Economists Love the Misery Index

The Misery Index has been around for a while, but recently, it's been getting a lot of attention. Let's break it down and see what it's all about.

You are reading Monday Morning Economist, a free weekly newsletter that explores the economics behind pop culture and current events. This newsletter lands in the inbox of more than 3,600 subscribers every week! You can support this newsletter by sharing this free post or becoming a paid supporter:

Economic indicators. You've heard about those, right? They’re those numbers that economists and analysts love to talk about—things like new home sales, the Fed’s Beige Book, and so many others. But let’s focus instead on measures that are included in two other big ones: The Employment Situation and the Consumer Price Index. These reports from the Bureau of Labor Statistics are like the heartbeat of the U.S. economy, telling us what’s happening with jobs and prices every month.

But here’s a twist—despite all these positive reports that came out last year, people weren’t feeling great about the economy. The vibes were off, to say it plainly. But now, something’s changed. People are feeling a bit better, and the Misery Index might help us explain what’s going on.

Some Background on the Misery Index

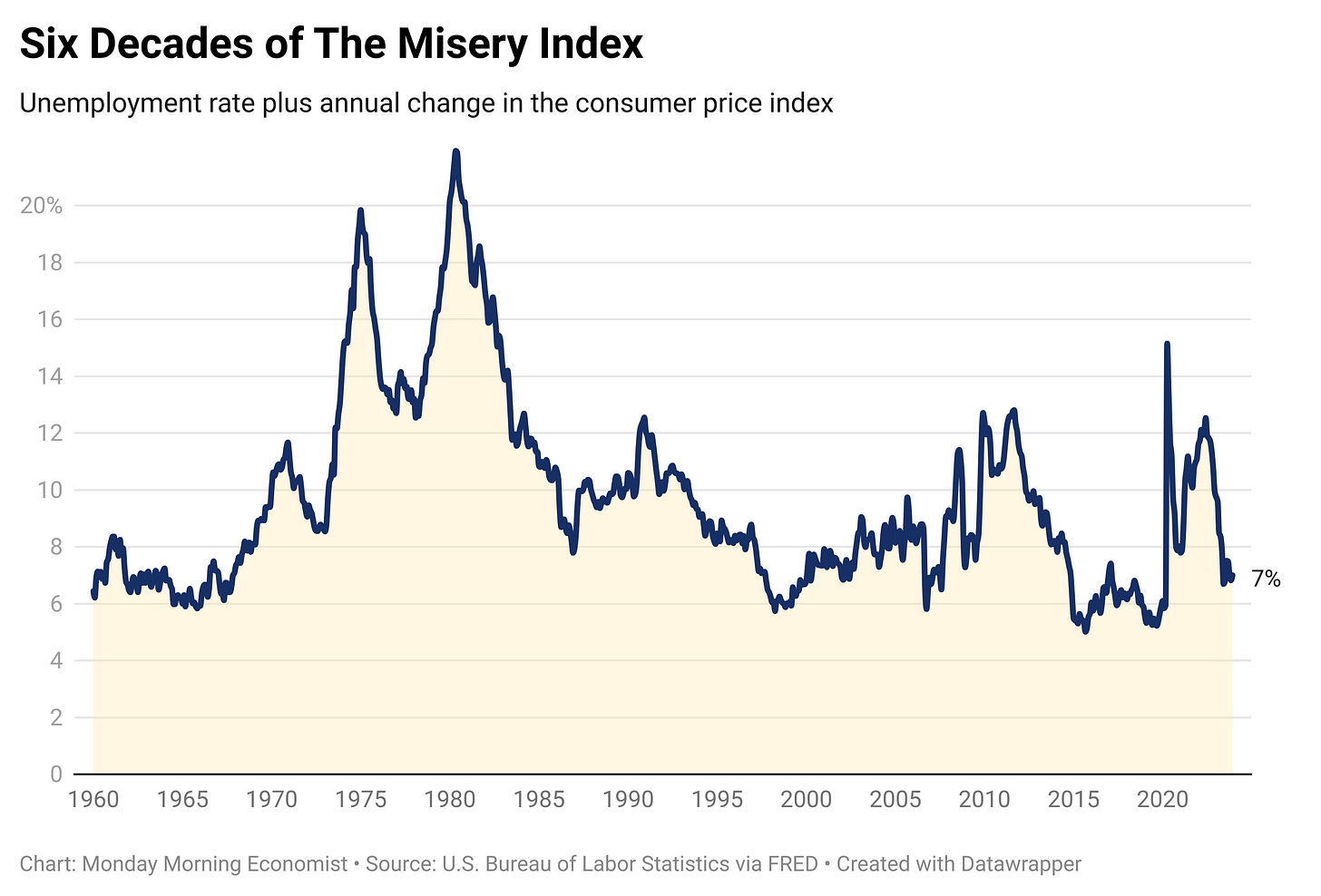

So, what exactly is the Misery Index? It’s not an official government measure, but politicians like to talk about it. Instead, think of it as a quick sum of two things: the unemployment rate and the inflation rate. The idea is simple—the higher the index, the more misery in the economy. Keep in mind that it’s only part of a bigger, more complex picture. It doesn’t tell us everything, like how wages are growing or how the GDP is doing.

Instead, it’s a snapshot of two things that people really care about: whether people have a job and how much things will cost them. It’s a crude measure, but it can be informative. Over the past seven months, that rate has slowly ticked down to its current level of 7.6%:

The Misery Index was popularized by an economist named Arthur Okun back in the 1970s. Okun was an advisor to President Lyndon B. Johnson and a big name in economics. He wanted to find a simple way to talk about the economic hardships people were facing, especially during the 1970s, a time of high inflation and unemployment, or what;’s known as stagflation.

The 1970s were a rough time for the global economy, especially in the U.S. The post-World War II boom had fizzled out, inflation was on the rise, and unemployment was creeping up. Traditional economic theories were being put to the test as they couldn’t quite explain this strange combination of high inflation and unemployment.

