Everything But the Bagel Tax

New York City may be known as the bagel capital of the world, but its inhabitants are subject to a "bagel tax" whenever they choose to buy a pre-sliced bagel with cream cheese.

Philadelphia Cream Cheese and H&H Bagels, a New York City-based bagel shop, created a new bagel in protest of an old law: one that is stuffed with cream cheese. Typically you’d slide a bagel in half and cover it with schmear, but for a few days, H&H bagel buyers could purchase something more closely resembling a cream cheese donut. The goal of messing with one of New York City’s most sacred delicacies? The two companies wanted to draw attention to the so-called "bagel tax" in New York City.

The bagel tax referred to an 8.875% sales tax applied to prepared foods in New York City. Packaged food and unprepared items are usually exempt from this tax. Once the bagel is sliced and covered with cream cheese, it becomes prepared food and is subject to the tax. By stuffing the bagels with cream cheese after they are baked, H&H Bagels can avoid applying the tax because the bagel is never sliced and thus isn’t considered prepared food.

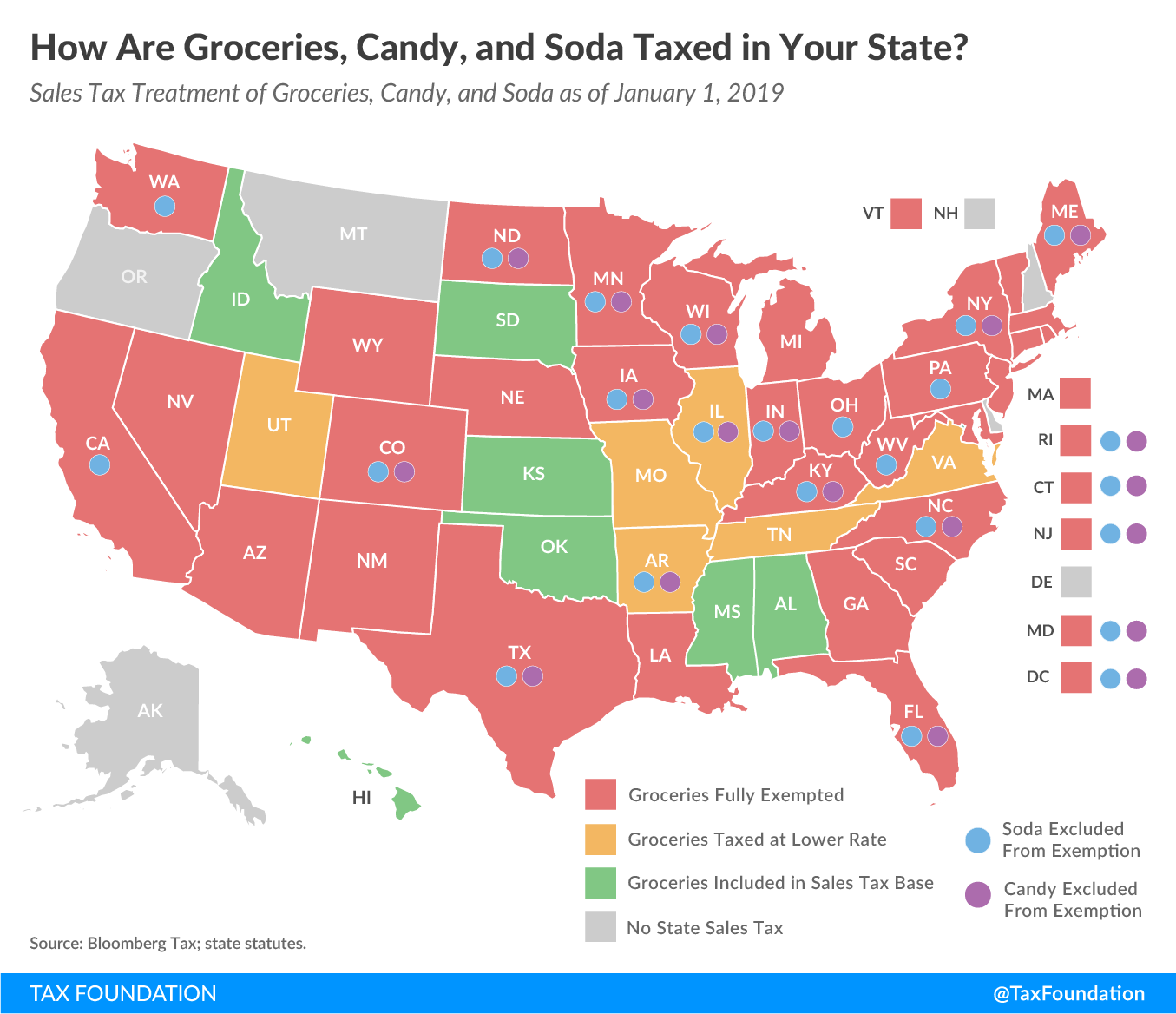

A tax on prepared food isn’t specific to New York City. The law was originally implemented during the Great Depression as a way to generate revenue while avoiding taxing essential items such as groceries. A number of other states and municipalities also impose taxes on prepared foods and a few states have chosen to tax groceries. Most U.S. states have sales taxes, but only 13 impose some type of tax on groceries. The rules and rates vary widely between these states. When groceries are taxed, they are often subject to a lower rate, or tax credits may offset some of the tax for low-income shoppers.

There are two ways governments can impose taxes, regardless of their intention of implementing taxes. A tax on the physical unit being sold is known as an excise tax, but an ad valorem tax is one that is levied as a percentage of the value of a product or service. In the case of the bagel tax, the tax is imposed as a percentage of the sale price of the bagel. Bagel sellers are responsible for collecting and remitting the taxes to the government, but the actual burden of the tax likely falls on both buyers and sellers. With the sales tax in place, sellers may lower their prices a bit to account for the higher, final price, and consumers ultimately pay higher prices than if no tax were imposed at all.

The relative size of the burden depends on the elasticity of demand and supply. Since we don’t know what prices would be like in the absence of a tax, it’s difficult to infer who is paying a larger share of the tax. The creation of the new stuffed bagel, however, demonstrates a creative way that sellers attempt to avoid taxes altogether.

Tax evasion typically refers to the illegal or illicit activities that people engage in to avoid paying taxes. Tax avoidance, however, involves doing something to reduce your tax liability. The creation of the stuffed bagel is a form of legal tax avoidance. It’s a creative, and perfectly legal, way to offer a similar product at a lower price to their customers.

