Why Politics Must Stay Out of Monetary Policy

Preserving the Federal Reserve’s independence is crucial to preventing political pressures that might undermine long-term economic stability and prosperity

Thank you for reading Monday Morning Economist! This free weekly newsletter explores the economics behind pop culture and current events. This newsletter lands in the inbox of more than 5,000 subscribers every week! You can support this newsletter by sharing this free post or becoming a paid supporter:

When it comes to economic policy, few institutions affect the lives of Americans as profoundly as the Federal Reserve. This central bank, often referred to simply as “the Fed,” plays a critical role in steering the U.S. economy—yet it typically operates behind closed doors, away from the watchful eyes of Congress and the President.

That low profile is by design. The Fed’s independence from political influence is essential to its mission of maintaining economic stability and promoting sustainable growth. But this independence has come under scrutiny lately.

Former President Donald Trump’s claim that the President should have a voice in the Fed’s interest rate decisions is the latest in a long line of attempts to assert political control over the central bank. It’s a move that directly challenges a century-old principle: that the Fed should operate independently of short-term political pressures to safeguard the long-term health of the economy.

The Role of the Fed in Monetary Policy

Think of the Federal Reserve as the captain of a massive, complex ship—the U.S. economy—navigating through both calm and stormy waters. Its primary tool for steering the economy is known as monetary policy, with interest rates serving as the main mechanism.

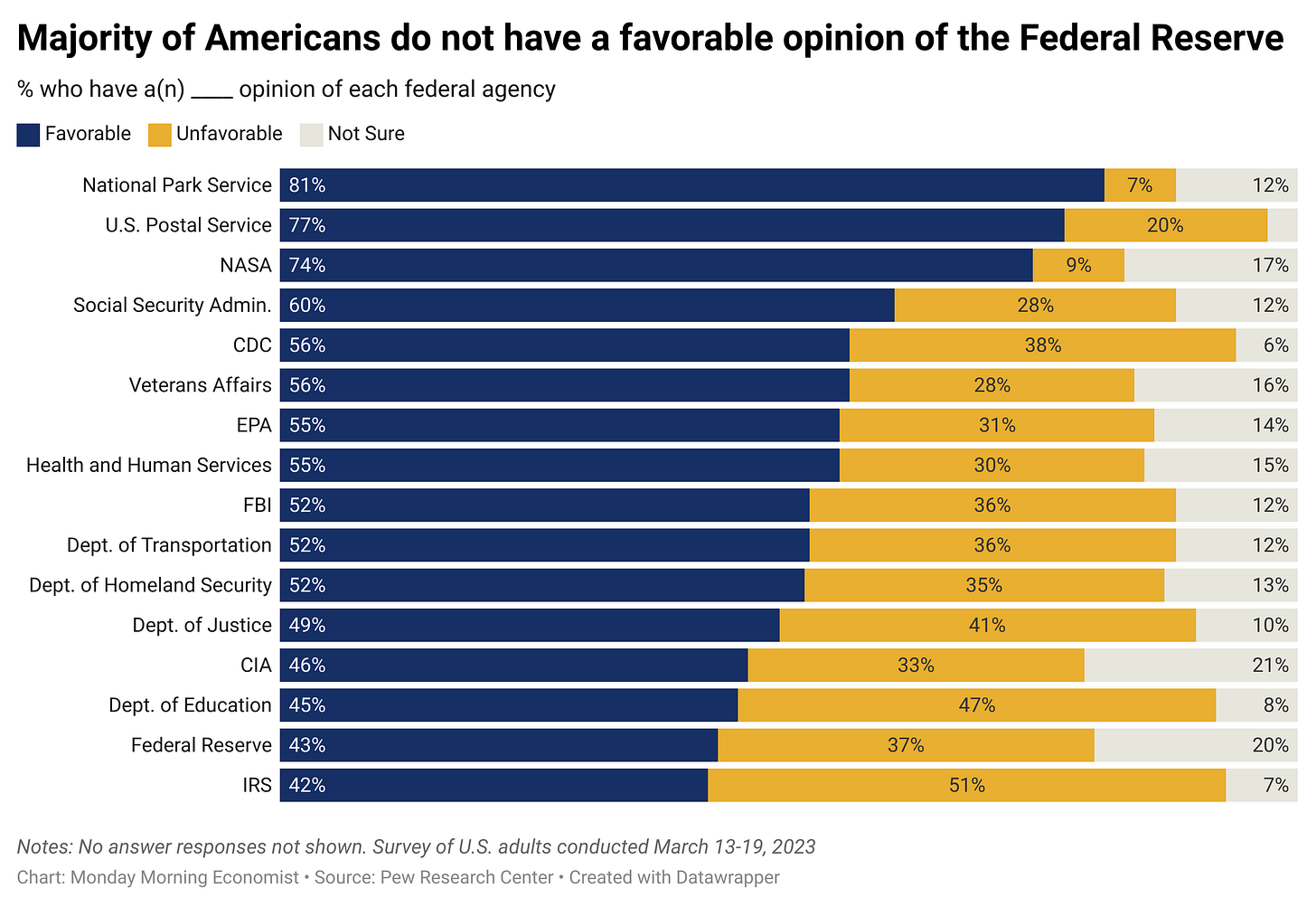

But the Fed’s job isn’t just about fine-tuning rates to tweak borrowing costs. Its decisions ripple through every part of the economy, influencing everything from your mortgage payments to the strength of the dollar abroad. With that much power, it’s no surprise that they are one of Americans’ more unfavorable government agencies.

