The guac isn't the only thing that costs extra

There are some moments over the course of the year where I see a news headline and get a little too excited to share the underlying concepts in the story. This week I have skipped over all of my previously considered topics so that I could jump straight to this one particular headline. There are some really good topics coming up, but we have the rest of the summer to talk about those. This one is just too good to wait for. Here was the tweet:

There are so many things going on in this one story, but broadly speaking there are two really big economics concepts that we talk about in our principles classes that are also happening in this story. I’ll approach each of these separately to make it a bit easier. The initial headline was really based on a corporate press release and was meant to stir up potential animosity to the company voluntarily paying higher wages. It all ties into a bigger debate we have in this country about the purpose of minimum wage.

The first thing that jumped out about the price increase is that it’s actually in line with increasing food prices, which we covered a couple of weeks ago. Food prices, in general, are up about 1% from last year, but beef prices have increased a little over 3% and pork prices are up almost 5%. Your steak or carnitas burrito bowls were already costing Chipotle more to make compared to last year, and some of that is likely accounted for in the increased price consumers now pay.

In their press release, Chipotle placed the blame primarily on the increased hourly wage they’re paying to attract workers, which we actually talked about back in May. It hasn’t taken long, but the topics we’re covering in this newsletter are finally starting to converge, and that is one of the reasons I love teaching! One key element missing from a lot of the initial headlines in the announcements and headlines was the size of Chipotle’s CEO Brian Niccol’s compensation last year. Niccol earned $38 million in 2020, most of which coming from long-term incentives and annual bonuses. It’s easier to place the blame on a workforce that is already heavily stigmatized rather than start a conversation on reforming CEO pay. In fact, you may remember this Google search result I shared at the time:

The second major theme, and one that is often hard to highlight in headlines, is the concept of elasticity. In our principles courses, we often cover elasticities of demand, which look at how the quantity demanded of an item changes when some other variable changes, like price or income. An elasticity, more broadly, measures the change of one variable after the change of another. Students often assume elasticities have to be based on quantities, but they can be based on any two items that have some sort of relationship, like costs and prices. Common sense (and the supply curve) tells us that if the cost of production increases then the final price consumers pay will increase as well. That’s pretty boring in and of itself. Elasticities, however, tell us how much final prices increase, and that is much more interesting.

Based on self-reported data from Indeed and GlassDoor, the average Chipotle crew member earned about $11 per hour before the wage increase. If average wages do increase to $15 per hour, workers would earn about 36% more. Consumers will pay about 4% more for their food, some of which is coming from those increased labor costs. It appears that a relatively large change in labor costs (36%) has a comparatively small change in the final price of the product (4%), which makes that relationship fairly inelastic. Sometimes it’s easier to see how small the change is in dollar terms instead. The people making your burritos are earning $4 more per hour (on average) and you will be asked to pay 40¢ more for your lunch if it usually costs you $10.00.

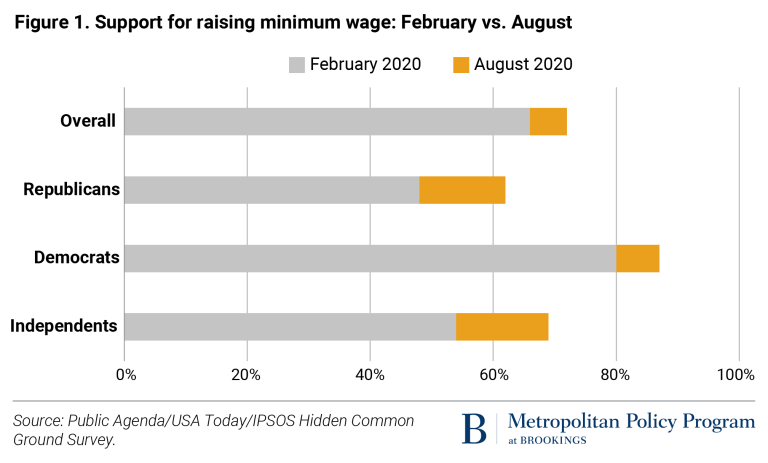

Part of the animosity some people have exhibited on social media and in editorials likely comes from the fact that Chipotle has pegged their target average wage at the same wage that minimum wage advocates are asking for: $15 per hour. In a Pew survey conducted in April 2021, the majority of Americans actually support a $15 minimum wage. Support for a higher minimum wage (not necessarily $15 per hour) has increased among political lines as well. Here’s a nice illustration of the results from a February 2020 and August 2020 survey compiled by the Brookings Institution:

