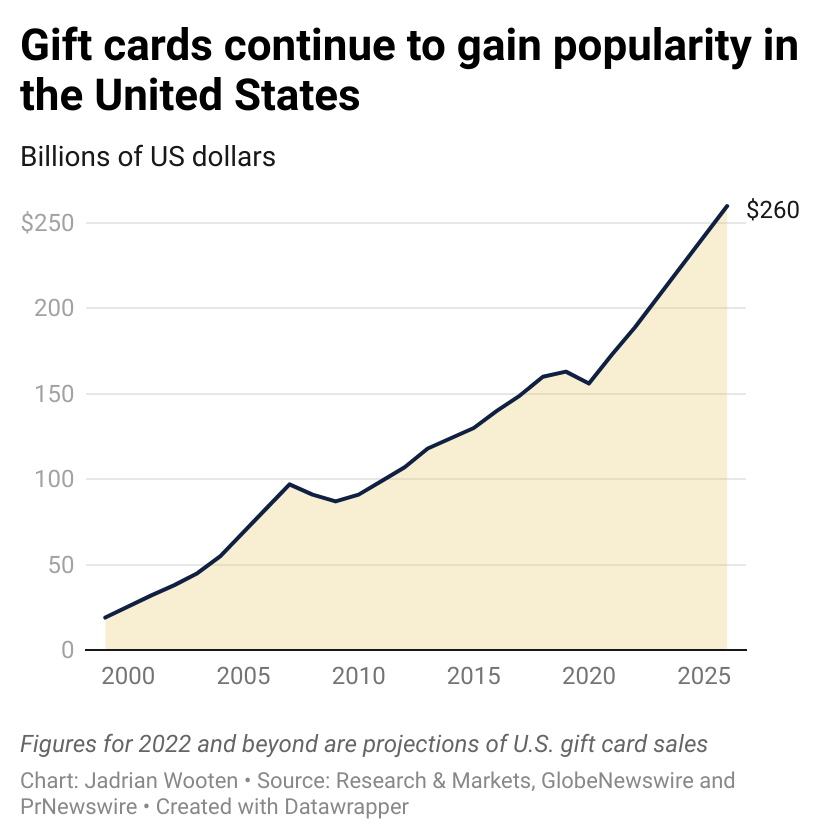

In an ideal world, gift cards are a win-win situation. Oftentimes, however, they go unused — we lose them, forget about them, let them expire, or fail to spend the full amount that was gifted. When that happens, there’s only one winner: stores selling the gift cards. More than 70% of all gift cards are redeemed within 6 months of purchase but after that, the rate flattens out. After just a year, just under 80% of cards are redeemed.

When you purchase a $50 gift card for your parents to have a nice night out at Red Lobster, the company takes your $50 and gives you a plastic voucher worth $50 that can be redeemed when your parents are ready. Big companies like Red Lobster use an accrual accounting system that counts your purchase as revenue only when the gift card is redeemed. Until then, it sits on the company’s balance sheet as a liability that is owed in the future. Darden Restaurants, the parent company of Red Lobster, held $521.1 million in liabilities for unused gift cards last year.

After a certain amount of time has passed (usually between 6-24 months), accounting laws permit companies to convert these liabilities into what is known as breakage income. Companies estimate how much of their gift card balances will never be redeemed and get to count that as income. If your parents stash that Red Lobster gift card for a special occasion, but actually end up losing it, Red Lobster will eventually earn $50 in revenue without actually having to do much of anything for it. It’s no wonder companies are willing to give away so much stuff during the holidays just to incentivize you to buy gift cards!

Gift-giving is a practice that has been around for centuries and is unlikely to disappear anytime soon. While gift-giving is a great way to show appreciation, economists argue that it can be an inefficient practice. Gift-giving often results in deadweight loss, misallocation of resources, and significant transaction costs. Despite all the negative connotations, gift cards aren’t inherently bad gifts. The key to making the exchange as efficient as possible is to make sure the gift is as close to a cash equivalent as possible. Get people something they can spend at a lot of different places (Visa or Amazon gift cards are great), and give them a gentle reminder to use them before they lose them.

In a survey of 1,200 adults, 59.92% of respondents said they have a strong preference for Amazon gift cards [Credit Summit]

The number of reported gift card scams has increased every year since 2018 with the median reported losses increasing from $700 to $1,000 [Federal Trade Comission]

Americans were expected to spend a total of $28.6 billion on gift cards during the 2022 holiday season, with most buyers giving between 3 to 4 gift cards at an average of around $51.47 per card [National Retail Federation]

In 2022, Walmart owed $2.56 billion in liabilities on unused gift cards [Walmart]

On average, shoppers spend $59 more than the value of their gift cards [Marketwatch]

Shoppers using gift cards are 2.5 times more likely to pay full price for an item than a customer paying with cash/credit card [Forbes]