The Fed’s dual mandate is deceptively simple: keep prices stable and maximize employment. When it lowers interest rates, borrowing becomes cheaper, encouraging spending and investment, which fuels job creation and economic growth. Raise rates, and the effect is the opposite—the brakes are applied to an economy that’s growing too quickly, helping to cool off inflation before it overheats. These approaches are known, respectively, as expansionary and contractionary monetary policy.

It’s a delicate balancing act. Set rates too low for too long, and inflation can get out of hand, eroding the value of money and savings. Push rates up too quickly, and you risk stalling the economy, driving up unemployment, and maybe even triggering a recession. The stakes are high, and the Fed’s decisions aren’t just about managing today’s economy—they’re about ensuring a stable future for all Americans.

The Importance of Political Independence

The Federal Reserve’s effectiveness hinges on political independence. This concept isn’t just a bureaucratic formality; it allows the Fed to make tough decisions that prioritize the economy’s long-term health over short-term political wins. Since its creation in 1913, the Fed has been deliberately kept at arm’s length from elected officials who might be tempted to tinker with monetary policy to serve immediate political goals.

Does independence really matter? Take the late 1970s and early 1980s, for example. Inflation was spiraling out of control, and Fed Chairman Paul Volcker made the tough call to hike interest rates to nearly 20%. The move was painful—unemployment surged, and a deep recession followed. But Volcker’s determination eventually broke the rising inflation rate and set the stage for an economic boom that followed in the 1980s and 1990s. Had Volcker been subject to direct political control, the short-term pain might have been avoided but resulted in a very different, and even worse, economic outcome.

In contrast, when central banks are subject to political control, the results can be disastrous. Zimbabwe and Argentina offer stark modern warnings. In 2008, political meddling in Zimbabwe’s central bank led to extreme hyperinflation where prices doubled every day—reaching a mind-boggling 89.7 sextillion percent. Government interference with Argentina’s central bank has repeatedly triggered runaway inflation, decimating savings and pushing millions into poverty. These are just a couple of examples of why the Fed—and central banks worldwide—must stay independent to protect economic stability.

Presidents and the Temptation to Influence the Fed

Donald Trump’s push for presidential control over the Fed might seem unprecedented, but history tells a much different story. The relationship between U.S. presidents and the Federal Reserve has often been a rocky one, especially when the economy hits rough waters and quick fixes become tempting.

One of the earliest confrontations happened during the Truman administration. With the Korean War increasing government spending, President Harry Truman wanted the Fed to keep interest rates low to help finance the war effort. But the Fed pushed back, leading to the Treasury-Fed Accord of 1951. This agreement reasserted the Fed’s independence and marked the end of pegged interest rates, setting a crucial precedent for the Fed as an independent authority on monetary policy.

Fast forward to the 1970s, and you find another significant clash. President Richard Nixon was facing re-election in 1972 and leaned heavily on Fed Chairman Arthur Burns to keep interest rates low. Burns was under intense political pressure and largely complied with Nixon’s request. That decision contributed to the inflationary spiral that defined the 1970s—often referred to as “The Great Inflation.”

But not every president has tried to directly meddle with the Fed. In the 1990s, President Bill Clinton famously vented his frustration, asking his advisors, “You mean to tell me that the success of my program and my re-election hinges on the Federal Reserve and a bunch of fucking bond traders?” Despite his annoyance, Clinton wisely chose not to interfere with the Fed’s decisions.

The Stakes of Keeping the Fed Independent

In today’s polarized political climate, the independence of the Federal Reserve is more important than ever. The temptation to politicize the Fed is strong, particularly during economic downturns or high-stakes elections. But history teaches us that when central banks fall under political control, the consequences can be dire—think economic instability, runaway inflation, or even financial collapse.

The Fed’s strength lies in its ability to make decisions free from the pressures of the election cycle. This independence is essential for maintaining the stability and prosperity of the U.S. economy. Sure, the Fed’s decisions might not always win popularity contests, and they can sometimes clash with the agendas of elected officials. But that independence acts as a crucial check against the dangers of politically driven monetary policy.

The Federal Reserve System was established on December 23, 1913, through the enactment of the Federal Reserve Act of 1913 [Federal Reserve Bank]

Fewer than one in ten people (8%) correctly identify that the Federal Reserve's role includes maximizing employment, while a slightly larger, but still a minority (34%), correctly recognize its responsibility to stabilize prices [Ipsos]

Although the Board of Governors is an independent government agency, the Federal Reserve Banks operate like private corporations [Federal Reserve Bank of St. Louis]

The Fed’s primary income comes from interest on government securities acquired through open market operations, with the remaining earnings, after expenses, turned over to the U.S. Treasury [Board of Governors of the Federal Reserve System]

Nearly three-quarters of Americans believe it would be 'too risky' to grant presidents more power [Pew Research Center]

Great post, Jadrian. Keeping the Fed independent from as much political pressure as possible is necessary. Every macroeconomist should do whatever they can to keep politicians out of office that believe they deserve a say in rate changes.

Fed independence, accepting defeat when you lose an election. It’s the little norms that make one appreciate having a party that did not nominate Trump to vote for.