The Upside of a Bubble (Yes, Really)

Artificial intelligence may be shaping up like a bubble, but history shows some bubbles can leave society better off.

You’re reading Monday Morning Economist, a free weekly newsletter that explores the economics behind pop culture and current events. Each issue reaches thousands of readers who want to understand the world a little differently. If you enjoy this post, you can support the newsletter by sharing it or by becoming a paid subscriber to help it grow:

Computer science majors were supposed to have it made. For the past twenty years, parents, teachers, and career counselors all gave basically the same advice to young people: learn to code, and you’ll never struggle to find a job.

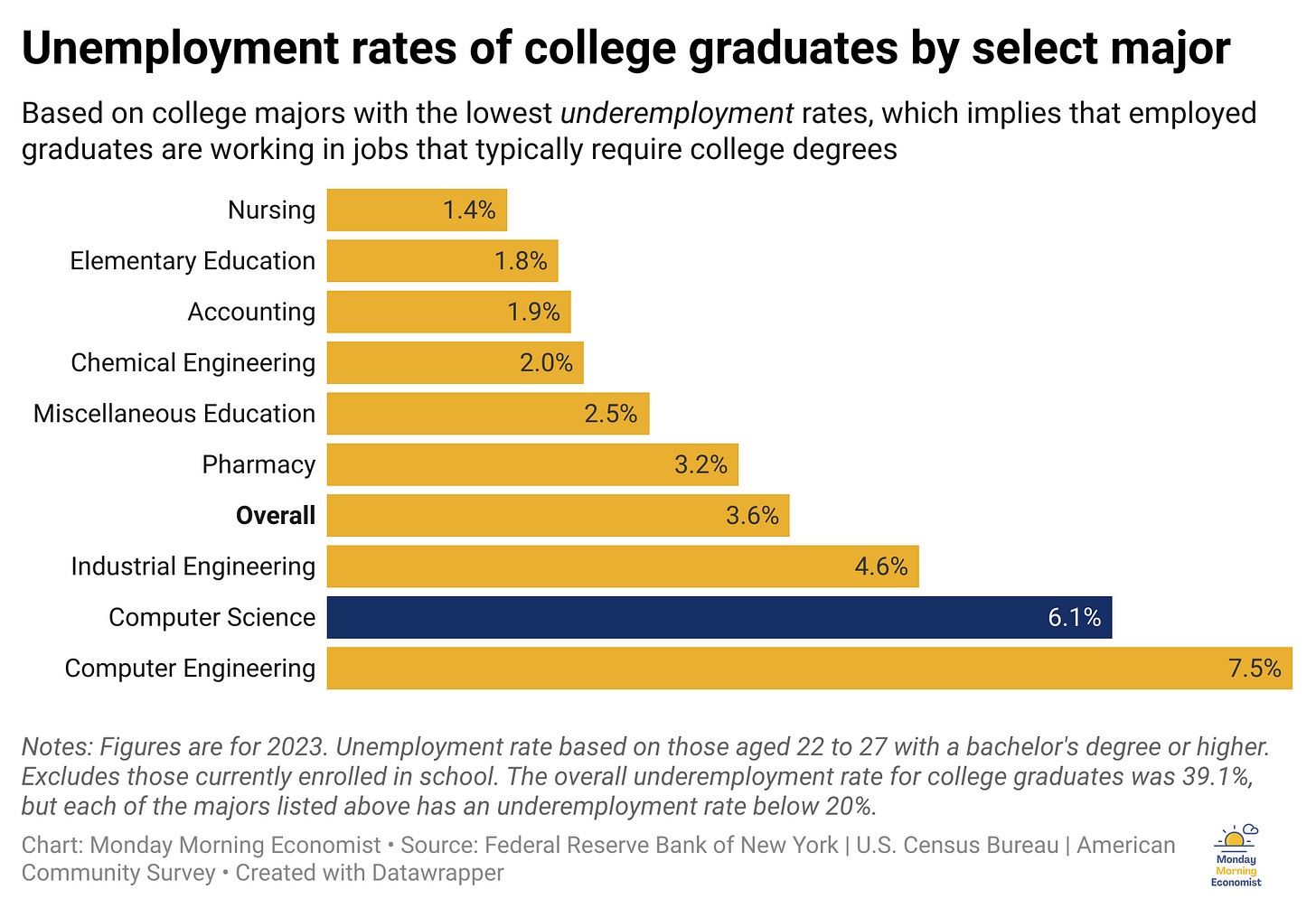

But now? New computer science and computer engineering graduates actually have a higher unemployment rate than the national average for college grads. Almost double, in fact. That’s weird, right? The world has been obsessed with artificial intelligence, companies are racing to pivot into AI, and yet the people we trained for this moment are stuck on the sidelines.