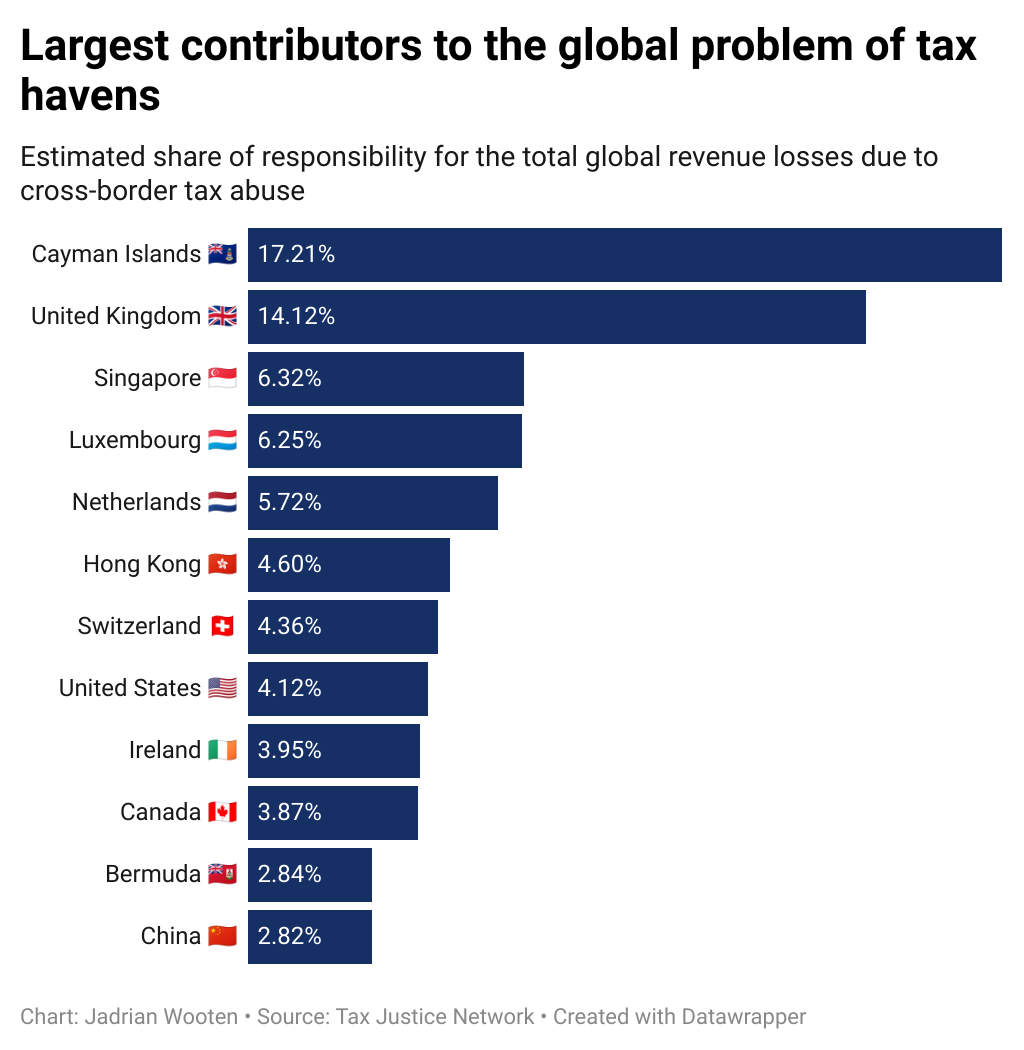

While tax avoidance can create fun new products, tax evasion can have serious consequences for the economy as a whole. When people avoid paying taxes, it reduces the revenue that governments have to spend on public goods and services like education, healthcare, and infrastructure. This, in turn, can lead to a decline in the quality of these goods and services, which can harm the overall economy.

A final concept to consider is associated with the original intent of the tax on prepared foods. Tax incentives refer to the tax breaks or subsidies that the government offers to encourage certain behaviors or activities. Taxing prepared foods is intended to incentivize people to cook their own meals instead of eating at restaurants. Despite that tax, the share of money spent on food cooked at home has been declining for decades, while the share of spending on food consumed outside of the home has increased.

Tax incentives can have both positive and negative effects on the economy. On the one hand, they can encourage desirable behaviors and may stimulate economic growth in a particular area. Tax incentives may encourage businesses to invest in new equipment, hire more workers, and expand their operations. On the other hand, tax incentives can also have unintended consequences and distort economic behavior. If you were hoping to snag a cream cheese stuffed bagel, you’re out of luck. The bagel was only available from April 14 through Tax Day, Tuesday, April 18.

In 2008, 1,979 people went to the emergency room due to a bagel-related injury [Wall Street Journal]

The world’s largest bagel weighed 868 pounds and was made by Brueggers Bagels [Guiness World Records]

There are an estimated 29,847 people employed at bagel stores in the United States [IBISWorld]

About 13% of all U.S. federal taxes go unpaid, even after compliance efforts are taken into account [Internal Revenue Service]