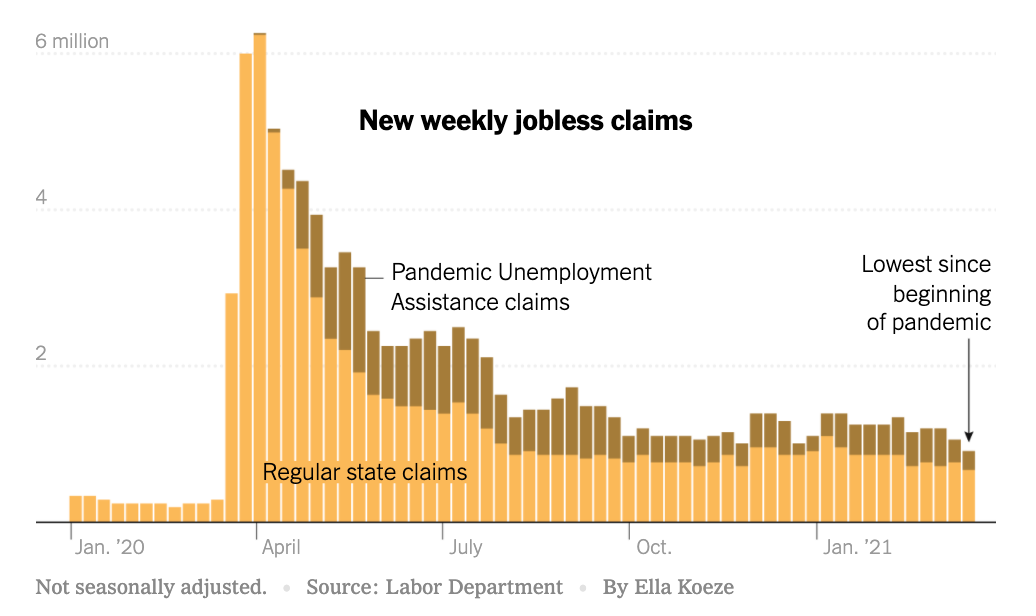

Despite the growing change of heart around the minimum wage, there are also a lot of generalizations and inaccuracies being thrown around that are very easy to check. Let’s start with the notion that people are “sitting on unemployment” instead of getting a job. This has been a criticism of unemployment benefits (and welfare benefits in general) for decades, but this data is actually available through the U.S. Employment and Training Administration. In the most recent release (the last week of May), there were about 3.7 million people who filed “continued” unemployment claims, down from 19.28 million at the end of May a year ago. The peak week of claims was the second week of May with 23 million.

3.7 million people are a lot of people, but there are almost 161 million people in the United States civilian labor force (those who are employed and unemployed). Those 3.7 million people who continue to file unemployment claims represent only about 2% of Americans who are actively participating in the labor force. I find it incredibly impressive how quickly the continued unemployment claims have decreased. After the 2008 Recession, continued unemployment claims peaked at 6.6 million people at the end of May 2009, but didn’t get down to 3.7 million until March 2011. It took almost two years for continued unemployment claims to fall to the same level that we’re at a little over a year after the recession started. While continued unemployment claims represent people who are on unemployment in consecutive weeks, we are currently at the lowest level of initial claims since the pandemic began:

I want to end by spending a bit of time talking about the characteristics of workers earning minimum wage or similar low-wage jobs. There’s a common misperception that these jobs are filled by teenagers or part-time workers and that generalization is flat wrong. The Bureau of Labor Statistics reports on characteristics of workers earning at or below the federal minimum wage (Yes, there are an entire group of people who early below the minimum wage and it’s not just servers). If a state, like California, pays above the federal minimum wage of $7.25 per hour, they may have a lot of people earning the state’s minimum wage but not appearing in the federal data since they earn above the federal data. A second issue is that these industries have been severely disrupted by the pandemic, so we can look at 2019 data instead.

Among workers earning at or below the federal minimum wage in the United States, over half of them (57%) are over the age of 25. Only about 17% of these workers are actually teenagers (between the age of 16 and 19). Women are overrepresented in minimum wage jobs, making up about 2/3rds of this workforce. In terms of hours worked in a normal week, 44% of these workers are working full-time (at least 35 hours). Simply put, the majority of workers earning the lowest pay in our country are adults, and a significant percentage of workers are working full-time. These workers are not a bunch of teenagers and college kids working to earn some extra spending money.

Personally, I’m willing to pay 40¢ more for my $10 burrito if it means those workers can have better pay and more bargaining power. If you’d like to learn more about how economists view the minimum wage, check out Noah Smith’s post from earlier this year. The Balance has also put together a great article on the minimum wage as well.

Chipotle’s CEO was the 12th highest paid CEO in 2020 [New York Times]

There were 82,289,000 workers who were paid hourly rates in 2019 [Bureau of Labor Statistics]

Among hourly workers, 1.9% earned at or below the federal minimum wage in 2019 [Bureau of Labor Statistics]

The education and health services industry employs the most workers (17.7% of all workers) earning at or below the federal minimum wage [Bureau of Labor Statistics]

The minimum wage in Emeryville, CA (a suburb of San Francisco) is $16.84, the highest local minimum wage in the country [Pew Research Center]

We’ve just wrapped up Week 23 of the year and my book total for the year has reached 29 books. If you’re looking for a book related to today’s newsletter, I highly recommend checking out Fast Food Nation. I worked for Quiznos and Dairy Queen in high school before working at a regional Mexican food restaurant chain in college. Some of the coverage in the book took me back to my experience and reminded me of things I had blocked out.

This past week I finished The Phantom Prince, which was written by one of Ted Bundy’s girlfriends shortly after his 1970s killing spree. The book was originally written as a memoir and has since been updated with a new introduction and afterword in which the author looks back on her original work. The book was incredibly captivating the entire time I read it and I really appreciated the afterward.