This disconnect may be one clue that something unusual is happening in the tech industry. Prominent tech CEOs like Amazon’s Jeff Bezos and OpenAI’s Sam Altman have said that AI is starting to look like a bubble. But unlike the housing bubble or the dot-com bust, could this be a good bubble?

Bezos’ Weirdly Optimistic Bubble

Welcome to the stage, Amazon Founder Jeff Bezos. He was in front of a packed room at Italian Tech Week, and mentioned how artificial intelligence looks like a bubble… but not the kind we’re used to thinking about. He argued that this could be an industrial bubble rather than a financial one. The implication being that there will be useful capital left behind when the bubble pops, even if investors get burned along the way.

But first, why does he think this is a bubble? He argued that “every experiment gets funded, every company gets funded” in the early hype phase. All that money makes it hard to tell the great ideas from the bad ones, which means some will ultimately flop. But society will still inherit the infrastructure and inventions that work out. His evidence of previous industrial bubbles? Back in the 1990s, the biotech industry looked very similar. There were a lot of investors who lost money, but we ended up with lifesaving drugs.

The frenzy over artificial intelligence might overshoot, but the underlying tech is real and broad. If the industry builds enough chips, data centers, and tools today, future firms will build on top of them tomorrow. Even skeptics who see bubble vibes agree on the core: bubbles often start with a kernel of truth. That’s how OpenAI’s Sam Altman put it when he compared today’s frenzy to the late-1990s internet boom.

So, What’s a Bubble Anyway?

Think about blowing a soap bubble. It starts small, shiny, and fun. Then it keeps getting bigger and bigger, until the tiniest poke makes it pop. That’s basically what economists mean by a bubble.

Prices or investments in something (e.g., houses, tech stocks, or tulips) grow way faster than the actual value underneath. People keep buying in because they think tomorrow’s price will be higher than today’s. That optimism feeds on itself.

But at some point, reality shows up. Expectations reset. The bubble bursts. Prices collapse, companies go under, and investors lose a lot of money.

History is full of them: the dot-com crash of the early 2000s, the housing bust that sparked the 2008 financial crisis, and even flowers in the 1600s. Each one starts with excitement, grows with speculation, and ends in a painful pop.

Final Thoughts

Most economic bubbles are disasters for ordinary people. The dot-com bust erased trillions of dollars. The housing crash kicked off a global recession. In both cases, a lot of households came out poorer, with not much to show for it.

But Bezos was pointing to a different kind of bubble. When these burst, investors may lose their shirts, but society keeps the toys. The 1800s railroad boom left tracks across the country that fueled commerce for decades. One bright spot of the dot-com era was that it buried the world in cheap fiber optic cables that future tech companies could tap.

Artificial intelligence could be the same. Even if the hype gets ahead of reality, the chips, servers, and cloud infrastructure being built today won’t just vanish. They’ll be sitting there, ready for the next generation of firms to use.

But there’s one small problem with all of this. We won’t know which kind of bubble we’re in until it pops. If AI is overinflated, the short-term pain will be very real. Investors deep in AI stocks could see big losses. Smaller startups could fold if they can’t keep up with the deep pockets of tech giants. And retirement accounts tilted heavily toward tech might take a hit too.

Yes, an industrial bubble can leave behind something useful for society. But that doesn’t mean the ride is painless. In the short run, bubbles tend to hurt. It’s only years later that we get to see whether the wreckage becomes the foundation for something even bigger.

Bubbles are better to talk about before they pop. Share this article with someone who should be in on the conversation or with that one person you know who won’t stop talking about artificial intelligence.