Enter the Misery Index. Okun’s creation became a tool for understanding how the public felt about the economy. It was simple, understandable, and politicians loved to use it to make their points. It translated complex economic situations into something everyone could grasp. At the end of the decade, Ronald Reagan used the Misery Index in a campaign speech as evidence of why President Carter shouldn’t be reelected:

The Misery Index Today

Fast forward to today. The Misery Index is still around, and guess what? It’s been falling a lot over the past few months. This drop lines up with a shift in consumer sentiment. People are (finally) starting to feel a bit more optimistic, but it’s a cautious optimism. Last year’s gloominess, despite strong economic indicators, was telling. But now, we’re seeing more of an alignment between consumer sentiment and the Misery Index.

What’s behind this shift? The job market has continued its strong record of adding new jobs, and inflation, while still a concern, has calmed down a bit. Additionally, a significant development contributing to the upbeat mood is the increase in wages, which are finally rising faster than inflation. The recent uptick in real wages has played a key role in boosting consumer confidence, aligning it more closely with the positive trends indicated by the falling Misery Index.

So, while the economic vibes seem to be improving, we have to remember that not everyone is feeling the same way. Many people are still facing hard times, and the recovery isn’t being felt equally by all. That’s why it’s so important to keep empathy and understanding at the forefront of these discussions. The recent trends point to a cautiously optimistic economic outlook. The U.S. economy is resilient, but we need to make sure the recovery reaches everyone.

The Misery Index was a comedy game show based on the card game Sh*t Happens where contestants can make a fortune out of other people's misfortune [Fandom]

December’s year-over-year inflation rate was 3.3% and the unemployment rate was 3.7% [FRED]

In November 2023, 57% of workers earned higher annual inflation-adjusted wages than the year before, a share higher than its 2017–2019 pre-pandemic average [Center for American Progress]

Okun is best known for discovering "Okun's Law" in 1962, an empirical relationship between GDP and unemployment in post-war data, specifically that every 1% decrease in unemployment increases GDP by 3% [History of Economic Thought]