Unbundling the Clash Between Disney and Charter

A showdown between Disney and Charter over what to include in a cable subscription bundle has left viewers hanging.

In a world where traditional cable TV is battling to stay afloat, a different battle has left millions of Charter subscribers without football and the U.S. Open. Disney and Charter Communications, two of the giants in the media and entertainment industry, are duking it out over streaming rights. It's a fight that has consumers on the edge of their seats.

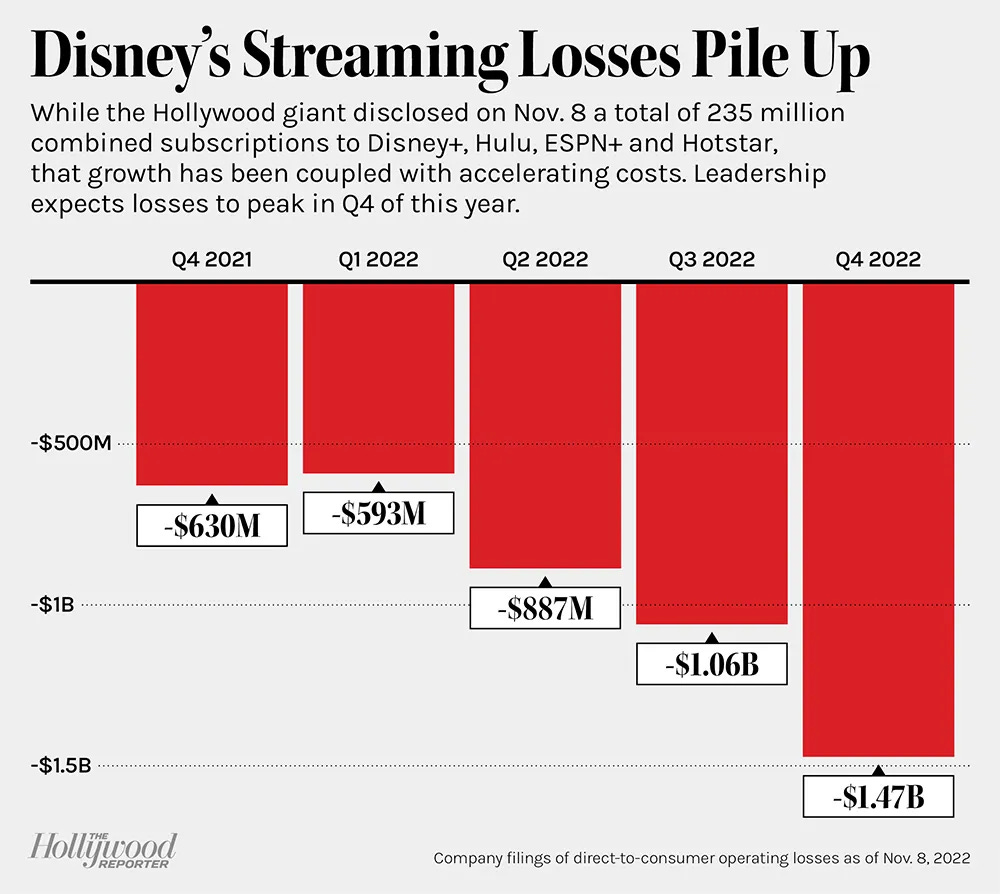

Legacy cable companies like Charter need to survive to continue generating the profits that entertainment companies rely on to support their streaming services. While streaming services may eventually become the future of entertainment, they are currently operating at a loss, collectively losing billions of dollars each year. Disney’s struggles have been well-documented since they first launched Disney+ at the end of 2019.

And this is where the concept of bundling comes into play. Bundling is a strategic move where multiple products or services are packaged together and sold as a single unit, often at a combined price lower than the sum of individual prices. However, critics argue that bundling can lead to market power issues and cross-subsidization, which means that some consumers end up shouldering the costs for others, and not everyone is happy about it.

Let's not forget about the efficiency benefits that bundling can offer. One of the primary advantages of bundling is the realization of cost savings through economies of scale. Much like the idea that buying in bulk can lead to lower unit costs, bundling allows businesses to streamline their operations and reduce per-unit expenses. When a cable company bundles channels from multiple content providers, it often gains stronger negotiating power. This leverage allows them to secure lower licensing fees for the bundled channels.

Now, imagine this scenario: consumers have to individually select and purchase each channel or service they desire. It sounds like a nightmare, right? Bundling simplifies this by offering packages that cater to a wide range of consumer preferences. It saves consumers time and effort, rather than asking them to navigate a complex menu of individual options.

But there's a twist in the story. Charter wants to include Disney's streaming services, including Disney+, ESPN+, and Hulu, in its cable packages. It’s reignited the unbundling battle from the past twenty years. Charter, as a cable provider, sees this as a way to enhance its offerings and appeal to subscribers. However, Disney has resisted, seeking higher licensing fees for its coveted content.

Some critics argue that bundling limits consumer choice and can lead to cross-subsidization, where some subscribers effectively subsidize the costs of others. It's a bit like having to pay for a bundle of channels or content, even if you're only interested in a fraction of it. A sports enthusiast might be forced into a bundle that includes sports channels alongside other content they may never watch. It's one of the key reasons why people are cutting the cord and switching to streaming platforms like Hulu and Netflix. They're tired of paying for content they don't want.

The cord-cutting revolution continues to be a movement where consumers abandon traditional cable TV services in favor of streaming platforms that offer a more personalized and cost-effective viewing experience. The frustration of having to pay for channels or content they have little interest in has driven many to seek more tailored alternatives. Current cable subscribers want to see the original programming offered on streaming services:

In the end, the Disney-Charter standoff underscores that the cable TV industry is at a crossroads. The traditional cable TV model faces an uncertain future, with streaming services, a la carte options, and changing consumer preferences reshaping the landscape.

This bundling battle between Charter and Disney represents a pivotal moment in the industry's evolution. One thing is for sure: the cable TV conundrum is far from over, and the economic concepts underpinning it will continue to shape our viewing habits and the media landscape at large.

Charter lost 241,000 pay-TV subscribers in the first three months of 2023 [Media Play News]

ESPN launched on September 7, 1979, and is 80% owned by ABC, Inc., an indirect subsidiary of The Walt Disney Company [ESPN]

Among surveyed adults, National Geographic received the highest positive rating, with 75% expressing a favorable view, making it the most positively regarded U.S. television network. [YouGov]

In 2022, NBC was the most-watched network with 5,148,000 viewers, while ESPN secured the sixth spot with 1,877,000 viewers [Variety]