Fresh computer science graduates are facing unemployment rates of 6.1% to 7.5%, more than double what biology and art history majors are experiencing [Yahoo! Finance]

Corporate investment in artificial intelligence reached $252.3 billion in 2024, with private investment climbing 44.5% and mergers and acquisitions up 12.1% from the previous year [Stanford Institute for Human-Centered Artificial Intelligence]

Meta, Amazon, Alphabet, and Microsoft intend to spend as much as $320 billion combined on artificial intelligence technologies and datacenter buildouts in 2025 [CNBC]

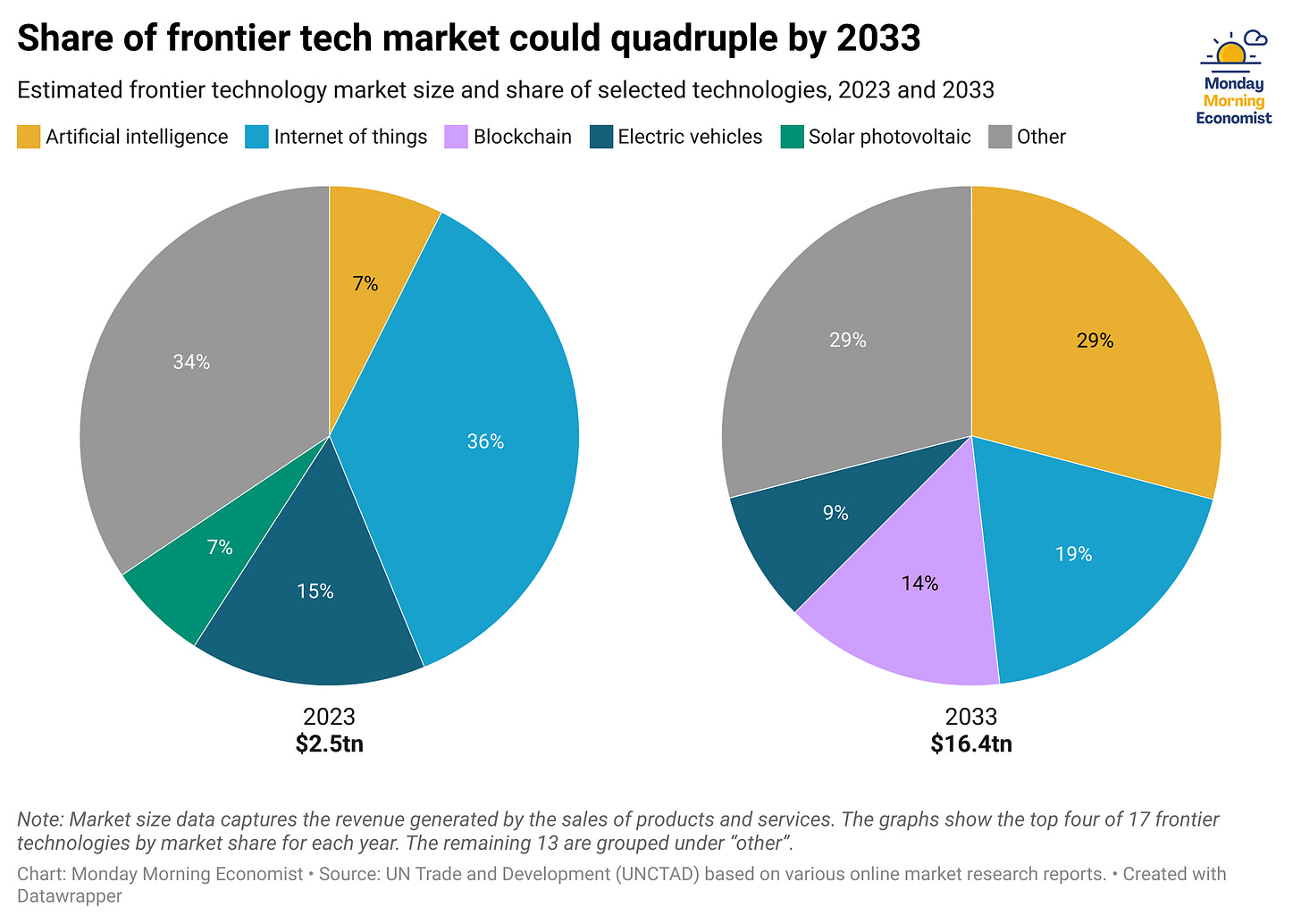

The global artificial intelligence market will soar from $189 billion in 2023 to $4.8 trillion by 2033, a 25-fold increase in just a decade [UN Trade and Development Report]

I'm not sure if we should keep using these data centers as studies show they're pretty bad for the environment. Maybe we should just take the L on AI.